Weighing The Week Ahead: Your Course For Uncharted Waters

Jeff Miller | Dec 23, 2018 03:30AM ET

We have a short week and one extremely light in scheduled news and economic data. Even the Wednesday-Friday stretch comes before another holiday weekend. In addition, the government shutdown will delay scheduled reports. Given the continuing divergence between economic news and market prices, that might not matter.

Pundits have plenty to talk about. We are beginning to see articles and TV segments about “protecting your portfolio.” This has been a challenge with declines in all asset classes and little solid evidence for the reasons. We can expect more to be asking:

What is your course for uncharted investment waters?

Last Week Recap

In my source page , you can use the interactive version, letting your imagination roam. Especially valuable are the indicators of news at various times.

The market declined 7.0% for the week. A brief rally on Monday did not hold, nor did the pre-Fed move on Wednesday. The trading range was also seven percent. Readings on actual and expected volatility are included in our Indicator Snapshot.

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too.

New Deal Democrat’s high frequency indicators are an important part of our regular research. This week’s update shows that the long-leading indicators remain neutral while other time frames remain positive. NDD has some excellent advice for data watchers:

I want to add a note this week that I think people are getting ahead of themselves, projecting weak trends to weaken even further, and assuming that means recession. It has struck me this week how in many ways the current situation reminds me of year-end 1994. Alan Greenspan was aggressively raising rates in the face of non-existent inflation. Sentiment turned awful, and portions of the yield curve briefly inverted. And then … it didn’t happen. There was a big slowdown in 1995 followed by a big rebound. I’m not on recession watch now, and I won’t go on recession watch unless and until the broad range of data justifies it.

When relevant, I include expectations (E) and the prior reading (P).

The Good

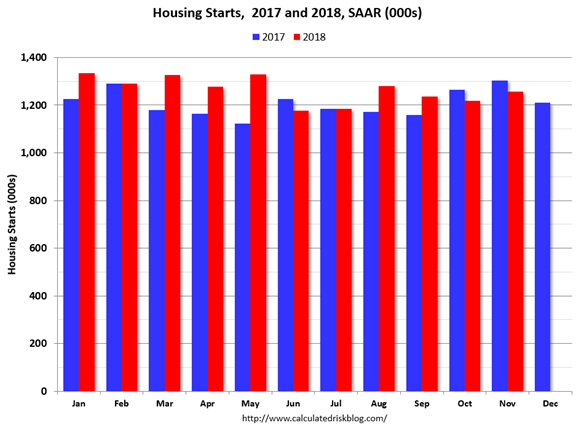

- Housing starts showed strength with a SAAR of 1256K E 1230K P 1217K. The strength was mostly fueled by the volatile multi-family sector. Calculated Risk explains. He notes that single-family starts were down 13.2% YoY, the weakest in the last eighteen months. Despite this, starts are up 5.1% compared to last year.

- Building permits registered a strong SAAR of 1328K E 1270K P 1265K.

- Existing home sales registered a 5.32M SAAR E 5.20M P 5.22M. (Calculated Risk ).

- Initial jobless claims remained low at 214K E 221K P 206K

- Personal spending increased at a rate of 0.4% E 0.3% P 0.8% revised up from 0.6%.

- PCE prices, the favorite Fed measure, increased only 0.1% on the headline and core. E for core was 0.2%

- Leading indicators increased 0.2%, beating expectations of 0.1%. P 0.3% downwardly revised from a gain of 0.1%.

- Michigan Consumer sentiment rebounded to 98.3 E 97.5 P 97.5. Jill Mislinski provides analysis and a great chart.

The Bad

- NAHB Builder Confidence declined in December – registering 56 compared to 60 in November. (Calculated Risk ).

- Personal income increased only 0.2%. E 0.3% P 0.5%.

- GDP for Q3 was revised lower to 3.4% from 3.5%. No change was expected.

- Durable goods orders increased 0.8%, much better than P of -4.3% and missing expectations of a 1.7% gain.

The Ugly

I intended to continue my holiday break from the ugly, but readers know my passion about maintaining standards in scientific research. TheBMJ published the results of a randomized controlled trial demonstrating that parachutes were not significantly better than empty backpacks in preventing death or major traumatic injury when jumping from an aircraft. Those who have read scientific reports will recognize some important lessons here.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that. Second best is planning what to look for and how to react.

The Calendar

The calendar is light, and we have a holiday-shortened week. The government shutdown will probably affect the home sales reports, but probably not Consumer Confidence. The shutdown will probably also affect next week’s scheduled employment report.

Briefing.com has a good U.S. economic calendar for the week. Here are the main U.S. releases.

Next Week’s Theme

Following my plan to highlight what is most important and hope that the punditry joins in, I want to discuss the most important current investor questions. In general, they take the form of “what next?” Everyone needs a plan.

How should you navigate these uncharted waters?

There are three important questions: What is happening? When will it stop? How should I plan?

What is happening?

Not what you hear on the daily news. Those stories say things like “Investors showed renewed global growth fears and resumed selling.” Or “Bulls were in full retreat, unable to defend support at….”

Turning the market into the decisions of “investors” and attaching a reason makes for a simple story. So does describing a game between bulls and bears. Both are simplistic and unhelpful for genuine analysis.

Morgan Housel writes about . The entire post is great, but here is the part most relevant to our current purpose:

Markets have to be pushed to crazy extremes once in a while, but it’s never as crazy as it looks. It’s the result of five innocent things playing out:

- Investors have different time horizons. Day traders, generational buy-and-holders, and everything in between.

- Each group tries to exploit profit opportunities within their own timeframe.

- Short-term investors are often after momentum. They can reasonably chase prices higher even when those prices are detached from a business’s intrinsic value.

- Sometimes that momentum, and those profits, are strong enough to capture the attention of investors with longer time horizons whose strategy relies on businesses trading at or near their intrinsic value.

- Things get crazy when the actions of long-term investors playing one game become influenced by the actions of short-term investors who are playing a different game and appear to know something the long-termers don’t. The long-termers usually don’t realize this, which is why the process is both innocent and bewildering, even in hindsight.

Current trading is dominated by those trading “fast,” perhaps 80% of the volume. I have written about some of these groups but let me flesh it out a bit with players in evidence this week.

- HFT algorithms. This is super-short term, triggered by a few words in a news story that you have not even seen yet.

- Factor systems, emphasizing characteristics like momentum, price, or quality. Popularity often leads to a crowded trade and a simultaneous desire to sell.

- Technical analysis-based systems. Once again, many traders get buy or sell signals at exactly the same time.

- Fund redemptions. Mutual funds that anticipate redemptions need cash to meet them.

- Fund liquidation. Failing funds face forced selling. Some of last week’s trading had that look, sparking some rumors. Aggressive managers use leverage based upon a normal range of outcomes. They are caught off base when there is a move of several standard deviations.

The first two elements are relatively new, perhaps changing the nature of other market signals. The danger to the average investor is that this trading is treated as meaningful and important, just as Morgan is saying in the quotation above.

When will it stop?

No one can provide a specific answer, but here are some important factors.

Sentiment. David Templeton (HORAN) covers several important sentiment indicators. Strongly negative sentiment is associated with “capitulation” and market bottoms. Here are two examples – the elevated put call ratio (2 is normal) and the Fear and Greed Index.

Earnings Season. We will have to wait until January, but it may provide the key catalyst. Trader expectations are that estimates will fall.

Post-holiday action by big investment funds. This is not “hot money” reacting to each tweet and new phrase from the Fed. There are investment committees with reports from well-prepared participants. Asset allocation is reviewed. We can expect lower stock prices to attract larger allocations.

What Should We Do?

The answer depends on individual objectives and time frame. In each case you should already have a plan. Market declines in this range are a regular part of investing. We just haven’t seen one in a few years. Enjoying the rewards of investing always involves some level of risk. A good plan limits that risk to a manageable level.

- Implement your plan. You created it in advance without emotion. If your trading has specific stops, that is one answer. If you are confident of your overall portfolio allocation and have plenty of time, you have planned to ride it out, even if there is a recession. My own plan includes exiting from trading programs when we get the “storm signal” described in our quant section. I reduce long-term holdings if recession risk or the SLFSI rises. Having a plan like this helps us know the limit of possible losses.

- No plan in place? Make one. While it is difficult to do during turmoil, it is no less necessary. If you cannot do this yourself, get help! It is important.

- Separate fundamental analysis from the emotion of the market. None of the proven recession models is showing a near-term threat. The SLFSI is solidly in low-risk territory. Economic data and earnings remain at high levels. If you have some cash, you can do some buying. It does not have to be all-in. If you are fully invested, you might do like the big boys – get a little more aggressive in your asset allocation when stocks are cheap. Don’t forget to rebalance if circumstances change.

Here is Eddy Elfenbein’s advice – always wise and clearly-stated. The full post is great – and he includes some stock ideas.

The first and most important thing to do is not panic. In fact, that’s so important that I’ll make it the first and the second thing to do. Remember Warren Buffett’s dictum: “Be fearful when others are greedy. Be greedy when others are fearful.” Right now, there’s a lot of fear. I don’t advocate greed, but I do support disciplined buying.

I also don’t want you to concern yourself about waiting for the absolute bottom. In retrospect, people think of “the low” as a big event that…happens. In reality, no one realizes it at the time, and it usually happens a lot faster than you think. You can be sure there will still be people predicting the next big leg down.

In 2008, a major low came on November 20. Although this wasn’t the absolute low, it was a good time to buy. At the time, people were massively freaked out. The VIX was at 80. That’s crazy, but the prices were good.

Right now, investors should focus on high-quality stocks going for discounted prices.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

Short-term trading conditions returned to the highest risk level. This reflects Vince’s research on the combination of factors that make successful trading difficult. It does not necessarily mean that markets will move lower, but the danger is there. When conditions are technically challenged, we watch trading positions even more closely. Each of our models has a specific exit strategy. The technical health rating may drop enough for a complete trading exit. It got close to that level again last week.

Long-term trading has also returned to the highest risk level. Those who emphasize technical analysis have emphasized the “damage” done to charts by the sustained correction. Our methods show that a clean bill of technical health will require some time.

Fundamental analysis remains strongly bullish. Earnings are great, prices are lower, and there is even less competition from bonds. We reduce fundamental positions (as we did in 2011) when we get a warning from the recession or financial stress indicators, not merely as a reaction to technical signals.

The C-Score method started showing higher recession probabilities in 2006. In early 2007 it showed that a recession was likely within the next nine months. The yield curve is part of the method, but it also includes indications for the likelihood of Fed action. It is an improvement over the yield curve by itself.

The St. Louis Financial Stress Index is not about recessions. It includes eighteen factors including various interest rates, credit spreads, the VIX, and similar factors. This research exhibits the higest statistical standards. Here is the historical chart and the suggestions for interpretation.

How to Interpret the Index:

The average value of the index, which begins in late 1993, is designed to be zero. Thus, zero is viewed as representing normal financial market conditions. Values below zero suggest below-average financial market stress, while values above zero suggest above-average financial market stress.

This leads me to a “neutral” overall outlook. It might be better stated as bullish for long-term investors and dangerous for short-term traders.

The Featured Sources:

Bob Dieli : Business cycle analysis via the “C Score.

Brian Gilmartin : All things earnings, for the overall market as well as many individual companies.

RecessionAlert : Strong quantitative indicators for both economic and market analysis.

latest update on his BCI indicator.

Big Four .

A recession starts when these indicators not only “roll over,” but also decline significantly from the peak. That is the official NBER dating process.

Insight for Traders

Check out our weekly “Stock Exchange”. We combine links to important posts about trading, themes of current interest, and ideas from our trading models. This week we questioned Blue Harbinger , provided fundamental counterpoint for the models, all of which are technically-based. The models have a much different approach to volatile markets than that which I recommend for investors.

Final Thought

Looking at the data instead of stock prices is such a challenge. What do you suppose would happen if we kept a batch of pundits in isolation, showing them only the news for the day? We then ask what they think the market did. My guess is many more sheepish faces and much less smugness.

My trader feedback emphasizes a message from markets. We can all remember a time when a stock price went down and then earnings were bad, for example. The trap is that we don’t remember all the times when markets made false moves. We cannot even define the terms for a good test of such hypotheses.

There is an important wild card that may be showing up in market action – a failure of leadership. Stories like resigning cabinet members and even a government shutdown do not typically generate a big market reaction. There is growing impatience with the failure of our leaders to take care of business.

- Why do we have repeated “crises” over a debt limit? If Congress wants to address debt, and it should, it must cut spending or raise taxes. Refusing to pay legally established obligations is nonsensical. It provides frequent opportunities for one or another party to play “chicken” and make demands unrelated to the debt limit.

- Whatever policies are chosen, people and markets expect them to be carefully considered and reviewed. We pay plenty to conduct research, analyze data, and develop experienced staff. When major decisions seem impulsive, announced via tweets, it creates fear.

- Leaders seem not to know what prior agreements can be relied upon. This is also damaging in our foreign policy.

- Leaders who do use staff effectively, must still listen, adjusting decisions to what they hear. Fed officials feel confident in the strength of the economy. They believe that the balance sheet reduction, at the current pace, is not important. They may be right on both counts, but there was a lot of good advice that a little pause might be in order. Waiting a meeting or two would have little policy effect but provide an important symbol. The communications from the Fed were terrible. One of those staff members should provide a memo on what is worrying the market. The leaders should make sure it is carefully considered and addressed. I listened to six or eight interviews. While supporting market prices is not a Fed mandate, it is an important source of feedback. Leading Fed expert Tim Duy Bloomberg TV interview .

These factors have created a collective effect – confusion and uncertainty.

[If you are confused about the current market and unsure how to react, you might want to request some of my papers for individual investors. Or even a complimentary portfolio consultation before we get too busy with end-of-year reports. Just send an email to main at newarc dot com]

I’m more worried about:

- Foreign policy turmoil. The Mattis resignation highlights the unsettled state of alliances.

- Loss of business and consumer confidence. No sign so far but spending and investment fuel economic growth. has a good post on how this can become a self-fulfilling prophecy.

I’m less worried about:

- Trade issues. Good progress is all we can expect. Significant China problems are decades old. It will take more than 90 days, but we continue to see positive, incremental steps.

And finally…parachute jumping.

I trust that the sophisticated WTWA readership recognized not only the satirical nature, but how realistically the article follows actual research reports. From the NPR account , of Dr. Yeh’s research:

The study’s findings were published in the traditionally lighthearted Christmas issue of the medical journal, BMJ.

“It’s a little bit of a parable, to say we have to look at the fine print, we have to understand the context in which research is designed and conducted to really properly interpret the results,” Yeh says. Scientists often read just the conclusion of a study and then draw their own conclusions that are far more sweeping than are justified by the actual findings.

This is a real problem in science.

Personal Note

I am planning some family time for the holidays, so posting will be light and probably no WTWA next weekend. I will be working on my annual preview post. We’ll see if Mr. Market gives me enough time to finish that in the next few days. I hope that today’s post covers the most important themes, more relevant right now than highlighting individual stocks.

There is a little trap in today’s post, explained in the conclusion. I hope you enjoy it.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.