The Week Ahead: Time To Ask 'What Could Go Wrong?'

Jeff Miller | Sep 03, 2017 02:31AM ET

We have a very light data calendar. It is a short week with some post-vacation (ahem) attitude adjustment. There is little fresh news, but plenty of data from last week. FedSpeak is on high. It is a perfect setup for pundit pontification. Expect lots of navel gazing, with an emphasis on flaws. Many will be asking:

What Can Go Wrong?

Last Week Recap

My expectation that last week would focus on jobs in the pre-Labor Day was pretty accurate, but also easy. There was plenty of competition from Harvey coverage. The economic news was solid leading into Friday’s payroll numbers. While that report was viewed as weak, it had little market effect.

The Story in One Chart

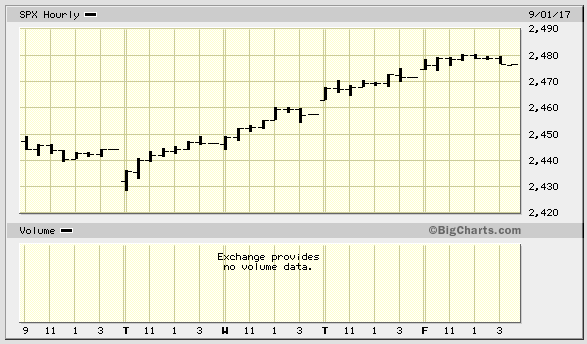

I always start my personal review of the week by looking at a chart of the S&P 500 on a day-by-day basis.

Once again, we had a low-volatility, gentle climb. The avalanche of data and geopolitical news is not apparent from the chart.

The Silver Bullet

As I indicated recently I am moving the Silver Bullet award to a standalone feature, rather than an item in WTWA. I hope that readers and past winners, listed here , will help me in giving special recognition to those who help to keep data honest. As always, nominations are welcome!

The News

Each week I break down events into good and bad. For our purposes, “good” has two components. The news must be market friendly and better than expectations. I avoid using my personal preferences in evaluating news – and you should, too!

The economic news generally positive. The employment report miss is the possible exception.

The Good

- Q2 GDP was revised upward to 3%, beating expectations and suggesting a higher base for the rest of the year.

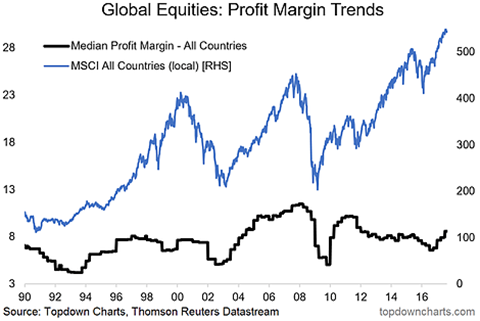

- Global profit margins are higher. (Topdown Charts ).

- ADP employment showed a gain in private employment of 237K, up from 201K in July and beating expectations of 190K. I have frequently suggested that this report should be treated as an independent estimate of employment, not a forecast for the BLS announcement. I am working on a project to show why this is important.

- Personal income increased 0.4% in July versus unchanged in June.

- Bullish investor sentiment continues. David Templeton (HORAN) explains this contrarian indicator.

- Core PCE Prices were 0.1% higher. This is the inflation indicator favored by the Fed. The continuing low reading suggests that the pace of interest rate increases will be modest.

- The ISM manufacturing index improved to 58.5, a “sizzling” number according to Bespoke . The Chicago index showed similar strength.

- Consumer Confidence remains high. The Conference Board – 122.9. Michigan sentiment – 96.8. Jill Mislinski has a nice update of the entire picture. Here is just one of the charts:

The Bad

- Consumer spending increased 0.3%, up from June but trailed expectations of a 0.4% gain.

- Construction spending had a surprising decline of 0.6% despite a positive expectation. Steven Hansen (GEI) reports, including his regular interesting comparison between spending and construction jobs.

- Harvey effects. While everyone’s main concern is the human cost — loss of life, injuries, and destruction of homes – there have already been stories about the effects on various stocks and sectors. (Thanks to our friends in Texas – especially Houston – for letting us know how you are doing). I’ll stick to a couple of observations about the economic effects on the indicators we track. Despite the massive losses, perhaps $150 billion, the effect on GDP may actually be positive. It measures production without regard to the purpose. The immediate effect on gasoline prices was a spike higher, up about twenty cents per gallon at $2.54. Estimates call for another 15-20 cents before a plateau is reached. (End of an Era for the records in initial jobless claims.

- Payroll employment dropped to a net gain of 154K and missed the 180K expectation. Average hourly earnings gains were also a bit light. As usual, the small “miss” was deemed by many to be major news. I wish more folks would read my guide for interpreting the employment report. Here are a few interesting takeaways. Please note that the results are from data collected before Hurricane Harvey.

- CNBC collects a range of viewpoints from Wall Street economists. Goldman’s Jan Hatzius thinks that wages are on the path to improvement. Some others question the effect on the underlying trend. Diane Swonk (DS Economics) noted that the manufacturing increase was the best since 2012. (CF. Steven Hansen below).

- Disappointing says Calculated Risk . Bill is especially unhappy with the meager wage growth.

- CNBC collects a range of viewpoints from Wall Street economists. Goldman’s Jan Hatzius thinks that wages are on the path to improvement. Some others question the effect on the underlying trend. Diane Swonk (DS Economics) noted that the manufacturing increase was the best since 2012. (CF. Steven Hansen below).

- New Deal Democrat sees the data as a sign of “late cycle deterioration .”

- Steven Hansen (GEI ) sees the report as “confused” with growth coming from the wrong places, i.e. “manufacturing and construction in a service economy.”

- Harry Holzer (Brookings ) explains that the current environment is just right for major gains, even if there is a current skill mismatch. Read the full post for interesting policy ideas.

A tight labor market creates unusual opportunities for us to address these many challenges. Because employer demand for workers is now so strong, the usual questions about whether jobs really exist for better-skilled or more motivated workers are moot. In addition, employers who experience unusual difficulty hiring or retaining workers will likely be more open to training them and perhaps will hire more marginal applicants whom they would not otherwise consider.

Indeed, tight labor markets do more to help disadvantaged workers than any policy interventions, and such policies will likely be more successful when markets are tight. After so many years of slack labor markets, with limited employer interest in such efforts, we must not let this opportunity go to waste.

- A “clear link” between the opioid crisis and unemployment.Business Insider describes the most recent research.

- Eddy Elfenbein has his expected calm summary hitting the highlights – basic job increase, downward revisions to prior months, unemployment higher, earnings increase disappointing, Fed less likely to act. And, why it is important. He beats many of the major media sources by noting that changes are “net,” an important distinction.

The Ugly

Harvey donation scammers. What could be worse than seeking personal gain from the misery of some and the well-intentioned efforts of others. Here is some great column shining a light on the problems in tax reform. Eliminating deductions in the interest of fairness sounds great, but is much more difficult when one looks at specific cases.

How do you feel about contributing nearly $1800 to help a rich Michigan fan buy a premium seat? That is the consequence of current tax policy. And not just at Michigan of course.

Multiply this by a few hundred provisions and you begin to see the problem.

The Week Ahead

We would all like to know the direction of the market in advance. Good luck with that! Second best is planning what to look for and how to react.

The Calendar

We have a very light economic calendar and a short week. Most important is the ISM services index, but that will not be the feature. In the aftermath of Jackson Hole and the quiet period, Fed participants are out in force! There is something every day, and the Fed Beige Book on Wednesday.

Briefing.com has a good U.S. economic calendar for the week (and many other good features which I monitor each day). Here are the main U.S. releases.

Next Week’s Theme

As I prepared for this edition of WTWA, I expected a pause for assessment of recent news and data. When I read my weekly issue of Barron’s this morning, the cover cried out: How This Bull Market Will End . Wow! Is the end near?

It was further evidence of the need to find fresh worries. Expect a week of wondering:

Is it finally time to worry about what can derail the rally?

Ben Levisohn’s cover story accurately linked past market declines to recessions. There is a well-conceived and executed chart of this relationship. And the chance of a recession? Here is the prominently-featured table.

This is a laundry list of anything that might go wrong. One cannot estimate the odds or the likely impact. It is typical of the normal list of worries. It has little to do with the likelihood of a recession.

The overall article is more balanced, especially noting that the most accurate indicators show no imminent recession. Too bad that was not the headline!

This story is not an isolated example, although it is a prominent one. Added to the recession assertions are three other factors:

- The nearly universal acceptance of valuation indicators that do not reflect low inflation; (Todd Sullivan )

- The myth that a market peak, in and of itself, is a signal of danger;

- The idea that if an economic or stock cycle is lengthy, it must be near the end.

There are good counter-arguments, but they seem to get less attention.

- The infrastructure upside; (Bipartisan Policy Center )

- Interesting and meaningful indicators – entertainment spending (much higher) and food stamp use (lower). (Washington Post )

- Dr. Ed Yardeni’s “Fundamental Stock Indicator.”

As usual, I’ll have more in my Final Thought, emphasizing my own conclusions.

Quant Corner

We follow some regular featured sources and the best other quant news from the week.

Risk Analysis

I have a rule for my investment clients. Think first about your risk. Only then should you consider possible rewards. I monitor many quantitative reports and highlight the best methods in this weekly update.

The Indicator Snapshot

The Featured Sources:

Bob Dieli : Business cycle analysis via the “C Score.

RecessionAlert : Strong quantitative indicators for both economic and market analysis.

Brian Gilmartin : All things earnings, for the overall market as well as many individual companies.

Georg Vrba : Business cycle indicator and market timing tools. It is a good time to show the chart with the business cycle indicator.

“Big Four” update .

There is a lot of green since January.

Guest Sources

Mark Hulbert , who warns that the September effect is over-stated. See his list of specific hypotheses that have been refuted, and an accurate explanation of statistical significance that few will understand. I applaud his effort!

Millennials are waiting longer to have families. The average age of fatherhood has increased to 30.9 years. (As I mention this study, Mrs. OldProf reminds me of a frequent comment: I am ready to be a grandpa but not ready for our son, now at law school, to be a dad). There is an investment implication, which I strongly endorse. Homebuilders are attractive. People want homes when they have a child.

Insight for Traders

We have not quit our discussion of trading ideas. The weekly Stock Exchange column is bigger and better than ever. We combine links to trading articles, topical themes, and ideas from our trading models. Blue Harbinger has taken the lead role on this post, using information from me and from the models. He is doing a great job.

Insight for Investors

Investors should have a long-term horizon. They can often exploit trading volatility!

Best of the Week

If I had to pick a single most important source for investors to read this week it would be Charlie Biello’s advice to “Put These Charts on Your Wall… ” Charts are powerful. His package illustrates several “obvious” conclusions that were completely wrong. Here is his conclusion along with an example that was especially costly for many.

They say a picture is worth a thousand words, but in investing it is worth so much more. Having a few extreme charts on your wall can be a helpful reminder that there is no such thing as “can’t”, “won’t,” or “has to” in markets. The market doesn’t have to do anything, and certainly not what you think it “should” do. The market doesn’t abide by any hard and fast rules; it does what it wants to do and when it wants to do it.

Stock Ideas

Chuck Carnevale continues his interesting and informative series on high-profile stocks. This week’s entry is Costco (NASDAQ:COST). As usual, the story includes reasoning, tips for analyzing, and a conclusion.

Brian Gilmartin’s deep dive into Wal-Mart (NYSE:WMT) provides an interesting contrast. Hint: He is not excited.

Stone Fox Capital has an interesting analysis of UnderArmor (NYSE:UAA) and the Finish Line effect (NASDAQ:FINL). It is another example of the knee-jerk market reactions to news.

Some ideas if tax reform is passed. (MarketWatch ).

Dividends and Yield

A beaten-down REIT with 9% yield? Double Dividend Stocks likes American Hotel Income Properties (AHOTF). The interesting angle is that they provide lodging for railroad employees. We hold other hospitality REITs, but this is an interesting twist.

Simply Safe Dividends looks at Pentair (NYSE:PNR). The company has logged forty straight years of dividend growth. The article provides an in-depth look at the company – worth considering, especially if you like the overall economic prospects.

Personal Finance

Seeking Alpha Senior Editor Gil Weinreich has an interesting topic every day. His own commentary adds insight and ties together key current articles. This week he had two great posts on expertise. In one, PhD in Finance is not necessary to manage one’s portfolio. Gil’s work was the source for today’s “best investment advice.” I am left with an uneasy feeling. There is so much emphasis on criticizing the expertise of others and so little on identifying people who actually know something useful. People spend more time finding the right plumber than they do in figuring out which sources provide the best information. Of course, confirmation bias in choosing plumbers meets a swift and wet confrontation with reality!

Abnormal Returns has a different topic each day. I read them all, but individual investors might find the warning about annuities , but check out the others as well.

Strategy

Why you should not just own the market. Four reasons from Morningstar.

Lawrence Hamtil has a stimulating piece on The Value of Lasting Moats . The Warren Buffett concept of identifying potential for weak competition gets increasing consideration. The article has several interesting links and ideas.

Watch out for….

… gold. Barron’s ETF focus (subscription required) warns that uncertainty may not be enough.

Utility ETFs. Sumit Roy (Ben Carlson takes on the recent comparison of today with 1937).

So many are interested in advising how investors should deal with a market collapse. There is no evidence for an imminent collapse, and certainly nothing fresh, but it is apparently a tempting topic. It has succeeded in creating plenty of nervousness. There will be a time to get conservative, but some real evidence is needed first.

There is little attention to stock upside. Fast Money’s Jim Lebenthal did a quick analysis of the potential tax reform effect. Like me, he does not think that current prices include much of this effect. His back-of-the-envelope calculation is S&P earnings of $140 for 2018 and a multiple of 18.5, not unusual for a low interest rate environment. That represents a gain of about 4.5% — not great, but better than inflation or bonds. If a tax reform package passes, earnings could move to the 145-150 range. He notes that the top of that range represents a 12% increase.

For several years the most difficult trade has been to remain invested in stocks in the face of continuous and ever-changing worries. As usual, the toughest trade has been the most profitable one.

What worries me…

- The possible ETF effects. The only major stock decline not linked to a recession was in 1987. Early in my career, I studied this carefully. The key problem was over-investment in stocks by many who thought that something called “portfolio insurance” would protect against their losses. Does the increased number of ETF investors create a similar situation? I am watching this carefully.

- The debt ceiling game of chicken. Congressional leaders have confidence. Administration officials emphasize the importance of a “clean bill.” The President seems willing to use this as a bargaining chip. The Democrats are not saying much. I expect a solution, probably starting with an extension, but the participants are making it scary – just as in 2011.

…and what doesn’t

- The Fed – at least in the near term. That includes both rate increases at a reasonable pace and the planned balance sheet reduction. At some point the Fed may find that inflation came faster than expected, but that type of action normally precedes a recession by at least a year.

- A recession. We are more likely (finally) to have a stronger rebound rather than a recession.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.