Further Upside Likely But Beware Volatility

Urban Carmel | Feb 21, 2016 12:10AM ET

Summary: Equities followed through on last week's reversal, gaining 3-4%. Importantly, the rally came on unusually positive breadth: this has a strong propensity to push equity prices higher in the weeks ahead. Further upside also seems likely given extremes in investor pessimism, with fund manager cash levels rising to a 14 year high this month. Aside from the unpredictable path of oil, the biggest watch out is volatility.

* * *

Equities followed through on last week's reversal, with the SPDR S&P 500 (N:SPY) gaining 3% and Russell 2000 (RUT) and Nasdaq 100 (NDX) gaining close to 4%.

Safe havens - Treasuries and gold - which have been in high demand during the sell-off in equities, closed lower, each losing about 0.5%.

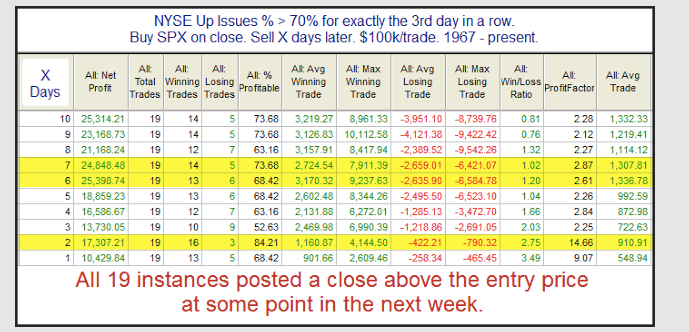

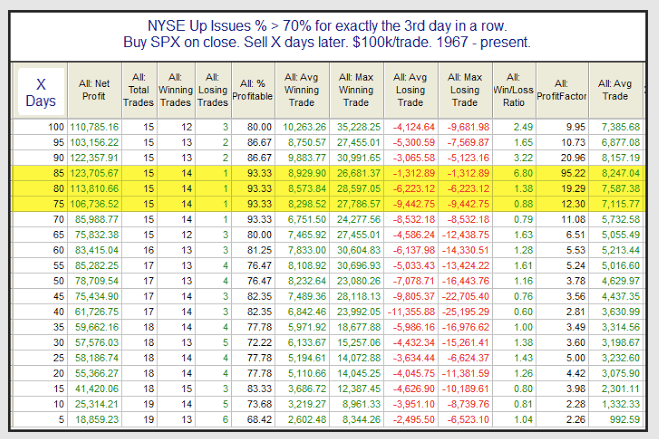

Importantly, the rise in equities this week came on strong breadth. More than 70% of the issues on the NYSE advanced for three days in a row. In the past 19 times this has occurred, SPX has closed higher than on Day 3 within one week every time (first table). This implies a close above 192.9 in the week ahead. Moreover, SPX was higher 3 weeks later over 80% of the time (second table). A post on this by Rob Hanna is here .

As usual, the change in stocks this past week was reflected in (or driven by) oil prices. For the week, crude gained 10%. This relationship continues to be both strong as well as the main wild card into each new week.

We reviewed a typical bottoming pattern for oil last week (here). With a big gain this past week, oil made it's first touch of the 50-d since early November. Over $35, and it will have exceeded the first pivot (green line). It barely became overbought (top panel) for the first time in 5 months. These are all positives. Look for oil to consolidate near the 50-d (which flattens/rises), push through the pivot and stay overbought as further signs that the trend may have changed.

Similarly, SPY rose to overbought on Wednesday for the first time since early November (top panel). If this rally has legs, RSI(5) should get back above 70 within a few days and not drop below 50; see October 2014 and October 2015 as examples (yellow shading).

There were good signs a week ago that SPY had made a potential bottom. This past week followed through. SPY is above its now rising 5-dma, 20-dma and 13-ema. Staying above 190 is the short-term objective to keep those MAs rising.

On an hourly chart, we were specifically looking for SPY to do three things this week:

- stay overbought (top panel; shading);

- hold above its rising 5-dma (green arrows); and

- climb back into the main 2016 trading range (yellow shading).

It did all three. If SPY is going higher, then it should not become oversold for long this coming week (top panel; boxes).

Above 195, and SPY is likely headed to 197-200 (blue line). We think this is a reasonable target for SPY, for two main reasons.

First, assume for a moment that SPY is in a bear market. Rallies during bear markets occur roughly every other month and gain a minimum of 7-8%. That targets the 197 and 200 areas which have previously been important levels for SPY. A new post on bear market rallies can be found here.

Second, even for a bear market, current investor pessimism is extreme. Fund manager cash is now the highest in 14 years, comparable to November 2001. That wasn't a bear market low, but equities rose nearly 10% in the following 2 months. A new post on fund managers' current asset allocation can be found here (data from BAML).

Macro data continues to suggest that a recession is unlikely. That's important, as bear markets rarely take place outside of an economic recession (a post on this is here). This past week, retail sales reached a new all-time high. The trend is higher, in comparison to the period leading into the prior two recessions (arrows).

Do rapidly falling Treasury yields indicate a recession? Probably not. Given the generally positive macro data we have, the rush into the safety of treasuries likely indicates investor fear and risk-aversion. The drop in yields the past 6 weeks is an extreme equalled only during other panics like those near the equity lows in mid-2010 and mid-2011 (data from LPL; read the full report here ).

The recent drop in equities is very similar to those instances shown above when Treasury yields dramatically fell. How did equities perform subsequently? On average, equities rose in the following month and were 10% higher 6-months later

Investors' risk aversion is also reflected in fund flows. $5.7b left equity funds this past week, making fund flows negative 11 of the past 12 weeks. Meanwhile, flows into bonds have been positive 9 weeks in a row. That dynamic can be seen in the Rydex funds: shown below is bear assets plus cash relative to all fund assets. Prior spikes in risk-aversion correspond to near lows in equities.

Aside from the unpredictable path of oil, the biggest concern is volatility. VIX is now oversold (top panel). In the past year, this has been where volatility has reversed higher (yellow shading). The one exception was in October (red shading). One bright spot is that period, like now, came after a more than 10% fall in equities and a spike higher in investor pessimism. In other words, there is a recent precedent for volatility to fall further under current circumstances.

Outside the US, emerging markets gained more than 3% this week. iShares MSCI Emerging Markets (N:EEM) is forming an ascending triangle; a close above 31 opens upside to 33-35.

On the economic calendar, new home sales are reported Wednesday, durable goods orders on Thursday and GDP on Friday.

In summary, this past week, equities followed through on last week's reversal, gaining 3-4%. Importantly, the rally came on unusually positive breadth: this has a strong propensity to push equity prices higher in the weeks ahead. Further upside also seems likely given extremes in investor pessimism, with fund manager cash levels rising to a 14 year high this month. Aside from the unpredictable path of oil, the biggest watch out is volatility.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.