Weekly Market Summary: Range Pattern Continues, Bigger Correction Ahead

Urban Carmel | Jul 26, 2015 01:30AM ET

Summary: What looked like the promising start of a new uptrend reversed hard this past week. There's a plausible scenario for SPX to fall under 1980 in the weeks ahead. Most of the indices ended the week oversold and on support. For now, it's reasonable to assume that the multi-month trading range pattern will predominate, but a bigger correction very likely still lies ahead.

As the week began, it looked as though the markets were beginning a sustained uptrend. Among other things, the market was impulsing higher. New uptrends make it hard to get long by moving quickly higher. NDX rose 8 days in a row and made a new bull market high. SPDR S&P 500 (ARCA:SPY) made a new ATH on Monday.

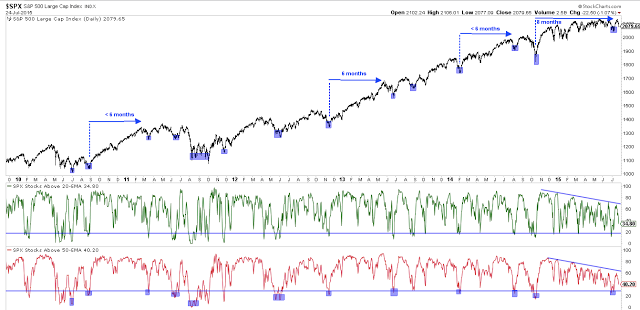

What made this scenario further credible is that breadth had washed out at the July low. This is how recent uptrends have started (blue shading).

Since then, the indices have fallen 4 days in a row. SPY has given back 62% of the gain from the July low. A durable new uptrend does not typically have such a strong sell off right from the start. This is now looking considerably less than an impulsive move higher.

Still, that NDX rose 8 days in a row is a sign of momentum and strength. Shown below are the last 4 instances (green) where NDX has risen 8 days in a row. We remarked early this week that the pattern has been for the prior high 'breakout' to be retested before the move higher continues (arrows). That retest took place on Friday at the close. That should be the lead hypothesis heading into next week.

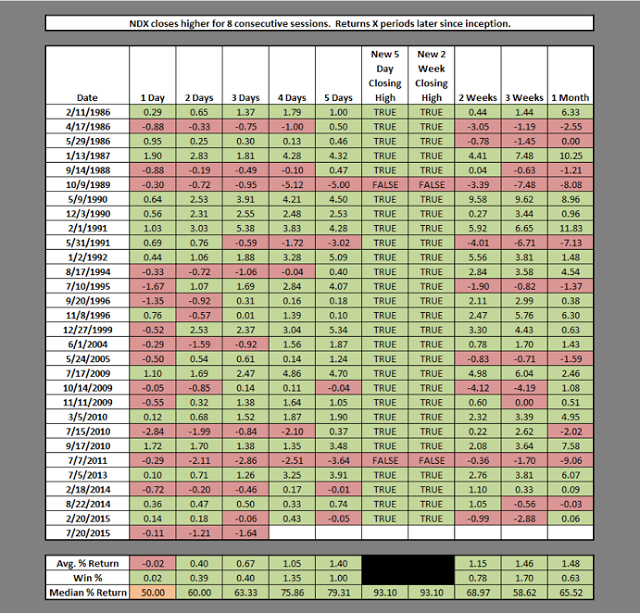

In the past 30 years, NDX has only twice failed to retest its recent high after rising 8 days in a row. In 94% of instances, a higher high was formed (chart from Chad Gassaway ).

The two instances that failed to form a higher high within a week, fell spectacularly over the next month (1989 and 2011). In 1989, NDX was 15% lower 3 months later. In 2011, it was 16% lower a month later.

It's possible that a similar set-up will take place now. Market breadth has been very weak for many months. August and September are historically weak and October is a notoriously volatile month. And sentiment, as measured by Investors Intelligence, never washed out: there were 2.8 times as many bulls as bears the week of the July low.

Moreover, each year since 1996, SPX has fallen from high to low by at least 7.5% (intraday basis; big hat tip to Cobra for this statistic). At the recent low, the fall was just 4%. A 7.5% fall targets 1975. (Since 1980, SPX has fallen at least 7.2% every year except 1992, 1993 and 1995. That implies a 91% historical rate of occurrence).

If the markets are going to have their annual swoon, now is near perfect set up, with price, breadth, sentiment and seasonality all in support. The odds of this taking place over the next 3 months seem to be very high.

For now, it's reasonable to assume that the multi-month trading range pattern will predominate. Starting with the DJIA, it failed at resistance and is now back at support. RSI is oversold (top panel). This has been where it has reversed every time since February. Until this pattern fails, assume that it won't. But failure to reverse likely implies that the annual correction is now underway.

Similarly, small caps (Russell 2000) ended the week on a 5 month trend line (dashed). What is notable is the recent uptrend made a lower high; assuming RUT reverses this coming week, watch that descending trend line for resistance.

The leader, NDX, has been stair stepping higher the past year. The Friday close retested the prior range top, the same pattern shown earlier. This should be major support. The retrace so far is just 38% of the rise from the July low, and so the sell off is not yet showing unusual weakness in NDX.

Unlike the other indices, SPY didn't end the week on a clear daily trend line or support level. It's in the middle of 6 month trading range. The May and June reversal levels were near the 206.6 area, so reversing next week from Friday's close constitute a 'higher low', a positive, and would go with the new high formed this week.

On an hourly scale, SPY closed two open gaps this week, ending Friday on the closed gap from July 13. Closed gaps are often support. Moreover, 208 was twice a key reversal point during the early July swoon, so there are reasons to expect this level to provide initial support next week. There's no divergence in RSI, so a rise and then low retest is a watch out. Closing above the weekly pivot (209.6; also the 50-dma) by mid-week would be a big positive.

When SPY has closed lower 4 days in a row, it has closed higher within the next 5 days in 16 of the last 17 instances (94%). The average gain was over 1%. It was higher 3 weeks later later 15 of 17 cases (88%) with an average gain of 2% (data from Chad Gassaway).

This coming week is the last week of July. Most months end strongly, and July is no exception (data from Sentimentrader).

With the turmoil in equities, Treasuries (using iShares 20+ Year Treasury Bond (ARCA:TLT)) ended the week up 2.3%. It has risen 9 of the last 10 days. RSI is now at a level where TLT has struggled and ultimately reversed in 2015 (yellow shading). Moreover, price reached the top of two channels. This should be resistance. If TLT can regain 123, making a 'higher high' from May, this would constitute a change in trend and add evidence that a larger correction in equities is underway. We already have a 'higher low' in July, as well as a positive divergence in MACD (lower panel), to support this bullish scenario for Treasuries.

The turmoil in equities also caused considerable fear among investors. The 21-d equity-only put/call ratio reached its highest level since November 2012. This is an extreme. The 'Fear and Greed' index also fell to 10 on Friday, another extreme.

We'll have more to say about gold in a separate post, but it's plausible that a short term low was made Friday. There were signs of selling exhaustion and then price reversed 2.1% during the day. Sentiment is consistent with other lows in gold over the past 8 years (data from Bloomberg).

On the macro calendar, the FOMC meets Tuesday and Wednesday and the first look at 2Q15 GDP is released on Thursday.

Our weekly summary table follows.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.