Weekly Market Summary For December 10

Urban Carmel | Dec 09, 2018 03:30AM ET

Summary: Emerging markets are in a bear market. Europe and the Nasdaq are getting close. After falling 10% in October, S&P 500 has been unable to sustain a rally. Even bearish sentiment, washed out breadth and the prospect of Santa Claus can't seem to rally stocks.

In real time, corrections always feel like they are the end of the bull market: the price pattern is bearish and the news emphasizes stories about a likely recession, poor forward earnings and geopolitical risks. Yet corrections usually happen every 18 months, and the current one has so far not been especially long or deep.

That is not to suggest that investors be complacent or dismissive of mounting risk. SPX had formed a topping pattern in August, and events since then have only strengthened this pattern. But there is little evidence of the underlying stress that is normally associated with big problems. For all the recent volatility, it is worth noting that the low in SPX was in October, 6 weeks ago. Everything since then has been a hot mess.

This is not a market trying to efficiently discount next year's growth; it's a market mostly driven by fear and emotion.

The correction from the September all-time high (ATH) is now in its 11th week. Aside from the NDX, all the US indices are now negative for the year. So are treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)). What's worked well so far in 2018? Volatility, which is up more than 40% (table from alphatrends.net ). Enlarge any chart by clicking on it.

From their ATH, SPX and the Russell 3000 (which represents 98% of US market cap) have declined about 12%. NDX might still be positive for the year but it has also fallen the most in the past two months (16%).

As bad as this sounds, the US has outperformed the rest of the world. The MSWORLD index (which excludes the US) peaked in January and is now down 19%. Emerging markets have been hit the hardest (which is normal in a correction); Europe is down 15%.

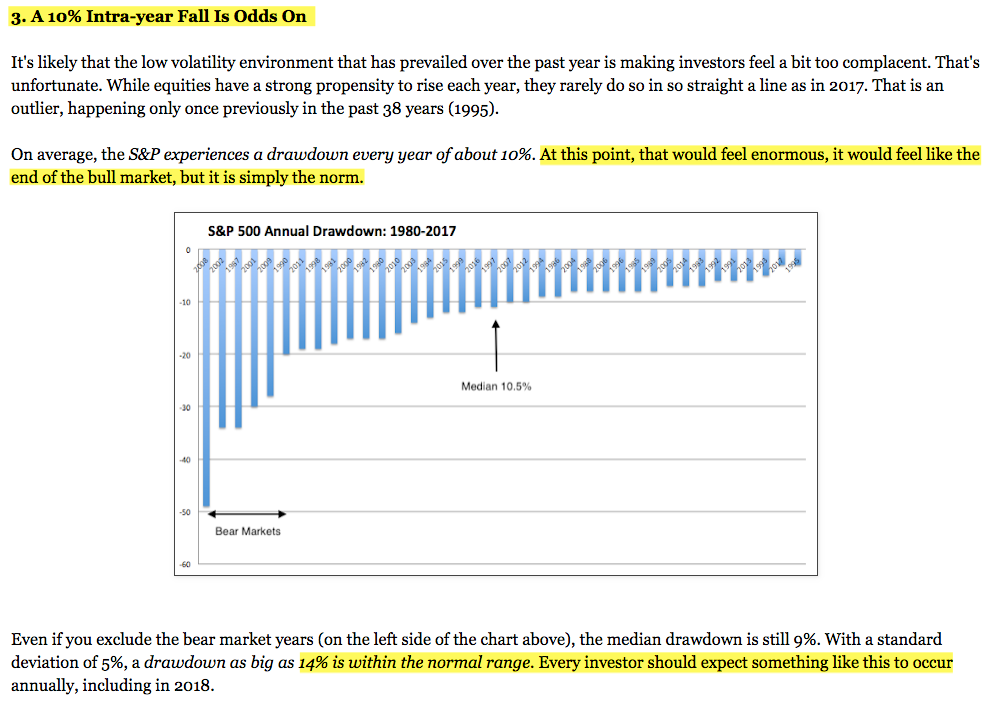

Annual falls of 10% are normal during the course of any year. Even 14% falls are within the normal range. But in real time, corrections always feel like they are the end of the bull market: the price pattern is bearish and the news emphasizes stories about a likely recession, poor forward earnings and geopolitical risks. This is not hindsight bias; our Outlook for 2018 emphasized the likelihood for exactly this outcome (here ).

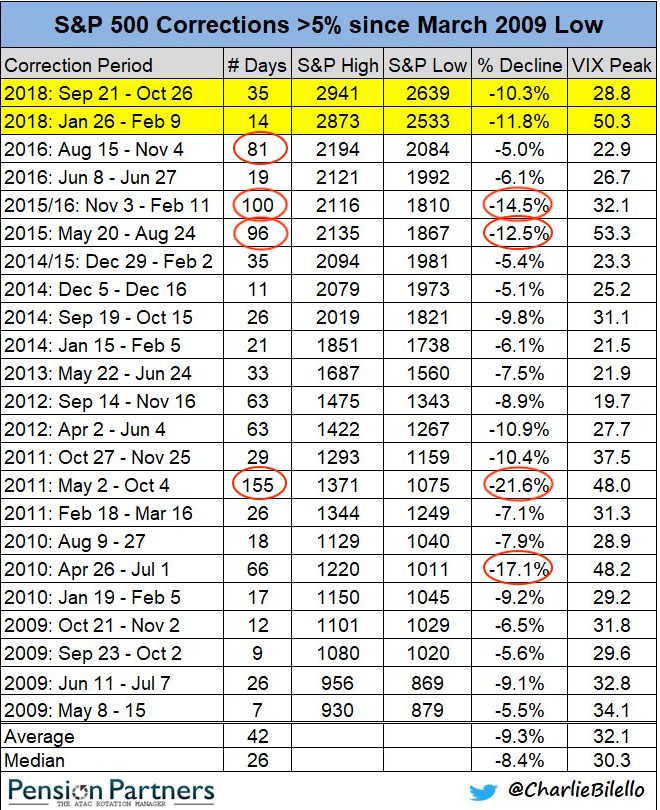

The correction is now in its 78th day. That's long, but not extreme. We don't know when this one will end, but there have been 4 corrections both longer and deeper than the current one since the 2009 low (table from Charlie Bilello as of October 26).

There is no doubt that recent volatility has been surprising. After falling 10% in October, SPX has rallied 6%, fallen 6%, rallied 6% and fallen 6%, all in the past six weeks. This week's 5% fall comes after last week's 5% rise and the prior week's 4% fall.

For all of this movement, it is worth noting that the low in SPX was in October, 6 weeks ago. All of the subsequent volatility has taken place within the 2600-2800 range. It's been a hot mess. The low has been tested 3 times and the high has also been tested 3 times. It's a good guess that whichever gets tested next (for the 4th time) is likely to break.

That makes the upcoming week a key one; below 2600 targets the February-April lows in the 2550-80 area. Be alert to a fake break, i.e., a break of 2600 that then reverses higher. That's the kind of move that triggers stops and marks capitulation, something that's been missing so far (note the long candle tails at the lows in February, April, May and October while Friday's candle lacks a tail).

The other end of the hot mess range (2800) has been a key demarkation level since February (note the 1, 2, 3s in the chart above). It's a good guess that the 4th attempt breaks higher and initiates a fear of missing out run higher to at least 2880. 2800 is also the 20-weekly MA (blue line) that we use delineate uptrends from downtrends. Equities are in a downtrend until that level is recaptured. Weekly highs in early November and this past week both stopped at that level.

In the chart above, note that down momentum (top panel) troughed in October. Subsequent retests of the lows have come on diminishing downward momentum. This supports a hypothesis that the last 6 weeks might have been a basing pattern.

We call the last 6 weeks a 'hot mess' precisely because the movements are wild, erratic and prone to violent reversals. This is not a market trying to efficiently discount next year's growth; it's a market driven by fear and emotion (from Barron's).

By itself, these swings are not a feature that are exclusive to bear markets. The number of up and down daily moves is on par with bull market years like 1988, the late 1990s and 2010, 2011 and 2015. In real time, it feels scary but this is not unusual, it's just very different from last year's placid ride higher (table from Charlie Bilello).

Over the past 20 years, daily volatility has more often been higher than what has so far been seen in 2018 (the black line is the median of all years). The red line at the bottom is 2017, the calmest year since the mid-1990s. 2018 seems like an outlier because 2017 was the actual outlier (from Willie Delwiche).

That SPX fell in October and then retested those lows in November (and December) is not surprising. The initial down momentum was too strong to dissipate quickly. At least one subsequent retest was strongly odds on (posts on that are here ).

What is now becoming surprising, however, is the inability of equities to sustain gains for more than a week. The recent extremes in some measures of sentiment have normally led to a multi-week rally. So far, rallies have ended after just 6 days (twice).

To take one example, the Advisor and Investor Model (AIM) from Sentimentrader, which combines sentiment survey data from several sources, first indicated a bearish extreme in early November. Since 2009, sentiment has not been much worse and in each case, an equity low was close and risk-reward was strongly skewed higher. Even in early 2008, a two month rally of more than 10% ensued (circle; from Sentimentrader; to become a subscriber and support the Fat Pitch, click here ).

In contrast, this time, after several strong but failed rallies, SPX is now 3% lower. It's encouraging that investors haven't become more bullish, but it's a bad sign when equities won't rally with bearish sentiment. The time has come for this to matter or a different investing environment has probably arrived.

One of the inputs into AIM is the AAII retail investor survey, shown below over the past 20 years with a 4-week moving average. By the time sentiment has reached current levels, SPX has been near at least a temporary low. In the 2008 bear market, bearish extremes led only to failed rallies (red box).

Two weeks ago - at the November low which was also near Friday's close of 2633 - AAII bearish sentiment dropped into lowest 5th percentile. This is when equities most often (but not always) start to outperform over the next 3, 6, 9 and 12 months. Average returns are nearly twice 'anytime' returns over the next half year (read the full post on this from Charlie Bilello).

It's not just sentiment surveys that indicate bearish sentiment. Equity fund outflows and hedging data are in concurrence.

The persistent sell off has pushed at least some measures of breadth into a washout. As noted by Sentimentrader ).

December is well known as the most bull friendly month of the year, closing higher 75% of the time since 1950. That has been especially true when investors do not expect equities to rally (like now). In the past 70 years, the 4th quarter has been negative at the start of December 19 times and then rallied into year end in all but two cases (90%). The worst failure was in 1957, when SPX fell 4.1%. SPX is already down more than that this month, meaning, it either rallies the next 3 weeks or it becomes the worst such December in 70 years (table from Paststat ).

Similarly, if SPX doesn't gain at least 1% to close the year positive, it will be the first time in its history that it has been up 10% during the year only to close in the red (from Steve Deppe ).

SPX has already fallen more than 2% on two of the first four days of this month. It fell 3% on Tuesday as the latest trade war spat with China intensified. In the past 90 years, that has happened in only 11 other years. SPX was higher a month later in all but two (a long time ago, in 1931 and 1941; table from Troy Bombardia ).

Without belaboring the point on the positive seasonal tailwind, it's worth remembering that SPX has risen over the next 6 months following a mid-term election every time since 1946. That's 17 occasions in a row. Since 1962: the average gain has been 15% with risk-reward more than 5:1 positive (from Quantifiable Edges ).

A final technical point: SPX has just experienced a 'death cross', meaning the 50-dma has crossed below the 200-dma. What happens next? Normally, equities rise. In the 34 instances this has happened in the DJIA since 1970, equity's performance over the next 3-6 months has not only been positive but better than after a 'golden cross' (from Mark Hulbert ).

What could go wrong? Primarily, the economic outlook could worsen. Since 1945, when the economy is growing, like now, the probability of a greater than 10% annual fall in the stock market is just 4%; 87% of the time, equities rise (from Goldman Sachs (NYSE:GS)).

There is notable weakness in housing. New home sales peaked a year ago (so far). That's not good, but in the past 40 years it has peaked a median of 2-1/2 years before the next recession, and 2 years before SPX's cycle peak. Net, a housing peak is not an imminent threat. Moreover, other indicators, like employment, appear to be still strengthening; 2018 is on pace to be the 4th best year for new jobs since 2000 (a new post of this is

Similarly, credit markets are not hinting at weakness. Swap spreads remain low. We’re not seeing tightening conditions, poor market liquidity or underlying stress. In the past, these have started to blow out well ahead of big problems. Similarly, high yield spreads are benign (read the full post from Scott Grannis ).

Likewise, while the 5-3 yield curve inverted this week, longer-term yield curves have not. Historically, 70% of yield curves have inverted before the next recession; right now, it's less than 10% (from Tiho Brkan ).

In fact, SPX normally gains over the next 3 and 9 months after the first 5-3 inversion of the cycle (second chart, from Troy Bombardia ; note that 1973 was the year of the oil embargo).

None of this is to suggest that investors should be complacent or dismissive of risk. We warned that SPX was making a bearish topping pattern back in August, a month before SPX peaked (here ). That it has since fallen 10% and ignored positive sentiment, seasonality and macro data only strengthens this pattern. A bear market is possibly underway, but, on balance, that is the least likely outcome. More probable is that the sell off is a reflection of fear.

On the calendar this week: CPI on Wednesday, retail sales and IP on Friday. The main upcoming event before the holidays is the FOMC meeting on Wednesday December 19 (from IBD Investors; for a trial subscription, please use this link ).

If you find this post to be valuable, consider visiting a few of our sponsors who have offers that might be relevant to you.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.