SPX: Long Term Bull Market

Tony Caldaro | Aug 30, 2015 03:41AM ET

REVIEW

The week started off at SPX 1971. On Monday, due to overnight selling, there was a huge gap down at the open to SPX 1875. Then after hitting SPX 1867 in the opening minutes, the market rallied to 1954 into the early afternoon, and then headed lower again. Tuesday was quite volatile and ended at Monday’s low. Then the market gapped up on Wednesday and Thursday, closing the week’s 100 point opening gap and hitting SPX 1990. On Friday, the SPX hit 1993, then ended the week at 1989. For the week, the SPX/DOW were +1.00%, the NDX/NAZ were +2.85%, and the DJ World index was +0.30%. On the economic front, positive reports outnumbered negative ones 11 to 3. On the uptick: Case-Shiller, the FHFA, new/pending home sales, consumer confidence, durable goods, Q2 GDP, personal income/spending, the PCE, plus weekly jobless claims were lower. On the downtick: the WLEI, the GDPN and consumer sentiment. Next week will be highlighted by the FED’s beige book, Payrolls and the ISMs. Best to your week!

OVERVIEW

This has been quite an eventful week, with long term implications. In an attempt to remain objective, we will present our findings and you can decide how to best deal with them. Monday’s flash crash at the open and retest on Tuesday was an international event. Many of the emerging markets, and commodity driven, foreign indices, which had been rising in corrective patterns for the past number of years, appear to have completed those patterns and are now back in bear markets. Our list includes: Australia, Canada, Hong Kong, Indonesia, Singapore and S. Korea. These indices join Brazil, Greece and Russia, which had already been in bear markets. These nine indices represent half of the foreign indices we track. Obviously the rest of the indices, plus the US, are now facing some headwinds.

After the SPX hit an all time high in May at 2135, it had a modest correction into early July to 2044. We had anticipated that low, and then expected the bull market to resume. The SPX then started to uptrend, but the advance looked corrective, as the NDX/NAZ were making new highs. We then suggested defensive positions were warranted. Over the following weeks, while the market went sideways, we determined there were three possible counts. Lengthy bull markets, like this six year rise, make it difficult to track due to the abundance of waves. The three counts suggested a range from a minimum decline of SPX 2040 to the largest correction since 2011. The previous Thursday, the market closed below SPX 2040, which had provided six months of support, then a three day selling wave took the market down to 1867. Creating the largest corrections since 2011: SPX -12.6%, DOW -16.2%, NAZ -18.0% and the NDX -19.3%. The worse case scenario had unfolded.

Our worse case scenario, for the bull market, was that the SPX 2135 high ended Primary wave III and a three wave Primary wave IV was underway. This count was carried on the daily SPX and some other major index charts. The selloff, after breaking SPX 2040 support, was so rapid that it nearly triggered a long term downtrend. Long term downtrends are confirmed only during bear markets. They never, ever occur during bull markets. This was quite unexpected, and suggests additional caution should be maintained until this bull market reasserts itself. Should the market break Monday’s/Tuesday’s SPX 1867 low, any time in the future, a long term downtrend is likely to be triggered, and we too will be in a bear market. Naturally we will post this information in the daily update when/if it occurs. Using this information as an objective foundation, we move ahead to the regular report.

LONG TERM: bull market

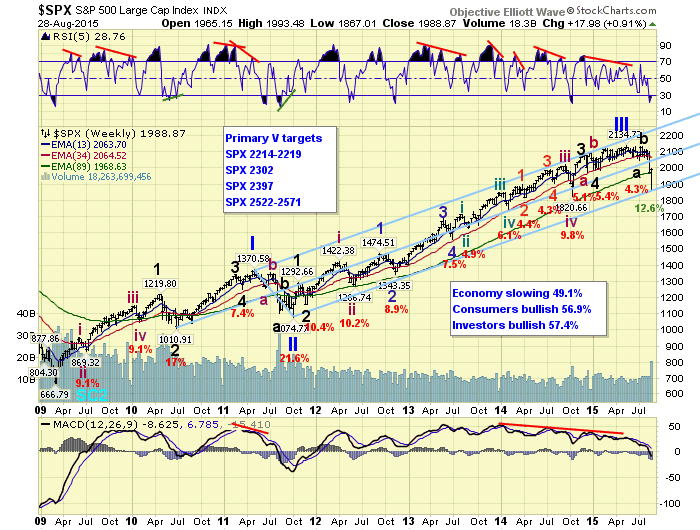

Our preferred count remains that this is a Cycle wave [1] bull market following the Super cycle bear market low in 2009. Cycle wave bull markets unfold in five primary waves. Primary waves I and II completed in 2011. Primary III completed in May, and Primary IV may have completed at this week’s SPX 1867 low. Over the past three months, the SPX has had three corrective trends: 2044-2133-1867. This would satisfy three Major waves down into a Primary IV low.

With Primary III topping in 2015, much of the historical references we have used this entire year no longer apply. We had thought, since this was the third longest bull market in history, that its three rising waves would unfold in Fibonacci years, like the other five. It has not. We also thought that the bull market would last for a Fibonacci number of years. We can no longer count on this relationship either. We are in unchartered historical territory.

At the beginning of 2015, we projected an upside target of SPX 2500+ by 2016. We had used the Fibonacci years relationship and the ECB’s EQE to determine this target. Unfortunately, EQE did nothing for the SPX, as we have noted for the past several months. And with the Fibonacci years relationship now discounted, this target now becomes the optimal target rather than the expected one. When considering everything noted thus far, we are forced to shift from an aggressive posture to a more conservative one.

Fifth waves, during this bull market, have been notoriously weak. A simple glance at the Major wave 5’s during Primary waves I and III illustrate this quite well. Nothing more than marginal new highs before those primary waves ended. If Primary wave IV ended at SPX 1867, as expected, we can make some projections for Primary wave V. Since we use Fibonacci price clusters to determine these types of targets, we will offer them now as guidance going forward. There is a cluster between SPX 2214 and SPX 2219. Then single hits at SPX 2302, SPX 2397, and then a cluster between SPX 2522 and SPX 2571. The two clusters suggests the minimum and the maximum upside targets for the rest of the bull market.

MEDIUM TERM: downtrend may have bottomed

After the Primary III high at SPX 2135, the market did a Major A down to 2044, a Major B up to 2133, and now a Major C down to 1867 thus far. This would appear sufficient, barring a retest of the lows, to complete a Primary IV correction. At the low, we had the most dramatic negative readings in the MACD in quite a while. The hourly MACD hit a negative 43.4, far below the -31.0 of Primary II, but above the -50.8 during 2008. The daily MACD hit negative 42.0, in line with the -42.4 of Primary II, and the -41.8 at the 2009 low, but well above the -77.2 during 2008. This week's activity was a very significant event.

The Major wave C downtrend, while swift, can be counted as three Intermediate waves: 2052-2103-1867. With each of the Intermediate waves dividing into three Minor waves. Intermediate wave C, which is most important right now, displays these three Minor waves: 1867-1956-1867. At the low, there were positive divergences on the hourly RSI/MACD, and the above noted extreme oversold levels on the daily chart. Normally, these are more than sufficient to indicate a downtrend low.

Last weekend, we had noted an expected downtrend low this week. Only we were not quite sure at what level it would occur. On Monday, we posted that the downtrend should bottom during a retest of Monday’s lows between the 1828, 1841 and 1869 pivots. We had no idea it would occur as soon as Tuesday. After hitting the extreme oversold levels, we posted a tentative green Primary IV label on the hourly/daily charts Wednesday morning. Thus far, that low has held. Medium term support is at the 1973 and 1956 pivots, with resistance at the 2019 and 2070 pivots.

SHORT TERM

Due to the volatility, we have expanded our short term algorithm range a bit and can see five waves up from the SPX 1867 low: 1915-1880-1990-1948-1993. The third wave divided into five waves as well. Quantitatively, however, due to the volatility, we only see three waves up at this time. The algorithm count would suggest support around the 1956 pivot. We will track both for the time being until the market provides additional data.

If we take the minimum Primary V target of SPX 2214-2219, it is possible this bull market could complete during one uptrend and this year. If so, the five wave advance of such an uptrend would be labeled with five Major waves. Since this is a possibility, and the simplest count, we will start off labeling it this way once the uptrend is confirmed and/or looks impulsive.

Short term support is at the 1973 and 1956 pivots, with resistance at the 2019 pivot and SPX 2040. Short term momentum is displaying a negative divergence at Friday’s highs. Best to your trading this volatile market!

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.