Weekend Sentiment Summary: Remaining In Neutral Territory

Tiho Brkan | Jul 09, 2013 06:46AM ET

- Due to the Independence Day holiday, last week's COT report was released on Monday and therefore I waited until Tuesday morning (Asian time) to do the following sentiment post.

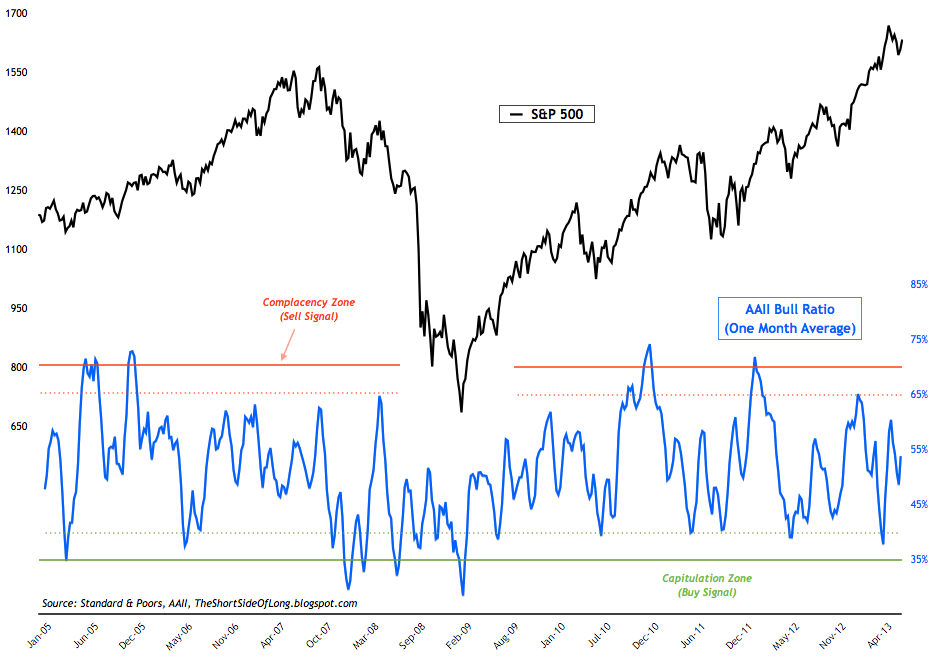

- AAII survey readings came in at 42% bulls and 24% bears. Bullish readings rose by 12% while bearish readings fell by 11%. The AAII bull ratio (4 week average) currently stands at 53%, still dead smack in the middle of the historical range. At the same time, AAII asset allocation survey showed that retail investors decreased their equity exposure by 3% to 62.1%, while cash levels increased 4% to 20.7%. For referencing, AAII Cash Allocation survey chart can be seen by clicking clicking here .

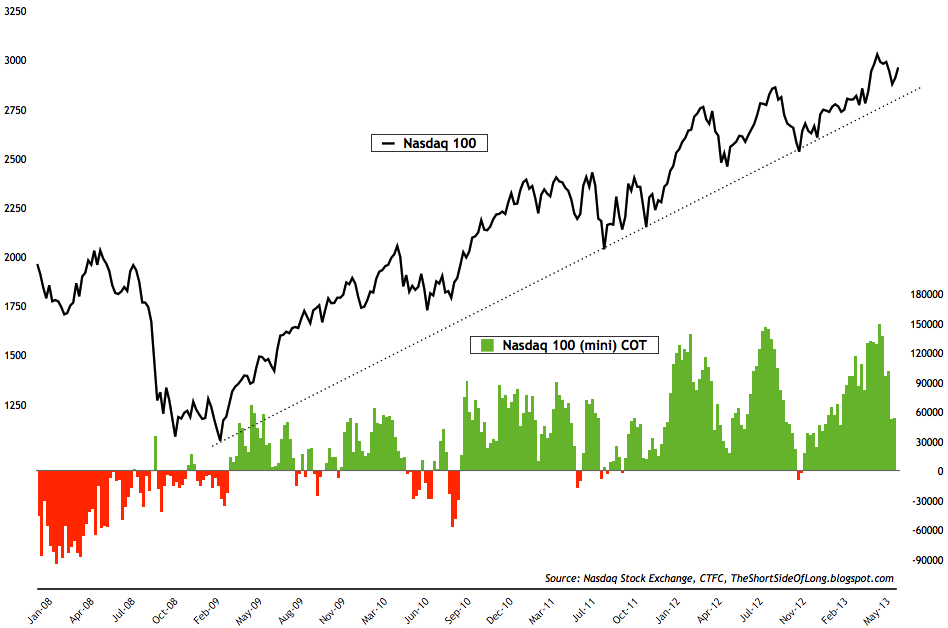

- Last weeks commitment of traders report (released yesterday) showed that hedge funds and other speculators held similar bets to last weeks data. While the exposure reached as high as 150,000 net long contracts several weeks ago, readings on the US tech equities has now fallen back to 54,000 net long bets. Once again, reduction of outright bullish sentiment is evident, but we are no where near a buy signal just yet.

- Bond sentiment surveys are nearing pessimistic territory, with certain surveys now reaching extreme pessimism. Market Vane survey & Hulbert Newsletter Bond survey are turning more negative but are not yet at the panic levels, while Consensus Inc survey has now reached extreme downside levels with only 28% bulls (historically readings of 25% to 30% bulls have marked intermediate degree bottoms). The sell off has been strong within the bond asset class, and it has not spared the Treasury market, the Munis, the emerging market bonds and nor the corporate or junk bond debt.

- This weeks ICI fund flows report showed "bond funds had estimated outflows of $28.12 billion, compared to estimated outflows of $7.97 billion during the previous week. Taxable bond funds saw estimated outflows of $20.45 billion, while municipal bond funds had estimated outflows of $7.68 billion." The data above shows a huge swing in retail investor sentiment. Consistently, month after month, we have seen bonds as the favourite asset class by retail crowd (especially corporate and junk bond space where inflows have been record breaking). The situation has now changed with recent sharp sell off on the back of "tapering hints" by the Fed, which has crashed bond prices and panicked the fixed income investment community.

- Last weeks commitment of traders report (released yesterday) shows that small speculators remain net short the Treasury Long Bond market, however the readings are not yet near extremes. This weeks positioning came in at 35,600 net short bets, which is almost half of the recent 60,000 net short position seen only a few weeks ago. The government bond market has plummeted in recent weeks, as I have been stating in previous reports that a downtrend of lower highs and lower lows seems to have established itself. Under this condition, net short bets can persist just as long as net long bets persisted during an uptrend from February 2011 until June 2012.

- As a quick side note away from sentiment readings, let us quickly focus on the chart above, which shows US stocks vs bonds. From a technical perspective, it seems that the bond yields have established some kind of a base from which they have broken out on the upside. In previous instances, the rise in yields (fall in bonds) has supported US stocks as a counter pair trade. However, US stocks have outperformed just about every asset class over the last few quarters and have recently risen in a parabolic manner. This makes them extremely overvalued in the medium term. Could both stocks and bonds enter a correction stimiitanously? And if so, what asset class would benefit under these conditions?

Chart 7: Funds have reduced their commodity exposure past the '08 lows

- Last weeks commitment of traders report (released yesterday) showed that hedge funds and other speculators reduced commodity net long bets dramatically for the second week running. Cumulative net long exposure currently stand at 167,000 contracts tracked by my custom COT aggregate, which is the lowest positioning level since at least 2001. Hedge fund exposure was dramatically reduced in agriculture, and in particular within the grains. Investors are panic selling Corn in particular. Energy exposure stayed similar from previous week, while metal exposure once again fell.

- It has been obvious for awhile now that agricultural commodities have been out of favour. If it wasn't for the drought in 2012, grains would have not rallied as high. The rise in grains last year masked the underlying weakness in the sector, as all commodities continue to be under pressure. This is very evident in prices of soft commodities like Sugar, Coffee, Cotton and Orange Juice. Please note that last weeks COT report showed that hedge funds reduced their cumulative agricultural commodity exposure to some of the lowest levels in a decade.

- Commodity Public Opinion surveys still remain near their bearish extremes, however in most commodities, investors are not in outright panic just yet. Expectation to this rule, where sentiment is extremely negative, are commodities such as Copper, Cocoa, Coffee, Lumber and Sugar. While I do not consider them commodities, precious metals like Gold, Silver and Platinum fall into this extremely pessimistic category too (more on that below).

Chart 9: Speculators have been whipsawed by the recent Dollar volatility

- Last weeks commitment of traders report (released yesterday) showed exposure towards the US Dollar almost doubled from a previous week, from $13.3 billion towards $22.3 billion. The US Dollar volatility has been high, with a sharp correction followed by an even sharper rally towards new 52 week highs. Investors are puzzled at the direction of the greenback, but as long as the uptrend line holds (shown in the chart above), King Dollar will keep rallying. Hedge funds hold short bets against all foreign currencies from Euro and Yen all the way to Aussie Dollar, where positioning has reached another record high net short.

- Currency Public Opinion survey readings on the US Dollar have once again started rising towards bullish extremes, but still not there just yet. At the same time, Public Opinion on the foreign currencies has fallen. In particular, investors dislike the Pound, the Euro, the Yen and the Canadian Dollar.

- Last weeks commitment of traders report (released yesterday) showed hedge funds and other speculators continuously keep on reducing precious metals exposure. Hedge fund positions on Gold remain at a decade low of 20,700 net longs, while in Silver positioning remains at extremely low 4,600 net longs. Gold net long positioning is currently at 5.5 percent of overall open interest, while Silver's is at 5.7 percentage points. This is extremely low (and a contrarian buy signal) as historically Gold's net long positions as a percentage of open interest can reach as high as 70% plus and has usually averaged around 44% mark.

- Public opinion on alternative currencies like Gold and Silver continues to remains depressed, which is confirming the ultra bearish COT reports discussed above. Sentiment can stay negative for a prolonged period of time during bear markets the same way it can remain positive for a prolonged period of time during bull markets. However, it should be noted that sentiment is ultra bearish and a sharp rebound can occur at any point in time.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.