Stocks Week Ahead: Fed Statement, Services PMI and Earnings to Shape Outlook

Michael Gouvalaris | May 05, 2025 03:02AM ET

Last week was full of important data and earnings. While this week isn’t as busy, there are a few important things to watch for.

For economic data:

Monday: April ISM Services PMI (50.2 est.)

The services sector is about 70% of the US economy, and its what has been keeping the economy from heading into recession while the manufacturing sector remains in a secular contraction. The estimates are for 50.2, when anything above 50 is expansion, which means the market is expecting the services sector to just barely escape contracting in April.

Last month's reading on Services was 50.8, so any number below would be the 2nd straight month of slowdown.

Tuesday: Trade Balance

Imports subtract from GDP growth, so we’ll see if imports are leveling off or getting worse. This data point is on a month lag, so it's not timely nor market-moving at this point. But I still like to look at total trade (imports + exports) to get an idea of the effects on economic activity.

Wednesday: FOMC Statement & Press Conference

Widely expected that rates will not change during this meeting. Regardless of the outcome, there will be something for everyone.

Earnings: 94 S&P 500 companies report results this week. Notables include Palantir (NASDAQ:PLTR) on Monday, AMD (NASDAQ:AMD) on Tuesday, and Uber (NYSE:UBER) on Wednesday.

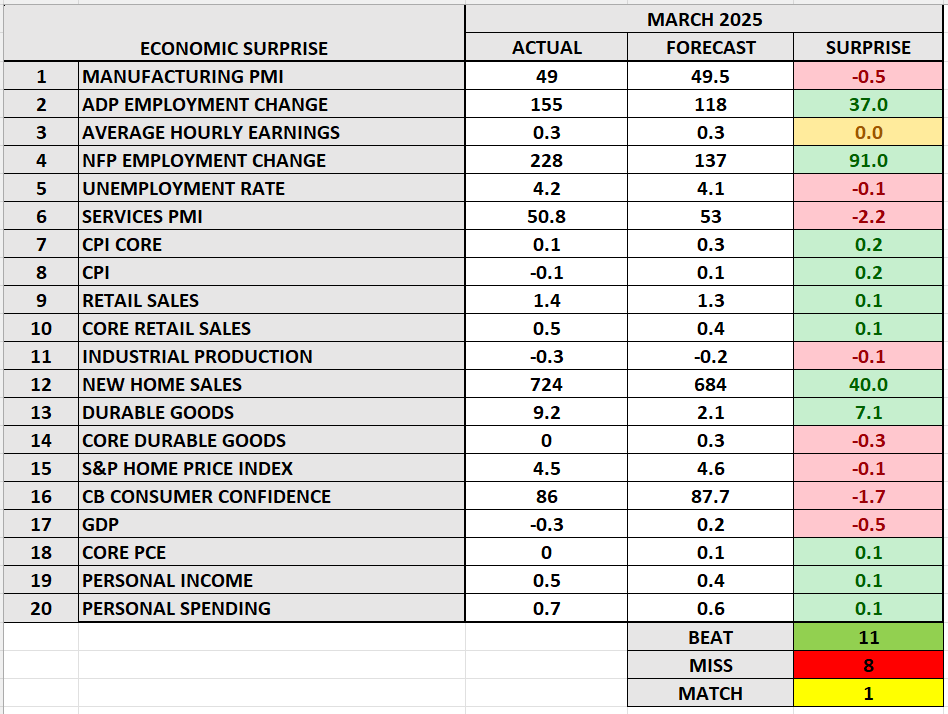

The remaining March economic data was reported last week. The final scorecard is above. We saw 11 beats (which is the best month of the year so far), while eight missed.

The beats centered around inflation and spending/income, while the misses came from the business-level data points like PMI’s, durable goods, and industrial production, along with consumer sentiment.

Most data points continue to be affected by tariffs.

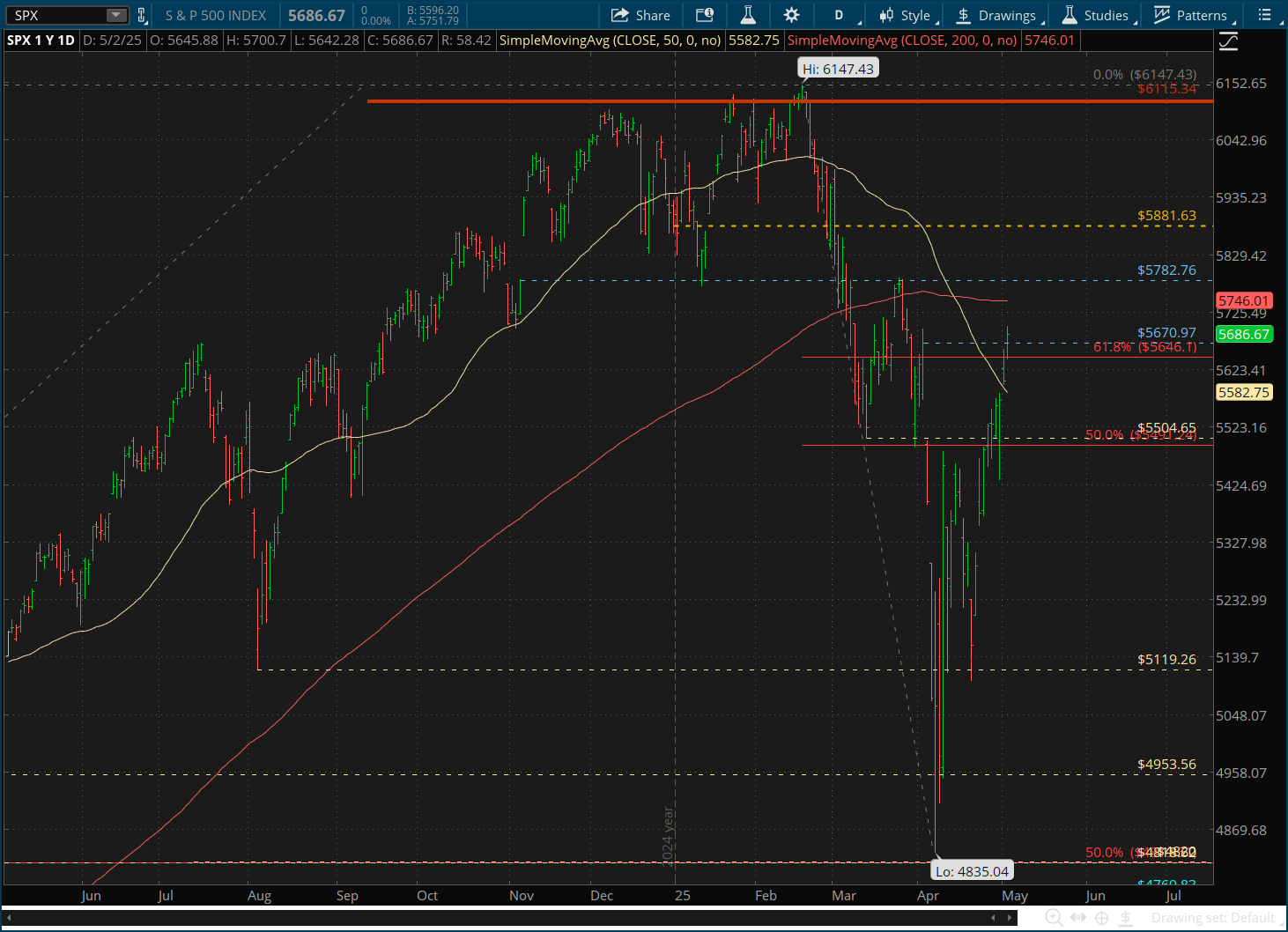

The S&P 500 and the Nasdaq both traded above the liberation day gaps this week. A stunning development given the uncertainty that remains. The only remaining obstacles left are the 200 day moving average (5746)and the prior swing high (5782). Bear market rallies usually don’t push this far above the 61.8% retracement level.

Interest rates started rising swiftly again to end the week. We’ll see if it picks up again this week. You don’t want to see bond yields rising this fast on a regular basis. Meanwhile, credit spreads, although moderately elevated from the levels they were at last month, are still low by historical standards.

The US dollar continues to struggle getting back above the 2024 low point around $100.17. We’ll see if we can get back above this week.

While it was a great week for stocks, the economy is still slowing. The PE ratio is now 21x to 22x, which is well above the long-term average, especially when you consider where rates are right now.

The forward PE hit 25x during the COVID recovery and we eventually grew into those earnings without another stock market sell-off. But here is the difference: rates got as low as 0.50% back then. There is a big difference between 25X earnings at a 1% rate versus 21x earnings at a 4.3% rate.

I can’t get excited about stocks at these levels. Lightening up on stock exposure during the rallies, and adding back if/when we get lower prices.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.