Wednesday's FX Outlook

Saxo Bank | Feb 12, 2014 10:46AM ET

• Sterling spikes after BoE inflation report

• Gains particularly strong against EUR, CHF

• AUDUSD possibly set to test 0.920/50

Today’s big mover was sterling, as the Bank of England’s Quarterly Inflation Report sent the currency on a moonshot against the struggling euro and Swiss Franc. Elsewhere, NOK was a big mover and the Scandie picture is interesting in general heading into critical event risks.

Looking ahead, in addition to the Scandie central bank policy risks tomorrow, note that we have an Australian employment report up tonight and US Retail Sales and Yellen’s second round of testimony tomorrow. AUD is particularly interesting after the break above 0.9000 in AUDUSD and we look for whether the squeeze will continue toward 0.9200/50 or pivot lower on a weak jobs report.

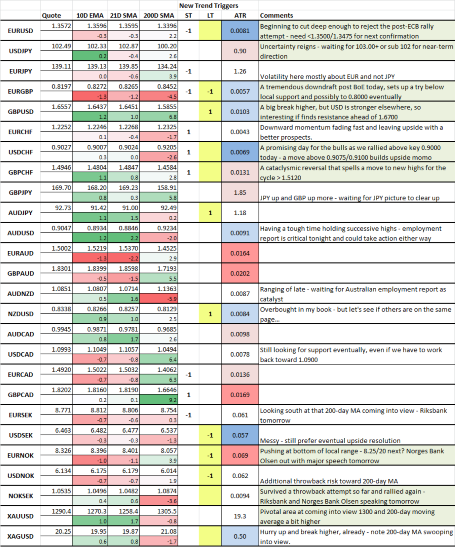

Today’s FX Board (beta)

EUR/GBP and GBP/CHF were the biggest movers today on the BoE inflation report as EUR/GBP crushed all the way lower to the ultimate local support all in one fell swoop. The momentum is now overwhelming on this move and we could test to new lows for the cycle and even on to new multi-year lows.

The rally today engulfed all most of the previous range trading as we focus on whether the pair can sustain a rally beyond 1.5120 in the days ahead.

A key Scandie battleground tomorrow in NOK/SEK, as the pair pulled back above 1.0500 today after a threat below on the mixed Norway GDP data. Tomorrow we have the Riksbank rate decision and Swedish employment report and the Norges Bank’s Olsen out making an annual policy speech.

Gold is pushing at key levels here. In the bigger picture, it’s time for the rally to get serious or find a more volatile rejection than it has seen thus far.

AUD/USD is nearing the highs for the year and will trigger off tonight's employment report possibly sending it toward the 200-day moving average in the days ahead on strong Aussie numbers and support from commodity markets or pivoting back lower on a weak number. Strategically, it is still looking for bear market resumption — it's a question of local entry levels at this point.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.