Weak Fundamentals And Negative Sentiment Contribute To Yen Weakness

Sober Look | Nov 04, 2012 03:28AM ET

The yen continues to be driven lower by Japan's fundamentals. And unlike in previous periods, the yen has often declined recently even when the S&P500 was lower. JPY is losing its status of a safe haven currency (NASDAQ : The net amount of investor cash betting the yen would fall more than doubled in the past week, government data showed Friday.

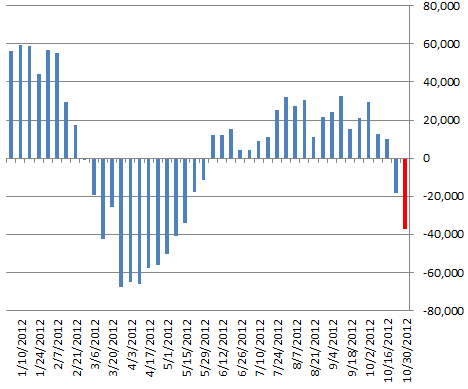

As of October 30, investors had increased their net short yen position to $5.8 billion, the largest short yen position since May 8. The previous week investors held a net $2.8 billion short yen position, according to the Commodity Futures Trading Commission.

Here is the latest from the CFTC.

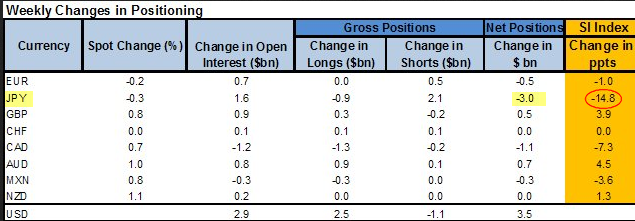

The GS JPY Sentiment Index has turned lower as well based on the changes in net positions.

Goldman: After switching to net short JPY positioning last week, JPY net speculative positioning continued to move further into short territory in this week's COT report. Net positioning now stands at -$5.8 bn, with most of the change coming from an increase of speculative short positioning in the currency. Our JPY Sentiment Index fell by another 14.8 points on the week, and is now at 24.0, the lowest reading of all eight currencies covered in the report.

Of course at some point one would need to put on a contrarian hat and ask the question if the yen is oversold. For now, however, taking a contrarian view on JPY may be premature.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.