Was April 2012 The Start Date Of The Recession In Europe?

Econintersect LLC | Jul 01, 2012 12:42AM ET

One of my favorite tools for monitoring the health of an economy is imports. Imports naturally increase when the economy expands, and contracts as the economy recesses. Most pundits watch trade balances as it is felt this is a measure of the competitiveness of the economy.

- when the trade balance change is negative and growing more negative, many feel the home team is losing its global edge;

- conversely a change positive and growing trade balance means the economy is lean and mean.

Although there is some truth in this way of thinking, the trade balance month-to-month movements may not say much about the competitiveness of one economy compared to other economies. A simple move in the price of crude materials moves the balances, and is no measure of competitiveness.

From my last post analyzing the trade balance:

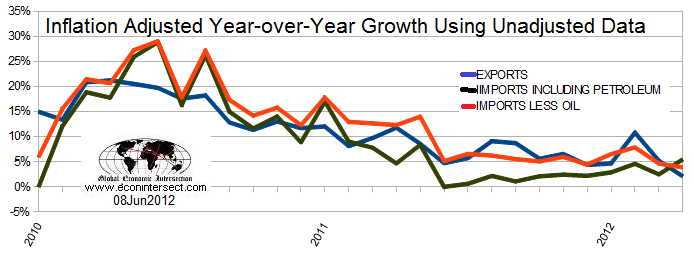

As shown in the above graph:

- import growth with oil has been trending up since mid-2011

- import growth less oil (red line above) has dropped below its trend channel. (One month of bad data is not a trend.)

- Exports (blue line) fell significantly this month, likely indicative of a cooling global economy.

I would not consider the data excellent this month with the deterioration of exports. The seasonally adjusted numbers the BEA has reported makes the trade data look better than what it is for exports. Note: This is a rear view look at the economy.

I watch the “imports less oil” which has been deteriorating over the last two months. This tells me the USA economy is slowing, but this data is two months old, and its trend (which would be used to forecast) is arguable.

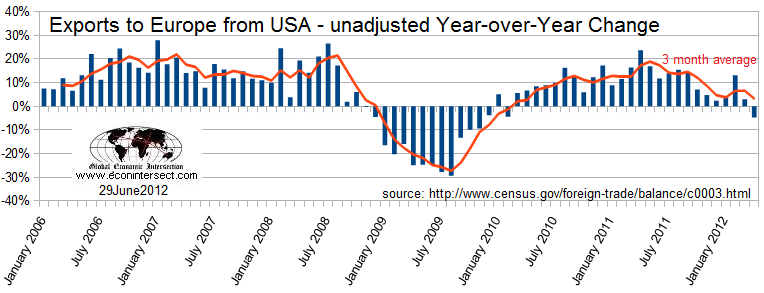

However, what is going on in Europe is clearer as the trends are obvious. What is an export to the USA is an import to Europe. The graph below clearly shows the degradation of European imports beginning in mid-2011.

Unless this trend reverses, it is likely Europe as a whole is already in a recession. One can use this data set and trends to suggest Europe’s recession began in April or May – but it will be months until enough data is available to confirm this.

However, based on other data we are seeing from Europe, it is not a stretch to believe Europe is already in a recession.

Other Economic News this Week:

The Econintersect economic forecast for Click here to view the scorecard table below with active hyperlinks.

Bankruptcies this Week

: Ritz Camera & Image

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.