Virus and Fed Dampen Investors' Morale: 5 Low-Beta Stock Picks

Zacks Investment Research | Nov 30, 2021 08:08PM ET

On Nov 30, Wall Street suffered yet another blow after the Black Friday rout. Discouraging comments by a COVID-19 vaccine manufacturer regarding Omicron — the latest variant of coronavirus — and lack of data regarding it made investors shaky before the market opened on Tuesday. To make the situation worse, the Fed Chairman’s comment on the likely speeding up of the bond-buy tapering process dampened market participants’ sentiment to a great extent.

Volatility returned to the U.S. stock markets at the end of November and is likely to persist till early December. So it would be prudent to invest in low-beta dividend-paying stocks with a favorable Zacks Rank. Here are five of them — Bunge (NYSE:BG) Ltd. TMO .

Wall Street Tumbles on Virus Fear and Fed Comment

U.S. stocks markets plummeted on Nov 26 once the news of the resurgence of coronavirus in the form of a new variant called Omicron came from South Africa. The Dow suffered its biggest Black Friday decline since 1969 while both the S&P 500 and the Nasdaq Composite posted their worst-ever Black Friday drop.

Markets rebounded to a large extent on Nov 29 as the medical world is divided on the severity of Omicron and the statement from a COVID-19 vaccine manufacturer that it will recreate a vaccine to combat Omicron within 1-2 months. However, the next day, the same company said that its vaccine may be insufficient to totally protect against the new variant and it could take months to develop one specific enough to adddress Omicron.

Moreover, on Nov 30, in his testimony before a Senate committee, Fed Chair Jerome Powell said the central bank will discuss speeding up the tapering process of its quantitative easing program in the upcoming FOMS meeting scheduled from Dec 14-15.

Powell said “At this point, the economy is very strong and inflationary pressures are higher, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases, which we actually announced at the November meeting, perhaps a few months sooner.”

In the November FOMC meeting, the Fed decided to start tapering its bond-buy program at the rate of $15 billion per month effective November. At that speed, the bond-buying program should have ended in June 2022 and the first hike in the benchmark interest rate since March 2020 was likely in the second half of next year. However, Powell’s latest statement has indicated that the first rate hike is likely to come in the second quarter of 2022.

Consequently, on Nov 30, the Dow, the S&P 500 and the Nasdaq Composite have tumbled 1.9%.1.9% and 1.6%, respectively. The yield on the benchmark 10-Year U.S. Treasury Note dropped to 1.44% as investors shifted funds from equities to government bonds. The price of the U.S. benchmark WTI crude oil fell 4.3% to $66.18 per barrel. For the month of November, the Dow and the S&P 500 fell 3.7% and 0.8%, respectively while the Nasdaq Composite gained 0.3%.

Fundamentals of U.S. Economy Remain Robust

Both consumer spending and business spending remained strong despite mounting inflation and supply-chain disruptions. Manufacturing and services PMIs stayed elevated. The struggling labor market is showing a systematic recovery. The last-reported weekly jobless claims data for the week ended Nov 20, came in at the lowest level since Nov 15, 1969.

Moreover, in its latest projection on Nov 24, the Atlanta Fed reported that the U.S. economy would grow by 8.4% in fourth-quarter 2021. U.S. GDP grew 6.4%, 6.7% and 2.1%, in the first, second and third quarters of this year, respectively.

Total third-quarter earnings of the market's benchmark — the S&P 500 Index — are projected to jump 40.3% from the same period last year on 17.2% higher revenues. Moreover, in fourth-quarter 2021, total earnings of the S&P 500 Index are expected to up 19.4% year over year on 11.1% higher revenues.

Our Top Picks

We have narrowed our search to five large-cap (market capital > $10 billion) low-beta (beta >0

These stocks have strong potential for the rest of 2021 and have seen positive earnings estimate revisions within the last 30 days. Moreover, the companies are payers of regular dividend, which will act as an income stream during the market’s downturn. Finally, each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

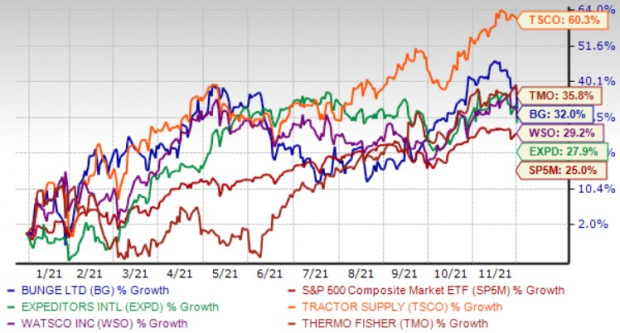

The chart below shows the price performance of our five picks year to date.

Tractor Supply Co. is the largest retail farm and ranch store chain in the United States. The focus of Tractor Supply is on recreational farmers and ranchers as well as tradesmen and small businesses. Given the changing consumer trends, TSCO aims to integrate its physical and digital operations to offer consumers a seamless shopping experience.

Tractor Supply is on track to build up on its Out Here lifestyle assortment and convenient shopping format to gain new customers and market share. The strategy is essentially based on five key pillars which includes customers, digitization, execution, team members and total shareholder return.

Zacks Rank #1 Tractor Supply has an expected earnings growth rate of 23.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.1% over the last 30 days. Tractor Supply has a beta of 0.94 and a dividend yield of 0.92%. The stock price of TSCO has soared 60.3% year to date.

Thermo Fisher Scientific Inc. benefits from strong end-market growth driven by robust fundamentals in the life sciences, strong economic activity globally and strong pandemic response. The underlying demand for Thermo Fisher’s product and service offerings used in the production and development of COVID-19 vaccines remained robust and TMO expects this demand to transition to non-COVID revenues.

Thermo Fisher is currently expanding its bioproduction purification resin capacity, which is used in the mRNA manufacturing process. In Biosciences business, TMO has launched several new products, including two instruments to advance cell analysis — the Invitrogen Bigfoot Spectral Sorter and the Invitrogen Attune CytPix Flow Cytometer.

Zacks Rank #2 Thermo Fisher has an expected earnings growth rate of 19.7% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.6% over the last 30 days. Thermo Fisher has a beta of 0.72 and a dividend yield of 016%. The stock price of TMO has jumped 35.8% year to date.

Bunge Ltd. operates as an agribusiness and food company worldwide. BG has an integrated global agribusiness spanning the farm-to-consumer food chain. Bunge operates in five segments: Agribusiness, Edible Oil Products, Milling Products, Sugar and Bioenergy, and Fertilizer. Bunge processes, produces, moves, distributes and markets food on five continents.

Zacks Rank #1 Bunge has an expected earnings growth rate of 44.9% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.5% over the last 30 days. Bunge has a beta of 0.64 and a dividend yield of 2.32%. The stock price of BG has climbed 32% year to date.

Watsco Inc. is the largest distributor of heating, ventilation and air conditioning equipment, as well as related parts and supplies in the United States, Canada, Mexico, and Puerto Rico. WSO has been benefiting from strong sales growth, a richer sales mix of high-efficiency systems, improved selling margins and operating efficiencies.

Watsco’s e-commerce business has been gaining traction in recent times owing to stay-at-home orders issued by the government. Also, WSO continues to invest in industry-leading technology for new customer acquisition, which aids it in enhancing shareholder value. Management is aggressively leveraging technology platforms to better serve, and protect customers and employees.

Zacks Rank #2 Watsco has an expected earnings growth rate of 49.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 0.2% over the last 30 days. Watsco has a beta of 0.79 and a dividend yield of 2.60%. The stock price of WSO has surged 29.2% year to date.

Expeditors International of Washington Inc. is engaged in the business of global logistics management, including international freight forwarding and consolidation, for both air and ocean freight in the Americas, North Asia, South Asia, Europe, the Middle East, Africa, and India.

Expeditors is optimistic about the buyout of Fleet Logistics’ Digital Platform. The acquisition has boosted Expeditors’ online LTL shipping platform, Koho. The move is in line with EXPD's focus on Digital Solutions. Amid the coronavirus crisis, the acquisition is expected to expand business and get further investments that are expected to drive the top line in the upcoming quarters.

Zacks Rank #1 EXPD has an expected earnings growth rate of 80.8% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.7% over the last 30 days. Expeditors has a beta of 0.79 and a dividend yield of 0.92%. The stock price of EXPD has advanced 27.9% year to date.

Zacks Names "Single Best Pick to Double"

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it's poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks' Stocks Set to Double like Boston Beer (NYSE:SAM) Company which shot up +143.0% in a little more than 9 months and Nvidia (NASDAQ:NVDA) which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Zacks Investment Research

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.