VASCO Data Security

Edison | May 16, 2014 07:38AM ET

Banking on stronger authentication

After a challenging 2013, recent trading has picked up and VASCO reports a strong pipeline of deals. If management can execute on its strategy, strong earnings growth should be expected through operational leverage and an improved product margin mix. The current share price does not fully capture the potential for growth and operating margin expansion, which at 11% in 2013 is considerably below historic levels and should represent a trough.

Pure-play strong authentication group

VASCO specialises in providing strong authentication, electronic and digital signatures to the banking industry – where it is the market leader – and the enterprise security markets. Revenues are derived from a mixture of repeatable hardware sales, recurring maintenance, licence fees and software sales. With its traditional and cloud-based solutions, it aims to penetrate deeper into the banking vertical and expand its reach into higher-margin verticals in the enterprise security and application markets.

Upturn in current trading after a challenging 2013

Growth in the banking vertical tends to be lumpy and efforts to expand into new verticals have progressed more slowly than expected. 2013 revenues were broadly flat and with ongoing investment in new products, operating margins of 11% were considerably below 2012’s 14.9% and 2007’s historic peak of 26.6%. However, the initial results of a reworked sales strategy and a better market have seen an improvement in recent trading (six months to March +11%) and management reports a strong pipeline of deals. Despite this pick-up, with a higher share of revenues expected from lower-margin hardware products, operating margins are likely to remain depressed in the current year. However, we see considerable scope for margin improvement in the forecast period if management can successfully execute its sales strategy; with higher margins from non-hardware and non-banking verticals, ongoing success in these verticals would also help to drive a higher overall margin.

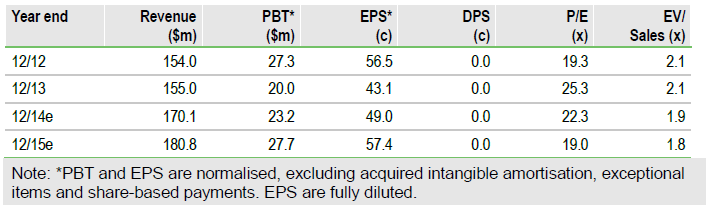

Valuation: Margin expansion needed to unlock value

Given its unique exposure to the structurally growing strong authentication segment, the recent recovery in trading, the fact that 2014 should be a trough margin year, and the ‘option value’ that cloud services offer, we consider VASCO’s 21% P/E premium to its closest peer appropriate. Our reverse DCF suggests the share is discounting low single-digit growth with no margin expansion beyond 2014. For investors to price in higher growth and margins, evidence that management can execute on its sales strategy and that the recent upturn in trading is sustainable will be required.

To Read the Entire Report Please Click on the pdf File Below

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.