USD/JPY Sustains 2024's Bullish Setup

XM Group | Jan 31, 2024 05:46AM ET

- USDJPY consolidates its 2024 upleg between key boundaries

- Momentum indicators point lower, but trend signals remain positive

- FOMC policy announcement due at 19:00 GMT

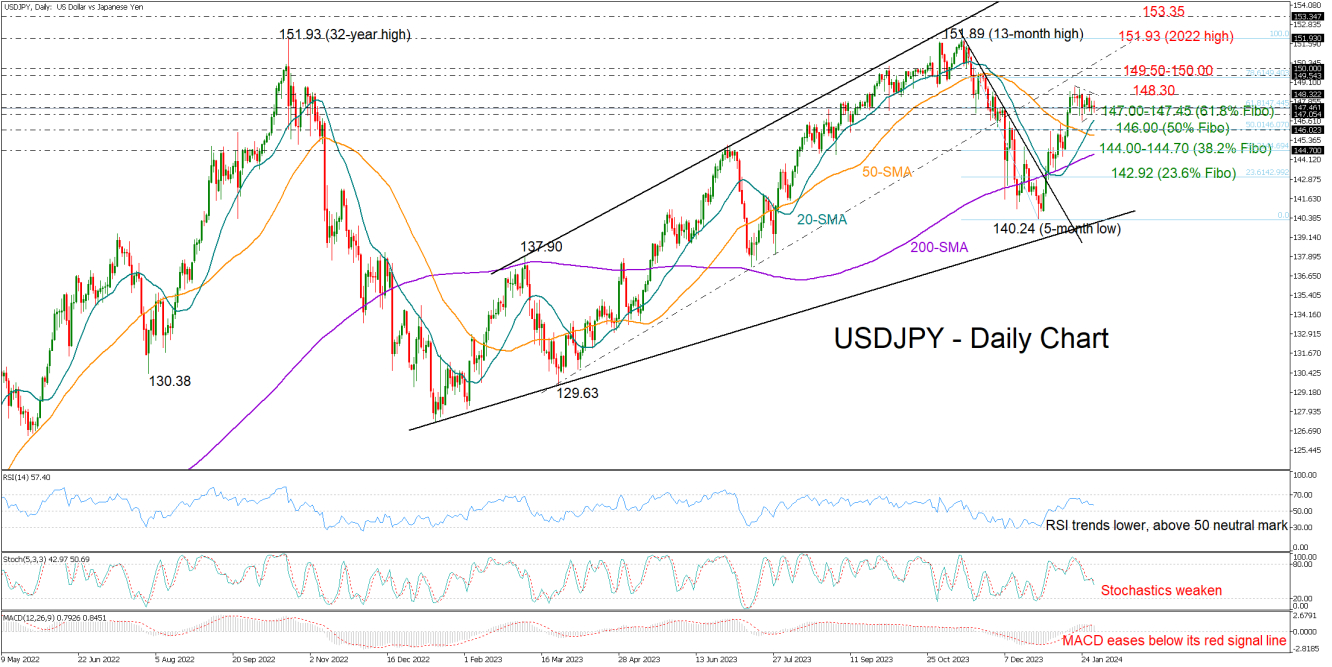

USD/JPY has been facing difficulties in surpassing the 148.30 regions for almost two weeks, but the 147.45 region, which coincides with the 61.8% Fibonacci retracement of the November-December downleg, kept bearish forces in control, sustaining January's almost 5% rally.

The momentum indicators have shifted southwards, pointing to more losses ahead as investors are hoping to get more details about the timing of rate cuts when the Fed announces its policy decision today at 19:00 GMT. On the other hand, the trend signals are more encouraging. The 20-day simple moving average (SMA) crossed above the 50- and 200-day SMAs, providing some optimism that the 2024 upleg has not peaked yet.

A close above the nearby 148.30 resistance is required for an acceleration towards the 149.50-150.00 territory. If the latter proves easy to pierce through, the door will open for the 13-month high of 151.89 registered in November and the 2022 top of 151.93. Additional gains from there could face some congestion near the 153.35-153.60 barrier taken from 1990 and 1987.

On the downside, a slide below 147.00 and the 20-day SMA could immediately pause around the 50% Fibonacci level of 146.00. Breaking lower and beneath the 50-day SMA, the bears could head for the 200-day SMA currently converging towards the 38.2% Fibonacci mark of 144.70. If the 144.00 bar fails to stop the decline too, the next stop could be around the 23.6% Fibonacci of 142.92.

In brief, USDJPY is sending mixed signals. An extension above 148.30 or below 147.00 could provide new direction to the market.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.