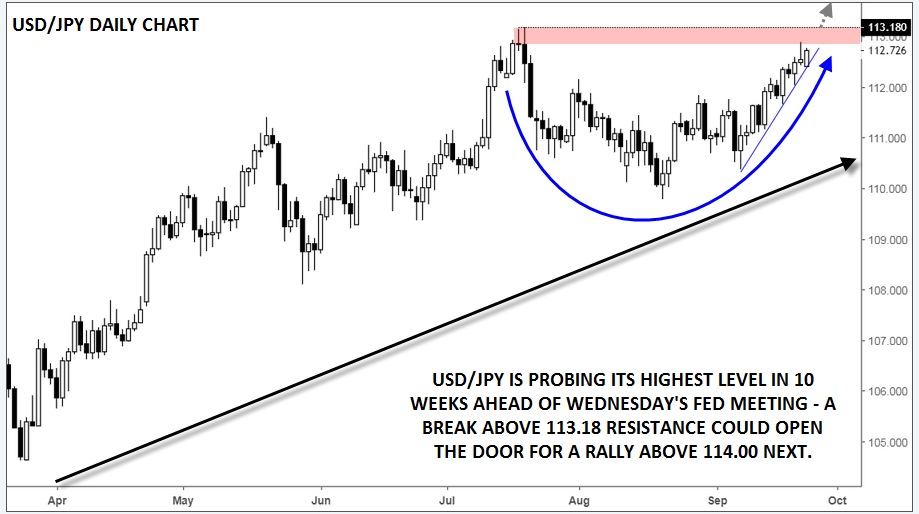

USD/JPY Probes 10-Week High Ahead Of Wednesday’s Fed

Faraday Research | Sep 24, 2018 03:28PM ET

Political news has dominated Mondday’s headlines on both sides of the Atlantic.

In the UK, Brexit Secretary Raab reiterated that he was confident that a trade deal with the European Union will happen, surprising absolutely no one, though rumors of a potential snap election in November certainly caused some traders to raise their eyebrows.

Meanwhile in the US, rumors swirled that Deputy Attorney General Rod Rosenstein was quitting his post before getting fired. Then it came out that he was refusing to quit and would have to be fired and now ultimately will remain in his post until at least Thursday, when he will meet with President Trump once again.

The news hit risk assets hard, as it could prompt a potential constitutional crisis if the next Department of Justice ranking member (Solicitor General Noel Francisco) tries to shut down Special Council Mueller’s investigation of the President. As of writing, all major US indices are in the red and the so-called “commodity dollars” (CAD, AUD and NZD) were among the worst-performing major currencies on the day.

Interestingly, the safe-haven yen didn't catch much of a bid on the headlines. In fact, USD/JPY traded higher on the day to test Friday’s 10-week high in the upper 112.00s. Technically speaking, the pair remains in an uptrend on both a medium- and short-term horizon, as the chart below shows. Rates have formed a “rounded bottom” of sorts over the last two months and bulls have now turned their eyes to July’s intraday highs around the 113.00 handle, which also marks the highest level the pair has traded at since the first week of the year. A confirmed break above the 113.18 level could expose the highs from May, July and November 201,7 above 114.00 next.

Source: TradingView, FOREX.com

Beyond political headlines, Wednesday’s FOMC meeting may be the biggest market mover of the week. Even though the central bank’s presumed plan to raise interest rates another 25bps has already been completely discounted, traders will closely parse the accompanying statement, economic projections and press conference with Fed Chair Powell for insights into how likely the Fed is to raise rates in December (currently priced at about an 80% probability according to the CME’s FedWatch tool) and how many times Powell and company plan to hike rates in 2019.

Stay tuned for our full FOMC preview and recap on Tuesday and Wednesday

Cheers

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.