USDJPY-Nikkei Correlation Suggests 12.5-Year High At 124.00 In Play

Matthew Weller | Mar 10, 2015 01:11PM ET

It’s the dollar’s world; we all just live in it.

The US dollar tagged a new 12-year high at 98.50 in today’s European session on the continued positive afterglow from sooner rather than later .

While EURUSD is understandably garnering all the headlines today, USDJPY is also on the verge of a major breakout above its 7.5-year high at 121.84. Beyond the broad-based dollar strength, USDJPY’s close correlation with the Nikkei equity index is also driving the pair higher. Historically, the performance of USDJPY has provided a reliable proxy for global equity markets and risk assets as a whole. This correlation makes sense: when traders are feeling more optimistic (high risk appetite), they tend to buy stocks and sell yen to fund carry trades in higher-yielding currencies, but when they are more pessimistic (risk averse), traders have to unwind these trades by buying back yen and selling equities.

Beyond the general risk relationship, the correlation between USDJPY and Japan’s Nikkei 225 index is further strengthened by the index’s heavy weighting in export-oriented companies. When the value of the yen rises (USDJPY falls), Japanese exporters see reduced demand from overseas buyers. On the other hand, a fall in the value of the yen (USDJPY rise) makes Japanese goods “cheaper” for foreigners, boosting Japanese sales and driving Japanese shares higher. As the chart below shows, this correlation has been reliable since Q4 of last year, though of course there is no guarantee that it will stay as consistent in the future. In fact, based on the chart below, the current level of the Nikkei (18,500) would be consistent with USDJPY trading closer to 124.00 than its current level of 121.00.

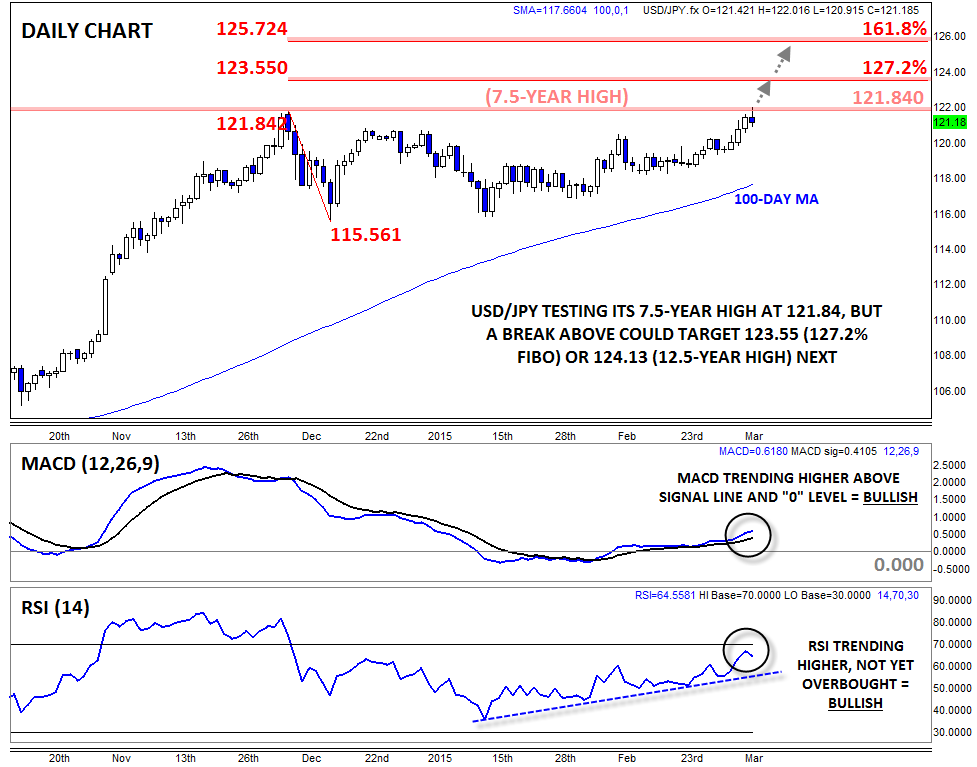

Turning our attention to more traditional technical analysis, USDJPY is testing its aforementioned 7.5-year high at 121.84 as we go to press, but there are some signs that this barrier could give way this week. For one, the MACD indicator is trending higher above its signal line and the “0” level, showing bullish momentum. Meanwhile, the RSI indicator has been trending higher since mid-January and is not yet overbought, leaving the door open for another leg higher.

If USDJPY is able to close above the 121.84 level, a continuation toward the 127.2% Fibonacci retracement of December’s pullback at 123.55 could be in play, followed by a potential move up to the 12.5-year high at 124.13. Regardless, the short-term bullish bias will remain intact as long as rates stay above the psychologically-significant 120.00 level.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.