USD/JPY Forms Bearish Descending Triangle, Gold Remains Supported

ORBEX | Mar 09, 2016 04:00AM ET

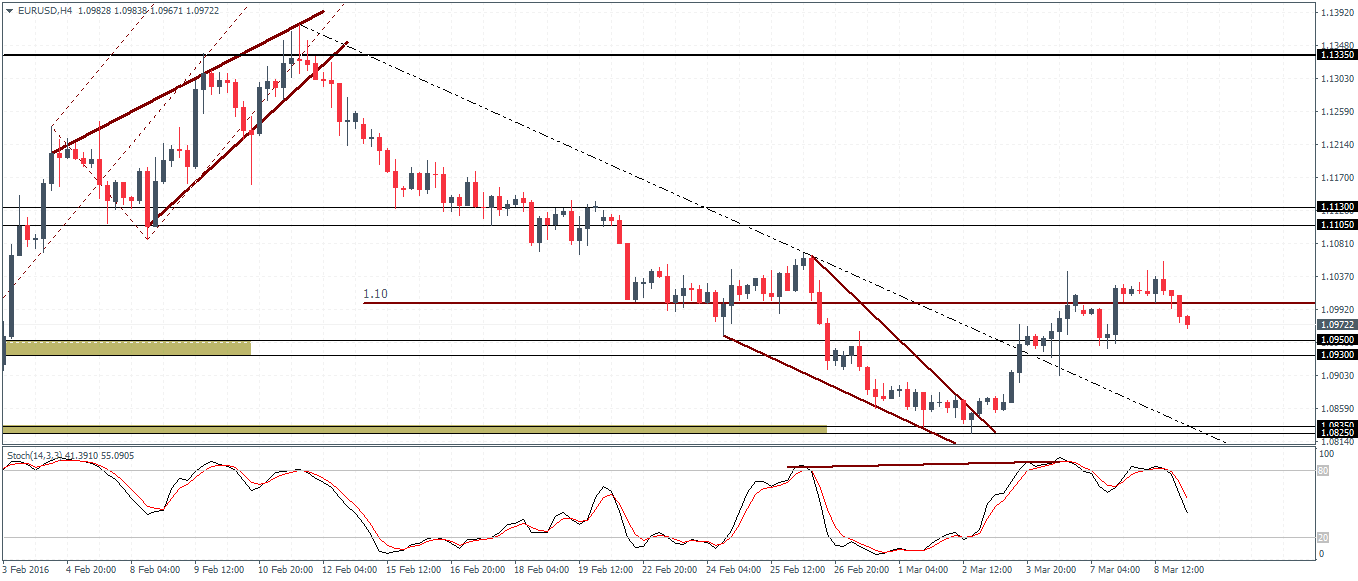

EUR/USD gave back its previous gains above the 1.10 handle and closed with a doji candlestick yesterday. Prices could remain range bound into the ECB's meeting with 1.08 and 1.10 likely to be the range highs and lows. Meanwhile, USD/JPY is forming a potential bearish descending triangle pattern with the support at 111.31.

EUR/USD Daily Analysis

EUR/USD (1.09): Following three daily sessions of gains, EUR/USD has closed in a doji candlestick pattern yesterday, with early price action today showing bearish momentum taking over. Failure to close above the 1.10 handle is being seen as a potential risk to the downside with 1.095 - 1.093 support likely to hold the declines. However, further downside could open up if the support fails, leaving EUR/USD to test the 1.0835 - 1.0825 support which was barely tested earlier in March. Into the ECB's meeting tomorrow, EUR/USD could remain pressured below 1.10 and 1.08 levels.

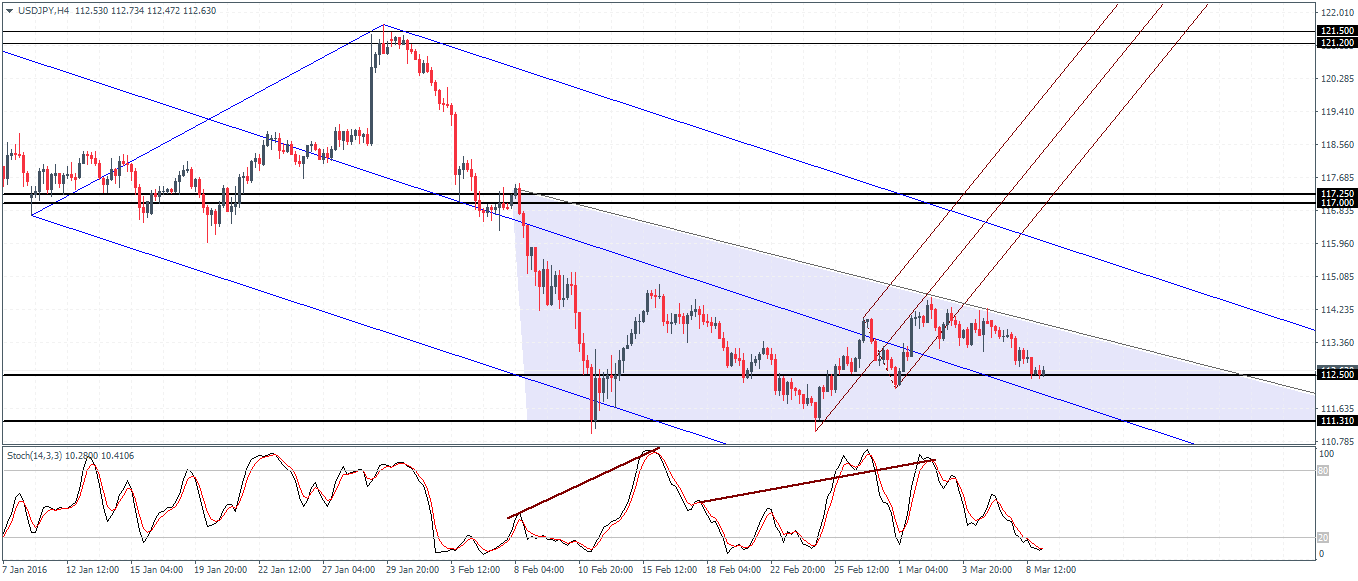

USD/JPY Daily Analysis

USD/JPY (112.6): USD/JPY continues to drift lower with the increasing likelihood of a test to 112 support. This view is further strengthened by the inside bar that was formed on Monday this week and with yesterday's prices closing below the low near 113.133. On the 4-hour chart, prices are trading in the support zone near 113 - 112.5, and a break below this support could see a test to 111.31 where the next support comes in. USD/JPY is also showing signs of forming a descending triangle pattern with the support forming at 111.31. A break below 111.31 could signal further weakness to the downside.

GBP/USD Daily Analysis

GBP/USD (1.41): GBP/USD has closed bearish yesterday following the previous strong consecutive rally. Price action is gradually moving lower just below the 1.43 resistance level following the hidden bearish divergence noted yesterday. 1.4025 - 1.40 support levels are likely to be tested to the downside, and a break below this support could see a test to previous lows. GBP/USD, however, could range sideways within 1.43 and 1.40 levels. Today's manufacturing and industrial production numbers are likely to remain a fundamental risk to the pound.

Gold Daily Analysis

XAU/USD (1255): Gold prices remain supportive above the 1246 and 1237 levels following the breakout of the minor ascending bullish triangle near the top. While prices briefly tested the 1275 measured target, further upside could see another attempt near 1275 and 1295 levels. Support at 1250 is likely to hold gold prices in the near term, but overall, the precious metal remains flat within 1275 and 1250.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.