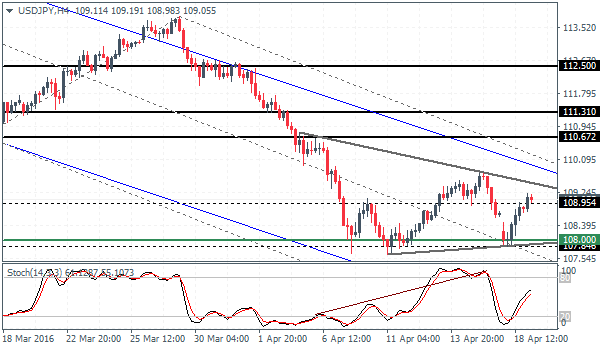

USD/JPY Consolidating Into A Triangle

ORBEX | Apr 19, 2016 03:50AM ET

Following lower oil prices yesterday, the markets opened on a weak note but soon recovered as USD/JPY managed to pull back strongly after a brief stint near the 108 level. However, the unfolding triangle pattern on the 4-hour chart points to a possible dip back to 108. Economic data remains fairly light today leaving USD crosses likely to stay flat into Thursday’s ECB meeting.

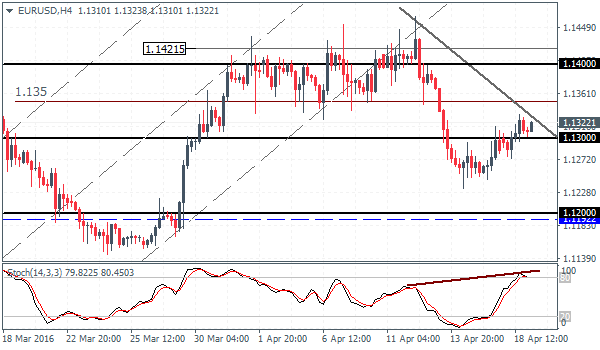

EUR/USD Daily Analysis

EUR/USD (1.13):EUR/USD continues to move very gradually with small ranges, now running for three consecutive days. Price action has managed to close above 1.13 level of support and could target 1.135 and move as high as 1.14 on bullish momentum. There is a hidden divergence taking shape currently, which could see the upside momentum fail in the near term. In this scenario, a break below 1.13 support could send EUR/USD lower to 1.12 level of support.

USD/JPY DailyAnalysis

USD/JPY (109.0):USD/JPY is attempting to pull higher following yesterday's strong bullish price action. A daily close above the most recent high at 109.40 could see further upside gaining momentum. Failure to post a new high could make way for a possible head and shoulders pattern on the 4-hour chart within the consolidating triangle establishing the neckline support at 108. A break below 108 could then pave theway for further downside in USD/JPY. Alternately, a break to the upside off the triangle could see further upside towards 110.67 - 111.31.

GBP/USD DailyAnalysis

GBP/USD (1.41):GBP/USD has been trading bullish for the past two days, but prices are currently struggling near the long term upper median line on the daily chart. The upside bias is starting to gain conviction with prices clearing 1.426 - 1.424 strongly. This could see GBP/USD look towards testing the next main resistance at 1.443 - 1.4425. To the downside, the recently broken resistance level could be tested for support to validate the view. A break below this support could, however, turn the bias bearish with GBP/USD likely to move back to 1.415 - 1.4126.

Gold Daily Analysis

XAU/USD (1230):Gold prices are consolidating near 1231 level and also forming a potential head and shoulders pattern against a slanting neckline. A break below 1220 - 1210 support could speed up the declines further as viewed from the daily chart. For the moment, Gold could stay range bound within 1243 - 1250 and 1230 - 1225 levels ahead of further declines lower, which could see a test to 1215 initially followed by 1280.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.