USD/JPY Bulls Set Sights on 151 Breakout as Fed, BoJ Decisions Take Center Stage

Investing.com | Mar 18, 2025 05:38AM ET

- Key central bank meetings lie ahead, with the BOJ expected to hold rates.

- Japan’s GDP missed forecasts, with both quarterly and annualized figures falling short.

- USD/JPY tests 151 yen, with 155 yen possible if resistance breaks.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 by subscribing to InvestingPro today .

This week will see a series of central bank meetings, including decisions from the Bank of England, Switzerland, Japan, and especially the Federal Reserve.

The Bank of Japan was expected to keep interest rates unchanged while planning to raise them in the coming months. Governor Ueda and his team took a stricter tone in their statements, though Japan's economic data remained weak.

The Federal Reserve will meet on Wednesday, with the market expecting no change in interest rates. However, concerns about a possible recession increased the likelihood of a rate cut as early as June.

Meanwhile, the USD/JPY currency pair moved through a local correction, approaching a test of the downward trend line.

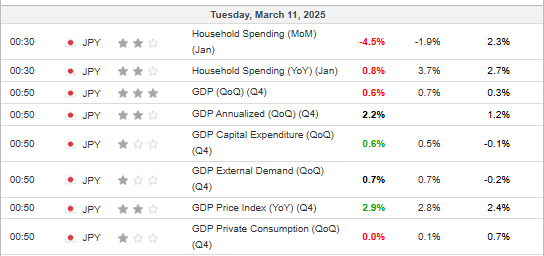

Japan's GDP Growth Fell Short of Expectations

Last week, new data showed Japan's economy grew less than expected. Both quarterly and annualized figures fell short of forecasts. The quarterly growth rate was especially disappointing at 2.2%, below the expected 2.8%.

Figure 1: Japanese Economic Data

Despite the Bank of Japan's strict tone, which suggests further rate hikes and the end of yield curve control, it may choose to delay changes. The decision will also depend on global factors, especially the planned 25% U.S. tariffs on Japanese cars.

These tariffs could hurt Japan’s economy, leading investors to expect interest rates to stay the same until the situation becomes clearer.

The tariffs are set to take effect next week, but diplomatic efforts are underway to prevent them. Japanese Finance Minister Katsunobu Kato strongly opposed the tariff announcement during the G7 meeting.

Awaiting Fed's Announcement

Since the Fed is unlikely to make any changes, the market will focus on its statement about future monetary policy. The most likely scenario is a neutral message highlighting various risks, suggesting a "wait and see" approach.

This would have little impact on the US Dollar and stock markets. Another possibility is a softer stance that stresses recession risks in the U.S., which could weaken the dollar further.

USD/JPY Rebound Continues

While the U.S. dollar continues to weaken against other major currencies, it is holding steady against the Japanese yen.

This suggests that, despite the Fed’s stricter tone, the market is concerned about a potential economic slowdown and a pause in rate hikes.

In this situation, buyers may push the USD/JPY pair toward the confluence of the downward trend line and the resistance level around 151 yen per dollar.

Figure 2: Technical analysis of USD/JPY

If this level is breached, USD/JPY could rise further, potentially reaching 155 yen. However, if the key support at 147 yen is broken, this bullish scenario would be invalidated.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belong to the investor. We also do not provide any investment advisory services.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.