USD/JPY: A Hot Core PCE Reading Could Send the Pair Soaring

Forex.com | May 26, 2023 03:02AM ET

- After this morning’s strong US data, traders are now pricing in a nearly 75% chance of another 25bps rate hike from the Fed by July.

- The US Core PCE report, the Fed’s preferred inflation measure, is the key fundamental data release to watch.

- USD/JPY remains in a bullish short-term trend, with room to extend its rally toward 142.00 before encountering meaningful resistance.

Despite a potentially worrying lack of progress toward a US debt ceiling deal ahead of next week’s deadline (and the accompanying news that rating agency Fitch has put the US credit rating on negative watch for a potential downgrade), the US dollar is the strongest major currency on the day.

Part of the boost comes from economic data: This morning, Q1 GDP for the US was revised to 1.3% q/q, beating expectations for a 1.1% print, and initial unemployment claims came in at just 229K, solidly below the 249K reading anticipated by economists.

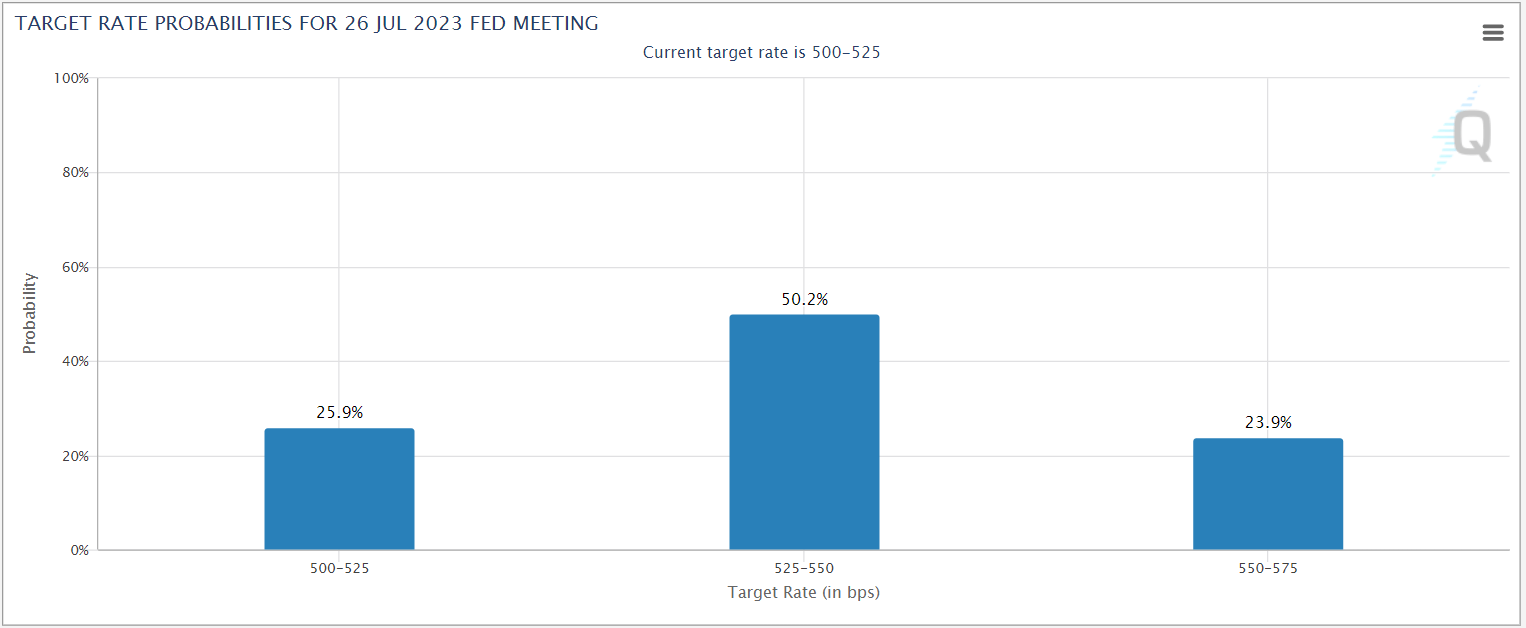

With both backward-looking and coincident data showing a stronger-than-expected US economy, traders have started to seriously consider the prospect of another interest rate hike from the Federal Reserve. Once seen as a longshot, traders are now pricing in a nearly 3-in-4 chance that we could get another 25bps increase in one of the next two Fed meetings, per the CME’s FedWatch tool:

Source: CME FedWatch

Tomorrow’s Core PCE report, the Fed’s preferred measure of inflation, will be the economic data highlight for the week, with economists looking for a 0.3% m/m print that would leave the year-over-year rate steady at 4.6%. A higher-than-expected reading here would increase the market’s expectations for another Fed hike, marking a particularly sharp divergence with the BOJ’s ongoing easy monetary policy.

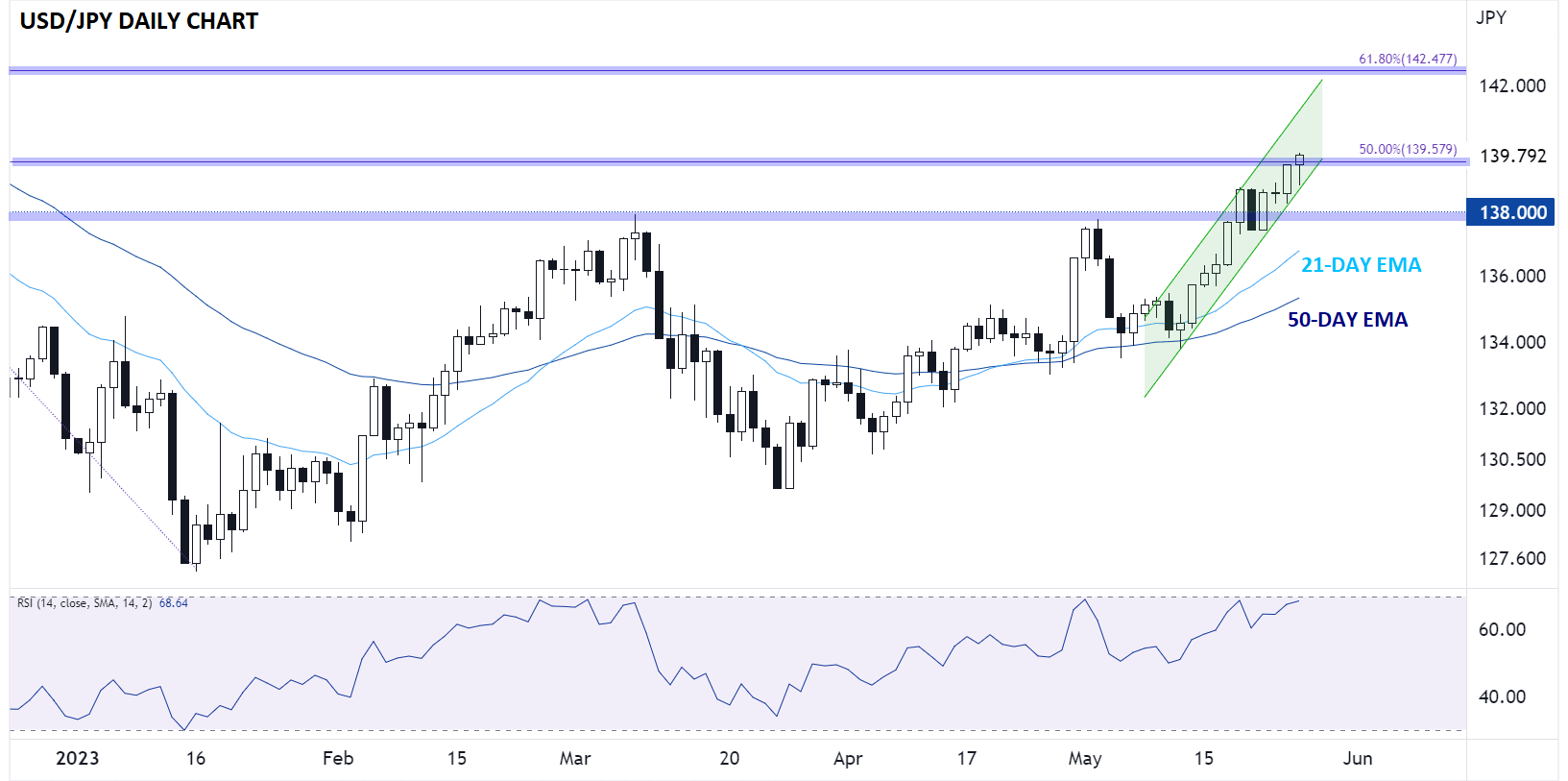

Japanese Yen Technical Analysis

Looking at the daily USD/JPY chart, rates continue to rise within a well-defined 2-week bullish channel. The pair has now eclipsed its year-to-date high near 138.00, and as of writing, rates are peeking out above the 50% Fibonacci retracement of the October-January drop near 139.60.

A clean break above that level (perhaps helped along by a hot Core PCE reading tomorrow) would leave little in the way of nearby resistance until closer to 142.00, where the 61.8% Fibonacci retracement and a minor high from November converge. Only a break back below the bullish channel and previous-resistance-turned-support at 138.00 would erase the near-term bullish bias.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.