USD/CAD: Heeding Poloz’s Call

Neal Gilbert | Mar 03, 2015 12:10PM ET

The North American trading session has been underwhelming for stocks and the USD so far as Canadian data has earned a majority of the attention in early trade. The lack of US data points has given way to Canadian GDP which improved 0.3% in the month of December when only a 0.2% rise was anticipated. In addition, the Annualized release that measured Q4 rose 2.4%, beating the 2.0% expected with the previous revised from 2.8% to 3.2%. It turns out the Canadian economy isn’t in as dire straits as many had assumed heading in to 2015 which may cause the Bank of Canada to raise an eyebrow toward the strong performance. Considering the BoC will be making a monetary policy decision tomorrow, this good news couldn’t have come at a more convenient time.

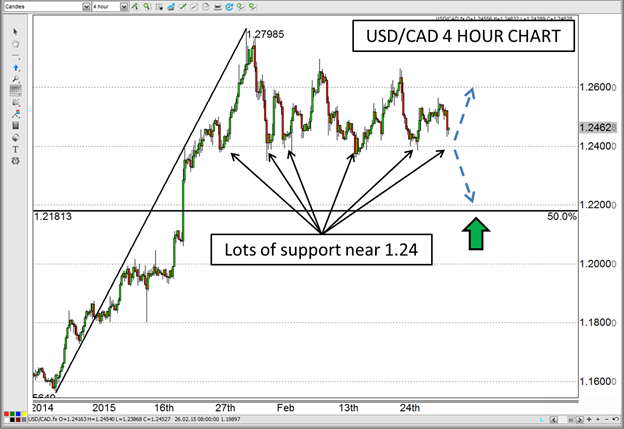

In response to the strong Canadian data, the CAD has improved against virtually all other major currencies, and threatens to challenge a well-supported level in the USD/CAD. However, simply looking at GDP to help determine the path of BoC policy would be a fool’s errand. Besides, that data was from 2014, and we’re already two-thirds of the way though Q1 of 2015, so it’s admittedly a bit crusty. On the other hand, BoC Governor Steven Poloz mentioned in a speech last week that “the downside risk insurance from the interest rate cut buys us some time to see how the economy actually responds.” If we were to read that as a direct statement insinuating what they will do this time around, it appears Poloz is telling us that they want to wait and see what happens; meaning no rate cut this time around.

The problem with expecting no rate cut from the BoC is that the majority of economists expected them to cut rates by another 25 basis points; at least at the end of last week. As we get closer to the decision, the majority has flipped to expect no cut from the institution. This indecision from those who should know best also creates a lot of indecision by investors who rely upon those opinions, which could lead to a lot of action in the CAD over the next 24 hours. The major level of support I mentioned earlier is around the 1.24 handle in the USD/CAD, and could be the major level that indicates what to expect from there. If broken, it could open the floodgates to a further decline as we approach Non-Farm Payroll at the end of the week, but if it holds, the market may just wait until after NFP before picking a side.

Source: www.forex.com

For more intraday analysis and trade ideas, follow me on twitter (@FXexaminer ).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.