USD/CAD Prepares For A Retest Of The Trend Line

Blackwell Global | Jun 16, 2017 02:19AM ET

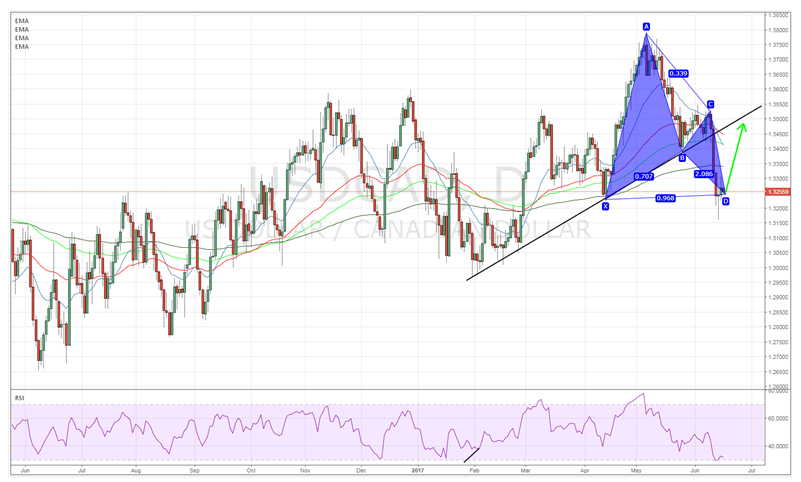

Key Points:

- Price action collapses below bullish trend line

- RSI Oscillator strongly oversold

- ABCD pattern completes and retest of the trend line is likely in the coming session

The USD/CAD has benefitted from a strong trend line that has been supporting price action since early January, 2017. Subsequently, the trend line has proved fairly reliable in trading long reversals but price action has proved elusive in the past week and dropped sharply through the trend line. However, the move was primarily fundamental in nature and some interesting technical factors might be just about to signal a retest.

In fact, the primary reason for the recent decline was a fundamental response to a shock announcement from the Bank of Canada that they intend to review their current level of stimulus with a desire to taper. Although this provides some useful forward guidance for the market, it fails to provide either a timeline or the extent to which the central bank intends to taper their QE. Subsequently, the initial sharp decline is likely to be short term and reactionary rather than a medium term change to the equilibrium between the two currencies. In comparison, the U.S. Federal Reserve has largely communicated a timeline of rate hikes and their desire to taper which is likely to only see upward momentum for the pair.

A quick technical analysis of the loonie largely demonstrates the above factors with price action's collapse below the medium term bullish trend line. However, it’s clear that the RSI Oscillator is currently strongly within oversold territory which suggests that, at the least, a mean reversion is likely to occur. Additionally, an ABCD pattern appears to have just completed which should see price action rising back towards the trend line, around the 1.3500 handle, over the next few sessions.

Ultimately, the stage is now set for a textbook rally and retest of the trend line, especially given the completion of the ABCD pattern. Subsequently, the scenario which I strongly favour, both fundamentally and technically, is a short period of sideways moderation before an upside break towards the trend line at 1.3500. At that point, it’s likely that price action will run into some resistance around the 1.3535 mark and a momentum stall could occur. However, given the technical and rising gap between the U.S. and Canadian economies (Canada faces a potential property crash and falling oil prices) this level of depressed valuation is only going to last for a short period of time.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.