USD/CAD Oscillates Within Sideways Range Between 1.2815 And 1.2900

JFD Team | May 03, 2018 07:35AM ET

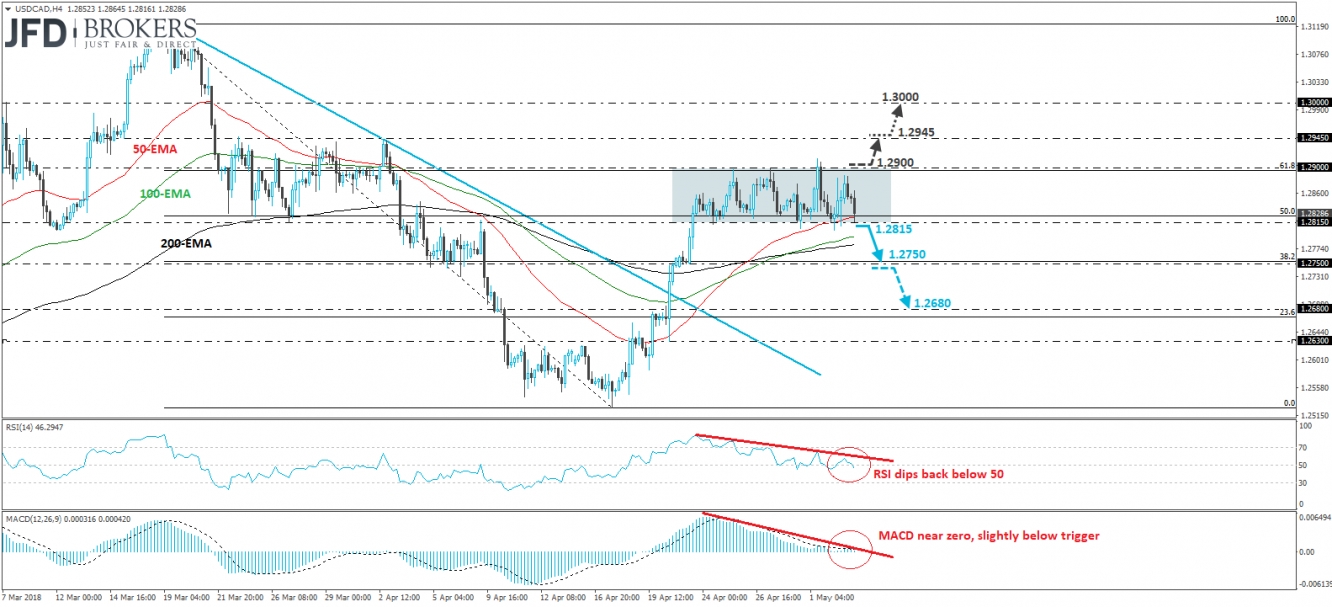

USD/CAD traded lower during the European morning Thursday after it hit resistance slightly below the 1.2900 barrier, which coincides with the 61.8% retracement level of the 19th of March – 17th of April decline. Nonetheless, the slide was stopped by the 1.2815 support zone. The pair has been trading in a sideways manner between the two aforementioned zones since the 23rd of April and thus, we prefer to stand neutral for now as far as the short-term outlook is concerned.

We would like to see a clear exit out of the range before we become more confident with regards to the forthcoming directional move of this pair. A break below 1.2815 could signal the downside exit of the range and could set the stage for the 1.2750 hurdle. If that barrier does not prove strong enough to stop the bears, then we may experience more downside extensions, towards our next support of 1.2680.

On the upside, we would like to see a clear move above 1.2900 in order to start examining whether the near-term picture has turned back positive. Such a move could initially aim for the 1.2945 zone, the break of which could see scope for extensions towards the psychological round zone of 1.3000.

Looking at our short-term oscillators, we see that the RSI turned down and fell back below 50, while the MACD lies slightly below its trigger line, near zero. It appears ready to turn negative soon. These indicators suggest that USD/CAD may be poised to trade south for a while more, but as we noted above, we prefer to wait for a clear dip below 1.2815 before we get more confident on that front.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.