USD/CAD Knocks on Key 1.3605 Support

Forex.com | Mar 24, 2023 12:47AM ET

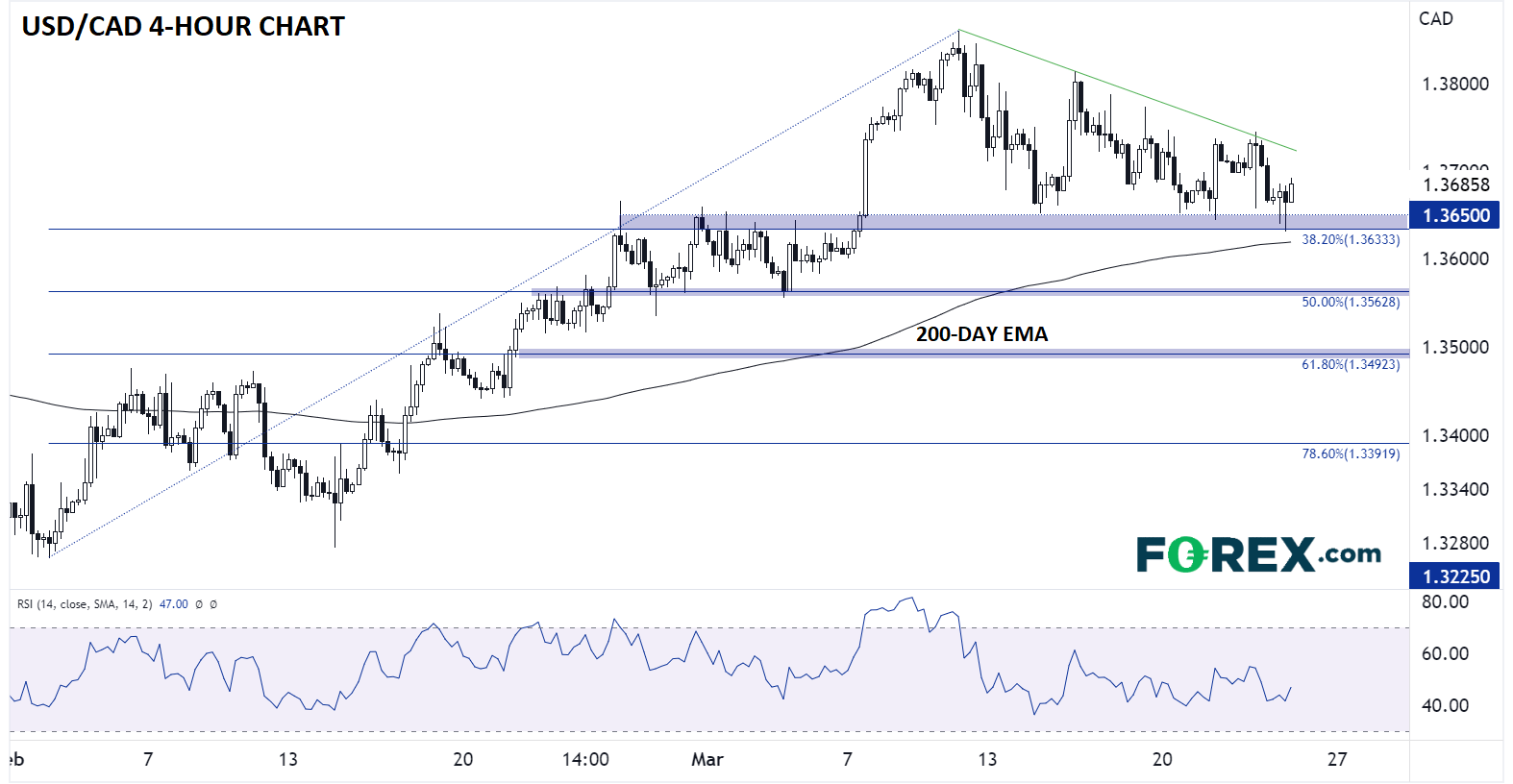

- USD/CAD is forming a potential descending triangle pattern into 1.3650 support.

- A break lower could expose support at 1.3560 or 1.3500 next.

- Canadian retail sales and US PMIs on Friday will play a big role in whether the pair can hold above support.

It’s been a whirlwind week already between a handful of major central bank meetings and top-tier economic data, but US dollar weakness has been a key theme. Markets have speculated that the Fed is either done or nearly done raising interest rates in the wake of yesterday’s “dovish hike,” and as a result, the US dollar index is working on its sixth consecutive bearish day.

Source: StoneX, TradingView. Note this product may not be available to trade in every region.

Meanwhile, North of the 49th parallel, the Canadian dollar has seen more mixed price action after a mixed CPI report early in the week, with the loonie sitting roughly in the middle of the week-to-date performance of major currencies.

USD/CAD technical analysis: All eyes on 1.3650

Looking at the USD/CAD chart, the North American pair has put in a series of lower highs over the past two weeks, though rates have thus far found a floor near 1.3650. beyond approximating the 38.2% Fibonacci retracement of the February-March rally, that level represents previous-resistance-turned-support from the early March highs.

Within the next couple of trading days, we should have a breakout from the current consolidation pattern, with a break lower targeting the next Fibonacci retracements near 1.3560 or 1.3500. Meanwhile, an upside breakout would target the year-to-date highs above 1.3800 next.

Source: StoneX, TradingView

USD/CAD fundamental data to watch

Ahead of the weekend, Canada will release its monthly retail sales report for January. Though dated, the report will still provide insight into the health of the Canadian consumer, with economists expecting a 0.7% m/m gain after 0.5% growth the previous month.

After that, the “flash” US PMI report will give a timely estimate of manufacturing and service sector activity in the world’s largest economy. Readings below 50 could hint that banking fears and Fed rate hikes are finally taking their toll after a strong start to the year.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.