USD Weakness, Fed Waits For Data

Swissquote Bank Ltd | Oct 14, 2015 08:11AM ET

Forex News and Events

US: Fed waits for more data

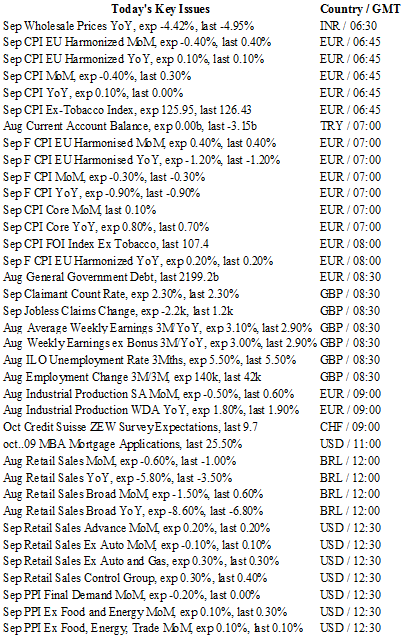

The Federal Reserve are still awaiting more supportive data for a further rate hike. Today’s data, September retail sales and PPI will be closely watched. Consumption is expected to increase by 0.2%, while the production index should decline by 0.2%. These figures will be essential to predict inflation - the key factor for a rate hike. Last month, data was disappointing, but upward revisions still leave some room for further improvement.

However, it seems that a rate hike for this year is no longer on the cards. Daniel Tarullo, a Fed member declared that raising rates in 2015 was “not appropriate”. He is not the only Fed member to make this affirmation. Lael Brainard is also waiting for more supportive data. Wait-and-hope is the Fed’s new mantra. Even if Fed Governor Yellen keeps hoping (and saying!) that a rate hike in 2015 is still possible, she is also waiting for more supportive data. The only difference is that Yellen should also admit that a rate hike won’t happen this year. We just hope that she won’t wait until the last meeting in December to disclose this.

In our opinion, the Fed has lost control of its monetary policy. When the fear of increasing rates by a quarter point is so great, it is absolutely normal that we begin to question the Fed’s ability to accomplish its dual mandate: promoting dual employment and stabilizing prices. Unemployment remains stable however, there are growing concerns that the current data overlooks long-term unemployment. Concerning prices, the Fed through its 3 QE has failed to create the environment – decent inflation – that would lead to more growth.

India’s Onion Problem

Data released today indicates that India's wholesale prices decelerated by -4.54% y/y vs. -4.42% expected and -4.95 read in August. The slight uptick replicated the acceleration in consumer price inflation reported earlier in the week. CPI inflation climbed 4.41% y/y following upwardly revised 3.74% in August. While food price inflation increased aggressively by 3.88% from 2.20% prior read. Price pressures on food remains broadly contained yet onion prices (and pulses) continue to rise. Despite government efforts to dampen pressure through imports and raids on onion hoarders, trend of rate of inflation for onions rallied 113.70% in September (Wholesale price onion index increased to 758.0 from 662.8).

Currently the RBI views the price surge as a function of poor market structure and perishable nature of the item which makes them ideal of price manipulation. However, onions are a critical part of Indian society and further price increase will produce a backlash towards the government and RBI. While the RBI is comfortable with its inflation expectations and existing monetary policy strategy, we suspect recent increases will keep policymakers cautious. With minimal risk from its “front loaded” 50bp rate cut last month and expectated CPI path to undershoot RBI forecast, the markets are contemplating further easing in 2016. However, with food prices to remain sticky and growth robust (September industrial production printed at a solid 6.4% vs. 4.8% exp) our base scenario suggests the RBI will hold policy interest rates steady at 6.75% thru H1 2016. In the current environment, INR is an attractive currency for risk and yield seeking traders. USDINR traders should target downside support at 64.6950.

Looking for more FX and commodity trade ideas & signals

The Risk Today

EUR/USD keeps pushing higher. Hourly resistance can be found at 1.1460 (18/09/2015 high). Support can be found at 1.1087 (03/09/2015 low). Stronger support lies at 1.1017 (18/08/2015 low). Expected test of the resistance at 1.1460. In the longer term, the symmetrical triangle from 2010-2014 favored further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). We remain in a downside momentum.

GBP/USD's momentum is fading. Hourly resistance can be found at 1.5383 (22/09/2015 low). Hourly support can be found at 1.5087 (05/05/2015 low). Stronger support can be found at 1.4960 (23/04/2015 low). In the longer term, the technical structure looks like a recovery. Strong support is given by the long-term rising trend-line. A key support can be found at 1.4566 (13/04/2015 low).

USD/JPY is pushing downward. There is a growing short-term momentum. The pair is holding below the 200-day moving average. Hourly support is given at 118.61 (04/09/2015 low). Stronger support can be found at 116.18 (24/08/2015 low). Hourly resistance can be found at 121.75 (28/08/2015 high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF is declining but has failed to hold below 0.9600. Hourly resistance can be found at 0.9844 (25/09/2015 high). Expected target of the hourly support at 0.9528 (18/09/2015 low). In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.