USD Supported Ahead Of FOMC, But Will A Hike Suffice?

Faraday Research | Dec 12, 2017 04:54AM ET

There’s plenty of event risk for traders to consider this week, although volatility has largely remained contained as we wait for the big events to hit our screens. The highlight is arguably tomorrow’s FOMC meeting, but we also have BOE and ECB meetings on Thursday along with all-important CPI reads for UK and US to consider (among others). So whilst these potentially high volatility events have limited our watchlist in some ways, when volatility returns it could open new opportunities.

Tomorrow marks Yellen’s last press-conference FOMC meeting before handing over the reins to Jeremy Powell in February, where there’s a widespread belief the FED will raise rates to mark the fifth hike as part of this cycle. Yet as markets are forward looking, the anticipated hike is more than likely priced into the Greenback which leaves it vulnerable to a sell-off if anything less than a hawkish meeting materialises. So bullish USD setups require the Fed to exceed expectations, whether it be via economic forecasts, statement, press conference or the Dot plot.

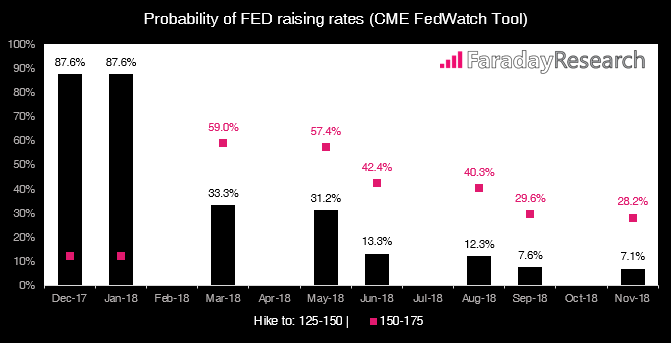

Markets are currently pricing in at an 87.6% chance of a hike on Wednesday and a 59% chance of another hike in March, according to the CME FedWatch tool. Whilst the accuracy of these numbers at times are debatable, they can provide a proxy for how the markets and sentiment may be positioned ahead such events. And as expectations require fulfilling, anything less can result in market volatility or new trends if the reality is too far from consensus.

Will Yellen go out with a bang?

Being Yellen’s last press conference, she has little to gain by rocking the boat especially when the makeup of the Fed is going to look very different next year. Therefor its unlikely Yellen will diverge too much from the usual script of ‘transitory inflation’ and for the economy to continue to pick up gradually. However, it’s also debatable as to how hawkish the Fed would want to appear with the threat of tax reforms and underwhelming inflation lingering in the background. So, whilst the USD Index remains supported below last week’s highs, there’s room for disappointment for Greenback bulls if a business as usual meeting is to materialise.

If we look at how the US Dollar Index responded in the weeks and month’s following the prior four hikes, we can largely agree it’s not been great for the bull-camp. In fact, the most notable bullish reaction following the Dec 2015 hike came when Trump was elected and promised to make “heads spin” with tax cuts and promise all will be “tired of winning”. So, traders likely need to feel a March hike is on the cards and there are no causes for concern to provoke a notable bullish reaction on the day. Although it’s more than likely tax reforms which would prove to be the catalyst to help it sustain a rally further out though.

Until the event happens, it’s difficult to say how this could play out with so many moving parts. And due to the potential complexity surrounding the FOMC release, USD crosses are on the back-burner until the event has passes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.