USD Subdued As Market Sentiment Turns Cautious

ORBEX | Mar 19, 2019 08:52AM ET

A number of ongoing global narratives kept a lid on the markets with USD trading subdued ahead of major events this week. These include the two-day FOMC meeting starting today and ending tomorrow, and the Brexit narrative.

The GBP remained volatile as the Brexit deadline inches closer with no real progress made. Economic data on Monday was relatively sparse. Oil prices spiked on news that OPEC reported higher conformity to production cuts. This sent NYMEX crude oil futures up 1% on the day to $59.09.

EUR/USD Invalidates the Double Top Pattern

The single currency invalidated the double top pattern that was formed by last Friday’s close with the currency pair rising 0.10% on the day. The breakout to the upside came against a weaker greenback. Data from the eurozone was quiet with only the release of the monthly report from the German Bundesbank. The report painted a bleak picture as officials acknowledged a weaker pace of growth in the first quarter of the year.

Will The Euro Advance Gains?

The upside breakout from 1.1329 resistance could eventually push the common currency to test the multi-month falling trend line which is likely to act as dynamic resistance around the 1.1400 level. The overall price action in the EUR/USD remains quite choppy. The recent gains have shown a sharp recovery as price rose at the same pace of declines as before.

Yen Advances as Investors Turn Cautious

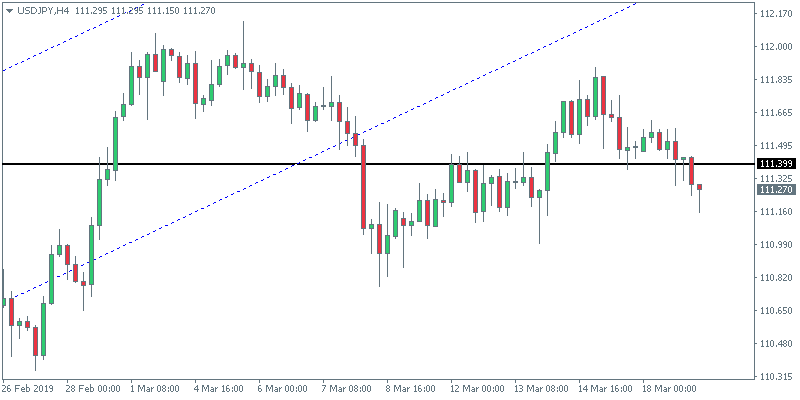

The Japanese yen was trading modestly stronger against the USD on Monday rising 0.03%. USD/JPY continued to retreat following a rally to a 3-month high of 112.12 earlier this month. Trade balance figures released on Monday showed that exports fell for the third consecutive month in February due to easing global demand for goods. Official data showed that exports fell 1.2% on the year, extending the 8,4% annualized decline in January.

Will USD/JPY Turn Bearish?

The USD/JPY currency pair was trading subdued on Monday with price action closing within a small range but bearish. This marks a second consecutive day of declines in the currency pair. A bearish follow through today could signal a move to the downside. Given that prices failed near the resistance level of 111.40, the USD/JPY could extend the declines lower to the 109.84 level at the very least in the near term.

Gold Advances on Falling Risk Appetite

Gold prices were trading mixed on Monday but price quickly recovered towards the close of business. The gains come as the global risk sentiment remains mixed. Themes such as the Fed’s forward guidance and the outcome of the Brexit talks have kept risk appetite in check. This led to gold making modest gains, tracking higher yields in the U.S. bond markets.

Can XAU/USD Maintain the Momentum?

At the time of writing, XAU/USD is breaking past the 1306 level while forming a minor ascending triangle pattern. This comes as the precious metal advanced 0.13% on the day on Monday. The upside breakout, if successful, could send gold prices higher as they test the upper resistance level of 1320 – 1321 level. This would potentially mark a retest of the level which previously served as support.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.