USD/SEK Surged Following Lower Than Expected Swedish Data

IronFX Strategy Team | Nov 13, 2013 12:18AM ET

Sweden: Back to deflation

The dollar was higher Tuesday morning in Europe against all its G10 counterparts. The main loser was the Swedish Krone recording loses of more than 1% against the US currency. SEK collapsed after Sweden’s CPI fell 0.1% yoy in October missing estimates of +0.1% yoy. Sweden unexpectedly returned to deflation last month and the question is if Riksbank will be forced to cut interest rates again. The pound was also lower against the greenback after CPI data for October showed that UK inflation decelerated more than the consensus forecast. CPI rose 2.2% yoy, the lowest rate since September 2012 and well below forecasts of 2.5% yoy. This brings the rate closer to the Bank of England’s target. The focus now is on tomorrow’s inflation report and the Bank's new economic forecasts. The Bank pledged not to reduce stimulus at least until the unemployment falls to 7%. The projections in August were that the threshold wouldn’t be reached until the end of 2016. Governor Carney will publish the new projections at a press conference tomorrow.

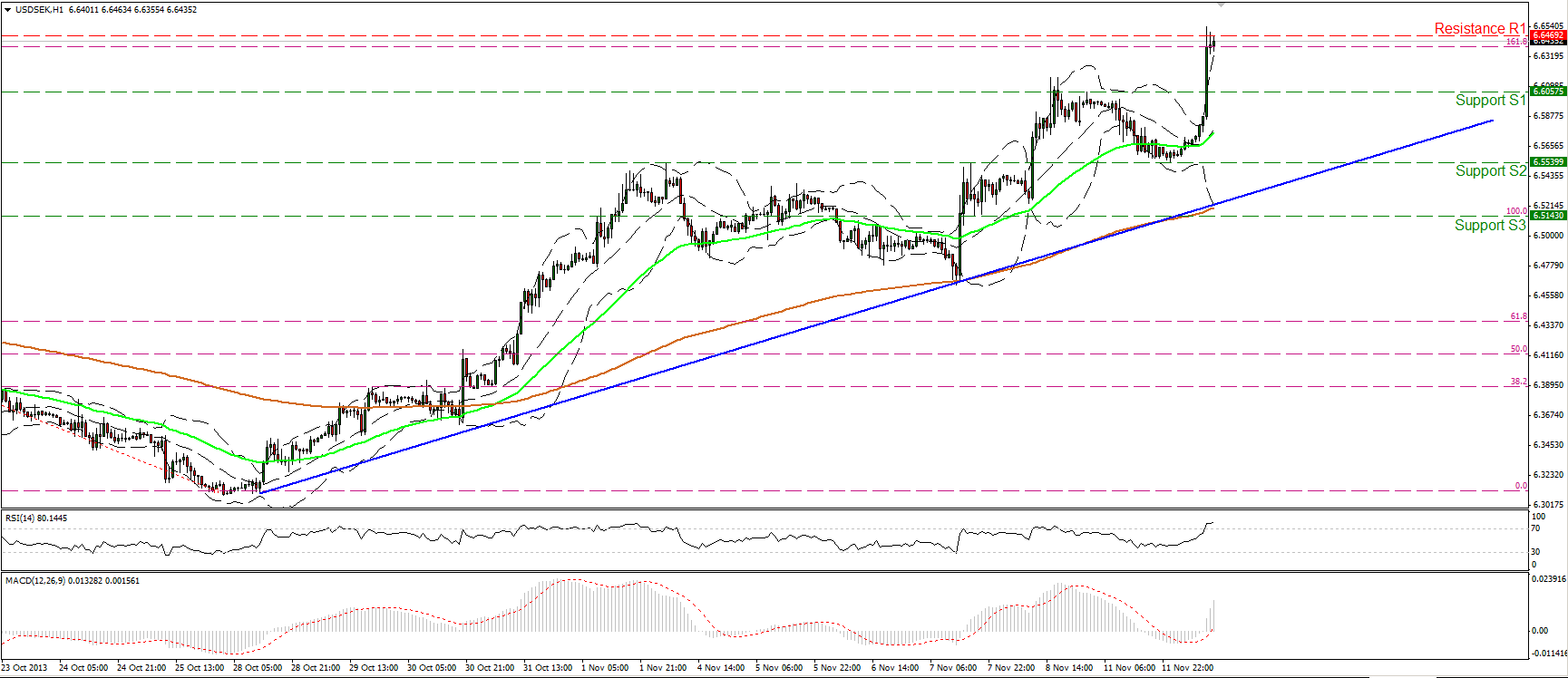

The USD/SEK surged after the lower-than-expected Swedish CPI data for October. The rally was halted by the 6.6469 (R1) resistance hurdle, near the 161.8% Fibonacci extension level of the 16th -28th Oct. decline. If the price manages to overcome that level, extensions might be triggered towards September’s highs at 6.6885 (R2). Nonetheless, the RSI indicates overbought conditions and if we see it crossing below 70, I would expect a short-term corrective wave, before the uptrend resumes. The overall trend of the pair is an uptrend, as confirmed by the blue trend line and the bullish crossover of the moving averages. On the daily chart, a completed double bottom formation is identified, favoring the continuation of the trend.

• Support: 6.6057 (S1), 6.5539 (S2), 6.5143 (S3)

• Resistance: 6.6469 (R1), 6.6885 (R2), 6.7132(R3)

Disclaimer: This information is not considered as investment advice or investment recommendation but instead a marketing communication. This material has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research. IronFX may act as principal (i.e. the counterparty) when executing clients’ orders. This material is just the personal opinion of the author(s) and client’s investment objective and risks tolerance have not been considered. IronFX is not responsible for any loss arising from any information herein contained. Past performance does not guarantee or predict any future performance.

Redistribution of this material is strictly prohibited. Risk Warning: Forex and CFDs are leveraged products and involves a high level of risk. It is possible to lose all your capital. These products may not be suitable for everyone and you should ensure that you understand the risks involved. Seek independent advice if necessary. IronFx Financial Services Limited is authorised and regulated by CySEC (Licence no. 125/10). IronFX UK Limited is authorised and regulated by FCA (Registration no. 585561). IronFX (Australia) Pty Ltd is authorized and regulated by ASIC (AFSL no. 417482)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.