US Stocks Review: Upside Reaction Continues

Eric De Groot | Oct 21, 2014 07:21AM ET

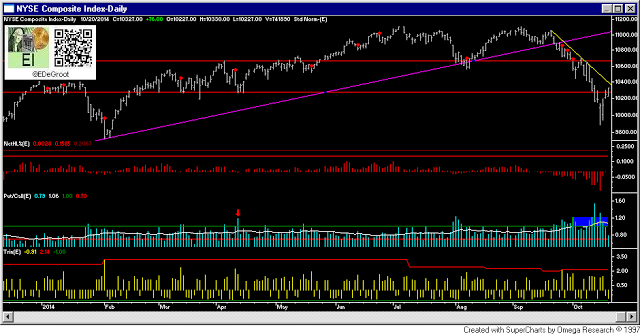

While fear towards US equities have receded during the light volume rally from the 10/15 low, it lingers in the periphery as long as the 21-day put/call premium ratio (put/call(E)) holds above 1. As of 10/20, it stands at 1.06 (chart 1). Fear, amplified by volatility, which, in turn, is driven by economic instability created by enormous debt burdens throughout the Western economies, can be transient (temporary) or persistent (lingering for months). Disciplined investors must respect the latter by viewing this rally as an upside reaction within downtrend of a cause building phase until the message of the market confirms a bullish interpretation.

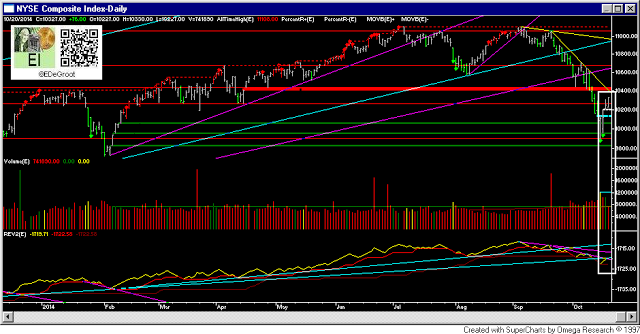

Heavy volume 'tests' of support (green lines), indications of expanding downside force, raise the probability that they'll be tested again (chart 2). The force behind the reactionary rally and cycles will help traders 'time' these retests. If previous support acts as resistance as volume contracts significantly, it suggests waning upside force and vulnerability. Vulnerable rallies often reverse around important transition cycles (chart 3).

The NYSE Composite stands at 10327 as of 10/20. Resistance zones for the NYSE Composite are 10130-10150 - broken to the upside on light volume, 10400-10500, and 10600 (chart 3). We will be watching volume, REV(E), and the movement of leverage (equity DI) as the rally challenges these zones.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.