U.S. Slowdown Signals Return

ING Economic and Financial Analysis | May 02, 2019 01:13AM ET

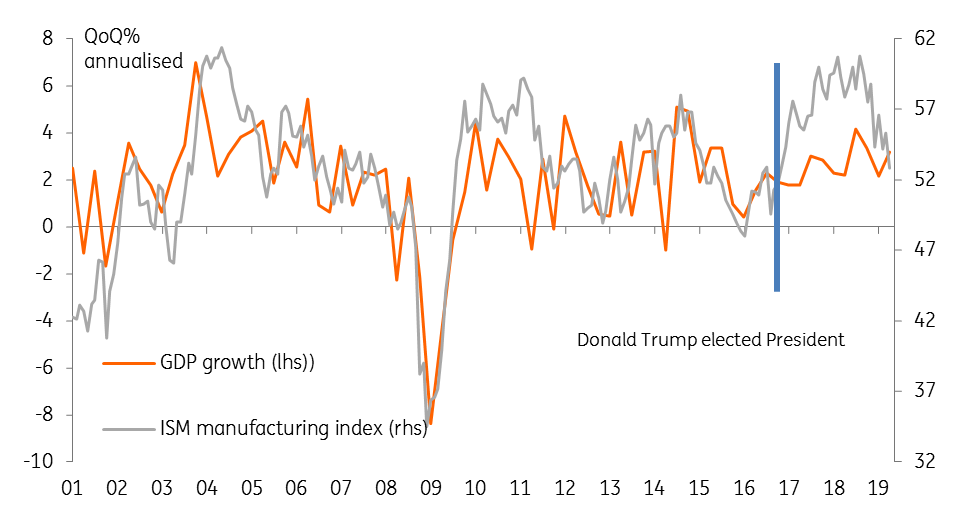

The ISM manufacturing index has fallen to its lowest level since October 2016, which will only help to fuel slowdown fears. But with consumer spending looking in good shape and inflation likely to grind higher we see little reason for Federal Reserve rate cuts.

The April reading of the ISM manufacturing index has fallen to 52.8 from 55.3 in March. This was well below the consensus figure of 55.0 and is the weakest reading since October 2016. Production fell to 52.3 from 55.8, new orders dropped to 51.7 from 57.4 while employment fell to 52.4 from 57.5. While all remain above the break-even 50 level they are below their 6M moving averages, suggesting the manufacturing sector has seen a broad slowing in the rate of growth in April.

The only positives are that the backlog of orders has increased to its highest level since last November while customer inventories remain low at 42.6, which doesn’t signal any major decline in manufacturing production anytime soon. Nonetheless, this can't take away from the fact that it is a slightly concerning the outcome, especially since it confirms a softer trend in surveys in other major economies for April.

US ISM manufacturing index versus GDP

We have also seen a weaker construction report for March with output falling 0.9% month on month while February’s figure was revised down two-tenths of a percentage point to +0.7% MoM. This could contribute to a marginal downward revision to 1Q19’s GDP growth rate of 3.2%.

The one positive so far today has been the ADP private payrolls figure which pasted a 275,000 increase for April while March employment was revised higher by 22,000 workers. We are also hopeful for a decent non-farm payrolls figure on Friday with wage growth accelerating to 3.4%. This should support consumer spending in the months ahead.

Overall today’s figures have been rather mixed and support the Federal Reserve’s patient strategy. The data reinforce the message that US growth will slow through 2019, but we continue to believe consumer spending will underpin overall economic activity and that the US is a long way from a recession-style scenario. The tight jobs market and rising worker pay will also likely lead to higher inflation readings and in combination with respectable growth means that stable Federal Reserve interest rate policy throughout 2019 is our favoured scenario.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.