U.S. REITs Trend Higher Despite Rate Hike Expectations

James Picerno | Aug 17, 2015 07:48AM ET

US interest rates may be set to rise next month, at the Federal Reserve’s policy meeting, but the outlook for tighter monetary policy isn’t weighing on Real Estate Investment Trusts (REITs). Highly prized for relatively rich yields, REITs are said to be among the more interest-rate sensitive slices of the capital markets—not quite as vulnerable as bonds but considerably more so vs. stocks. But that theory looks a bit wobbly these days in the wake of a modest rally in securitized real estate securities.

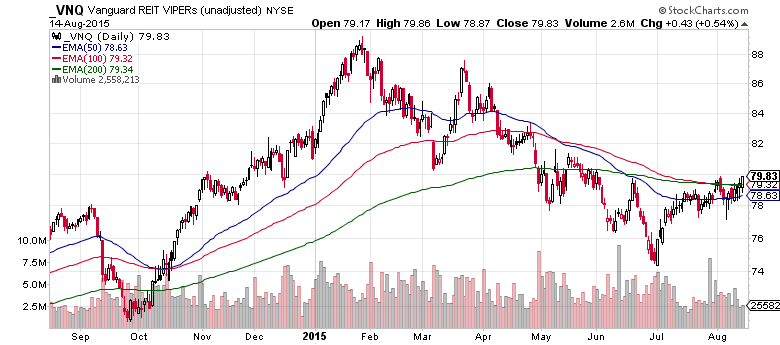

Indeed, last week’s top performer among the major asset classes: US REITs, based on the Vanguard REIT ETF (NYSE:VNQ). Although there’s a possibility that the Fed will begin raising rates in September for the first time since 2006, VNQ climbed 1.3% last week—the best performer among a set of ETF proxies that represent the major asset classes.

Granted, the latest leg up may be a reflection of renewed worries about the global macro outlook–worries that have been exacerbated by China’s currency devaluation last week. Then again, the current rally in US REITs predates last week’s turmoil. VNQ has been trending higher since its recent trough at the end of June. So far in the third quarter, VNQ is up 6.9% through Friday’s close (Aug. 14).

From a momentum perspective, there’s still reason to wonder if this is a rally that will endure. Although the upside trend looks firmer, the strength still looks shaky by way of exponential moving averages (EMAs). The 50-day EMA, for instance, remains well below its 100- and 200-day counterparts. Deciding if the current REIT rally will last may depend on whether the bullish momentum continues in the days and weeks ahead and delivers a change in the trend via rising EMAs–the 50-day EMA increases above the 100-day EMA, for instance.

From a fundamental perspective, is there any basis for expecting that REITs can do well in a period of rising rates? Yes, according to Kevin DiSano, chief portfolio strategist at IndexIQ. He recently told Investment News that “there’s a prevailing thinking that REITs don’t do well in a rising-rate environment, but that’s not a given.” Much depends on how the economy fares. If rates are rising because growth is picking up generally, higher rates may not be a headwind for REITs.

In the same article, Michael Black of Michael Phillips Black Wealth Management advised:

“Initially, with any discussion of rising rates, REITs should come down with the rest of the market because they get lumped into the fixed-income category, but that’s when you have to start thinking of the business structure of a REIT.” A strengthening economy allows many REITs to raise rents, making properties more valuable, he said. “So, I see it as a buying opportunity.”

For the moment, the crowd seems inclined to agree.

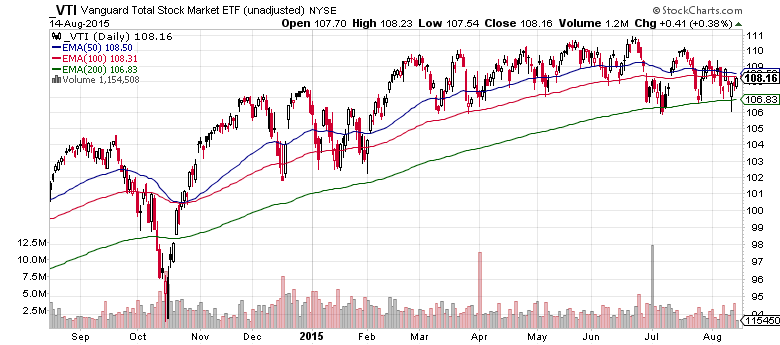

As for the rest of the field, negative momentum continues to weigh on most ETF proxies for the major asset classes. The main exception: US equities. The Vanguard Total Stock Market ETF (NYSE:VTI), for instance, continues to post a bullish pattern for its 50-, 100-, and 200-day EMAs. But the upside trend looks a bit tired at the moment, based on the daily closing prices in recent sessions.

If the weakness persists and translates into the 50-day EMA falling below its 100-day counterpart, it may be time to reconsider the outlook for US stocks on a tactical basis.

Meantime, a bearish trend in no uncertain terms continues to weigh on emerging market stocks (Vanguard FTSE Emerging Markets (NYSE:VWO))…

Ditto for emerging market bonds (Market Vectors Emerging Markets Local Currency Bond (NYSE:EMLC))…

And for commodities (broadly defined) via iPath Bloomberg Commodity Total Return ETF (NYSE:DJP)…

The trend in foreign stocks looks slightly more encouraging in comparison, although the case for optimism is hanging on a thread in terms of EMAs by way of Vanguard FTSE Developed Markets Fund (NYSE:VEA):

Key questions for this week and beyond: Will US REITs and US equities continue to defy momentum’s gravity that’s harassing so many other corners of the major asset classes?

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.