US Indices At The Edge Of The Cliff?

Alexandros Yfantis | Dec 31, 2012 05:01AM ET

With ‘Fiscal Cliff’ all over the news headlines and investors waiting to push the right button when news regarding the upcoming agreement are announced, markets trade near the edge of their ‘cliff’.

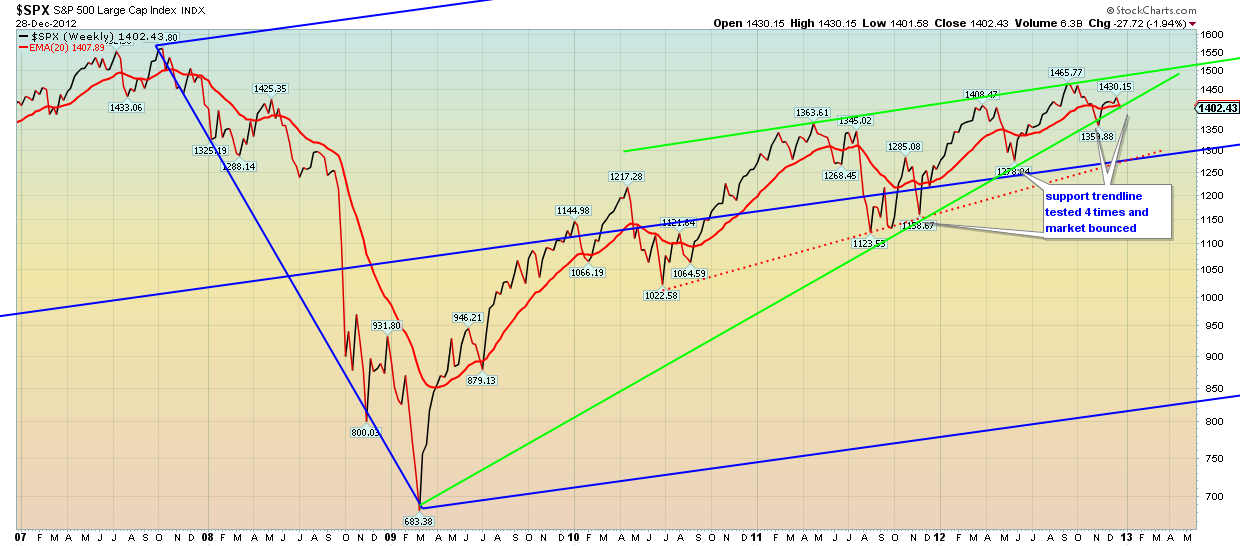

The S&P 500 is once again testing the green upward sloping trend line as shown in the weekly chart above. Crossing once more the red EMA combined with a break under the green trend line, could generate a selling panic, specially if news regarding the agreement come out negative.

I usually don’t expect a piece of news to come out to trade, but in situations like this, it is certain whatever the outcome, volatility is going to rise. If you followed our previous posts regarding the S&P 500, our first alert for bulls was signaled when prices broke the short term upward trend line at 1425.

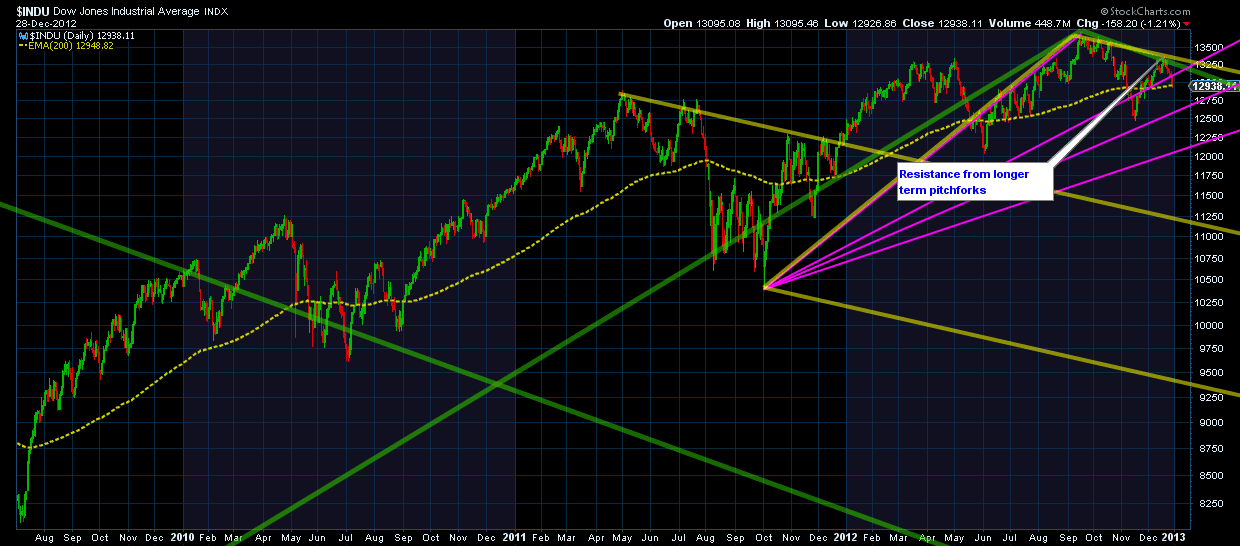

The Dow however, had a better and clearer bullish picture than the S&P 500, though it did not manage to complete a clear 5 wave move from 12471. As shown above in the weekly chart, prices got rejected at our longer term upper pitchfork resistance. If prices don’t manage to overcome this barrier, then bulls must be ready for a steep decline. Support is found at 12850 and 12750.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.