U.S. Growth On Track To Slow In This Week’s Q2 Report

James Picerno | Jul 23, 2019 07:20AM ET

The government’s preliminary estimate of gross domestic product for the second quarter, scheduled for release on Friday (July 26), is expected to reveal a substantial downshift in U.S. economic growth, based on a set of nowcasts compiled by The Capital Spectator. Although output will be strong enough to skirt a recession through the end of June, the downshift comes at a time of rising concern that the economy’s forward momentum will continue to decelerate in this year’s second half.

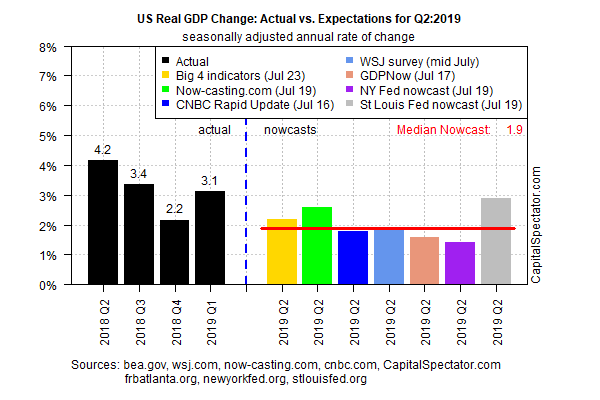

GDP is projected to rise 1.9% in Q2, based on the median for several nowcasts (see chart below). If correct, U.S. economic activity will post a substantial slowdown after Q1’s strong 3.1% increase. The good news is that today’s revised nowcast for Q2 reflects a slightly firmer estimate vs. the 1.7% median estimate published earlier this month. That may be an early sign that the recent deceleration in the U.S. macro trend is stabilizing.

Meanwhile, economists are expecting that this week’s GDP report will confirm suspicions that the U.S. economy has hit another soft patch. Note that Econoday.com’s consensus point forecast is also projecting that growth will slide to a 1.9% advance in this Friday’s release.

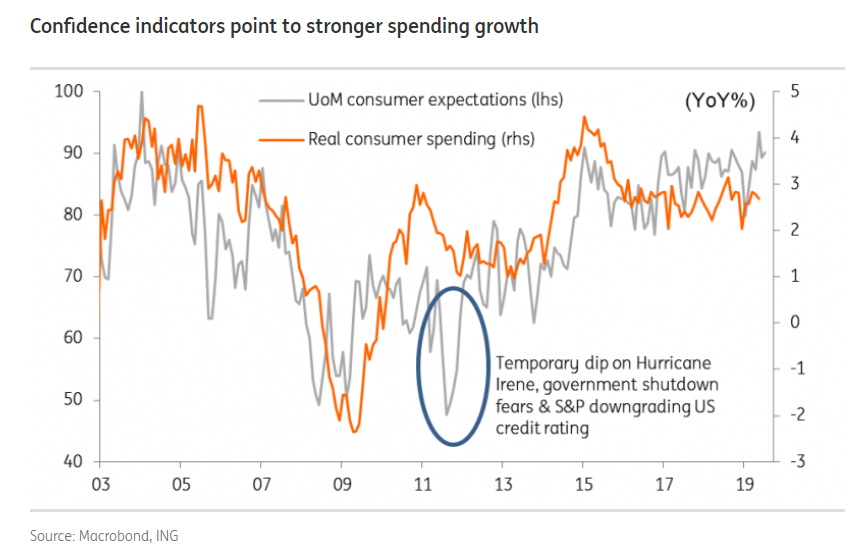

Although the broad trend for the economy appears set to ease for Q2, analysts point to ongoing strength in consumer spending as a reason for thinking that the U.S. can sidestep a new recession in the near term. “We expect to see signs of strength in consumer spending — much stronger than the first quarter,” says David Donabedian, chief investment officer of CIBC Private Wealth Management.

Economists at ING last week advised that “households have the cash and the confidence to spend.” Pointing to the July estimate of the University of Michigan consumer confidence index, it’s close to a cyclical high, which is “hinting at a possible acceleration in consumer spending growth in the coming months.”

A firmer pace of consumer spending would help keep the U.S. out of a recession, but for now the broad trend is expected to reflect softer growth. The one-year GDP trend continues to indicate a gradual slide for the near term, based on The Capital Spectator’s average point estimates via a set of combination forecasts. Today’s revised outlook advises that the year-over-year rate of growth will ease in the coming quarters, but remain above the 2% mark. As such, the slowdown doesn’t look set to deteriorate into a recession in the immediate future. If and when the one-year GDP change falls closer to the 1% mark, by contrast, recession risk will be elevated.

As for this week’s data, the expected downshift in this Friday’s GDP report will strengthen the case for cutting interest rates at next week’s policy meeting. “For sure, the Fed is going to dominate for next week. I think we’ll get at least a 25 basis point cut,” predicts Tony Roth, chief investment officer at Wilmington Trust.

The crowd agrees, based on Fed funds futures. A rate cut at the July 31 FOMC meeting is priced at a virtual certainty, with an 81% probability of a quarter-point drop in the Fed funds target rate to a 2.0%-2.25% range, according to CME data. This Friday’s GDP report isn’t expected to change the calculus.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.