US economy To Accelerate? BCB On Hold

Swissquote Bank Ltd | Mar 03, 2016 08:51AM ET

US economy back on track? (by Arnaud Masset)

The US economy seemed to have started the New Year on a firmer footing. Indeed, the world’s biggest economy has kept sending mixed signal during the past year, forcing the Federal Reserve to delay the start of its tightening cycle to December. However, we are only two months into 2016 and the picture already looked brighter as most economic indicators stopped printing systematically below market’s expectations. As a reminder, only the job market showed continuous improvement throughout the year, while on the inflation front the situation seemed desperate.

Nonetheless, 2015 is over and 2016 may prove to be a turning point in the US economy. For now, most indicators are pointing toward a reversal, which may suggest that the US economy should not fall into recession. However, investors would rather remain cautious to switch too quickly to risk-on mode as China’s slowdown may have darken further the global outlook.

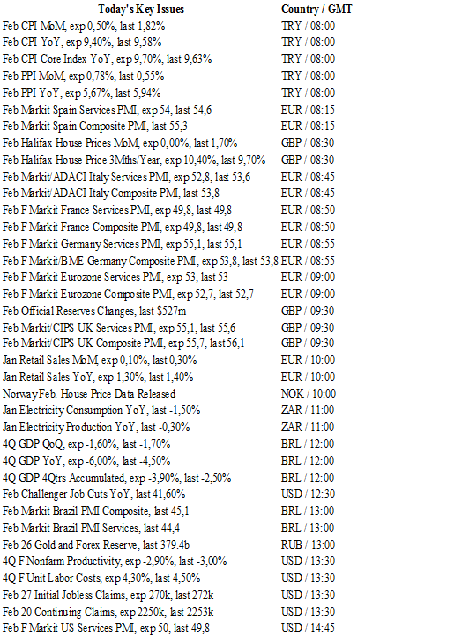

On the data front, yesterday’s ADP report came roughly in line with median forecast by printing at a solid 214k versus 190k consensus; previous month’s reading was revised lower to 193k from 205k initially. Today, the market will stay focus on the second estimate of the Services PMI, which fell below the 50 threshold in February. Factory orders is also set to be released later this afternoon. Friday’s NFP report will be the highlight of the week. The dollar index is treading water at around 98.25 as traders await the new batch of data before reloading long USD position.

More conservative BCB (by Peter Rosenstreich)

As was widely expected the central bank of Brazil voted to hold the Selic rate at 14.25%. However, in a minor twist two Copom members (Tony Volpon and Sidnei Marques) continued to vote for a rate hike of 50bp. Markets had anticipated that the more hawkish members would vote to maintain the Selic rate starting the process towards a rate cut. The post meeting communique provided scant new insight into the thinking of the board members. The statement repeated the decision was based on evaluation of the balance of risks for inflation, deterioration of external conditions but less erosion on the domestic side and general uncertainty around the macro environment. While the specific rationale for the persistent votes for tightening was not provided at this meeting (as in prior meeting minutes), the higher than expected underlying inflation in February’s IPCA-15 print (y/y 10.71% vs. 10.52% exp and 10.67% prior read) combined with rising inflation outlook remains the primary culprit. The board remains skewed to the conservative side, likely to be waiting for a steady inflation slowdown before discussing any policy easing. In our view, the split vote will not drive the market to price in near term rate hikes but rather push out policy easing. Expectations for Copom to begin monetary policy easing in August feel unlikely given the sustained momentum of inflation. However, deeper deterioration in incoming data based on deceleration of macro trade and domestically, significant weakness in labor markets, which would lessen upside surprise in inflation and quicken the pace of downward inflation expectations, could shift our view on the timing of BCB's first rate cut. Spread between 1m Implied/Real vol continued to narrow indicated a lessening of tensions and probability of further USD/BRL downside. Although 1m vol (smile) remains heavily skewed to the right. Meeting minutes released on 10th March will help provide guidance on the BCB next move.

Mexico’s QIR (by Peter Rosenstreich)

From Mexico, traders will be watching today’s release of the central bank’s Quarterly Inflation Report (QIR). We will be interested in any updates on the bank’s economic outlook, specifically in regards to headline inflation forecasts and comments on the impact of FX pass-through into domestic prices. Following the MPC decision to raise its policy rate to 3.75%, yet not to publish meeting minutes, today’s QIR could provide insight into the bank’s monetary policy strategy. We suspect Banxico policy will reconnect and outpace the Fed’s rate path and we anticipate tightening by 50bp in 2016 (slightly more hawkish then the market). Despite economic headwinds and steady monthly declines analysts are not seeing significant slowing in consumer price inflation with y/y to reach 3.34% in 2016. While GDP growth outlook remains subdued, recent pick-up in PMI manufacturing (53.1 vs. 52.2 prior read) has provided a mildly optimistic tone. However, should currency depreciation increase risk to economic stability we could see Banxico proactively moving.

USD/CAD - Selling Pressures Are Still On.

EUR/USD continues to retrace the rebound that started from the low at 1.0810.The short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.0893 (01/03/2016). Hourly support can be found at 1.0810 (29/01/2016 low). Expected to show continued weakness. In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD is retracing higher. Hourly support lies at 1.3836 (29/02/2016 low) and hourly resistance is given at 1.4043 (26/02/2016 high) has been broken. The technical structure suggests further monitoring of the hourly resistance at 1.4168 (22/02/2016 high). The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY is lifted by a strong bullish momentum, as can be seen by recent higher highs. Strong resistance is given at 114.91 (16/02/2016 high). Hourly support can be located at 113.22 (02/03/2016 low) then next support lies at 112.16 (01/03/2016 low). Expected to show continued strengthening. We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF is moving sideways between the support at 0.9950 (29/02/2016 low) and the resistance at 1.0034 (29/02/2016 high). Break of the support at 0.9950 would suggest further selling pressures. In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.