U.S. Dollar Index Review: UUP, UDX

Eric De Groot | Sep 13, 2019 08:45AM ET

Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to long-term trends, it does not define them. The focus on short-term noise rather than trends, a source of confusion for the bagholders at major trend transitions.

The US Dollar Index's overall trend, revealed by trends of price, leverage, and time, are defined in the The Matrix

Dollar is falling again, largely because the Euro needed to rally. Draghi's speech said nothing coherent in terms of fixing the EU or Euro, but market action creates commentary, so a rally materialized after a sharp open lower. Please frame the dollar decline as another attempt to talk it down. They'll bring in the same old dollar bears and tell us how bearish the technicals look really bad; search previous reviews as I expect the old dollar bears will re-materialize despite worthless calls.

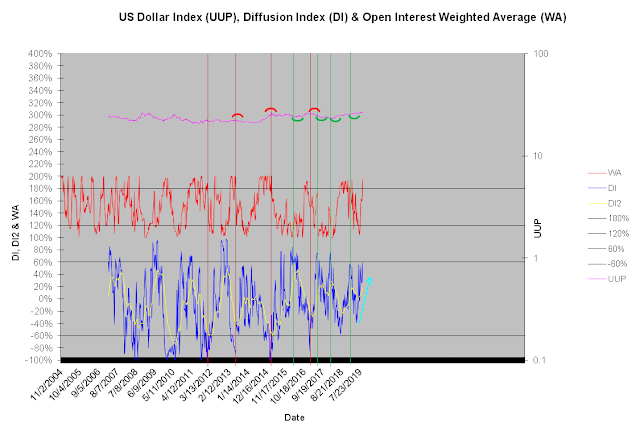

Subscribers, however, are smarter than the public. They see late cycle triple alignment in need of a reset, not a bear market. What will be even more impressive this time around is that the reset will be taking place under a near bullish setup. The dollar's most recent DI and DI2 are 58% and 18%. If these numbers rise as the dollar index resets, it shows an aggressive bullish energy build as the headline prepare the fools for lower prices. This game is all about what the invisible hand is doing, not the fools.

Dollar DI

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.