US Dollar Continues To Gain, Wall Street Hits Fresh Records

JFD Team | Oct 26, 2021 03:51AM ET

Most global equity indices continued to drift north yesterday and today in Asia, aided by better-than-expected earnings results, with the Dow Jones Industrial Average and the S&P 500 hitting fresh record highs.

Despite the risk-on trading, the US dollar kept gaining, perhaps as market participants became convinced that, next week, the Fed will indeed begin its tapering process and may deliver the first rate increase earlier than previously thought.

Fed Tapering Bets Lift US Dollar, Equities Keep Advancing on Earnings

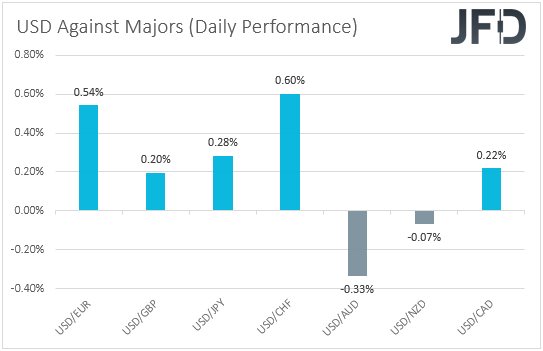

The US dollar traded higher against most of the other major currencies on Monday and during the Asian session Tuesday. It underperformed only versus AUD and slightly against NZD, while it gained the most against CHF and EUR.

The strengthening of the risk-linked Aussie and Kiwi, combined with the weakening of the safe-haven franc, suggests that market participants may have continued to add to their risk-exposures yesterday and today in Asia.

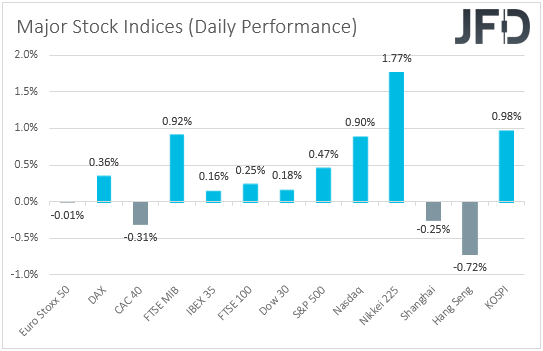

Indeed, most major EU and US indices finished their sessions in positive territory, with the exceptions being Euro Stoxx 50, which traded virtually unchanged, and France’s CAC 40, which slid somewhat.

In the US, both the Dow Jones and the S&P 500 hit fresh record highs. Today in Asia, Nikkei and KOSPI followed suit and inched higher.

China’s Shanghai Composite and Hong Kong’s Hang Seng declined after China said it would roll out a pilot real estate tax in some regions, adding to concerns with regards to the property sector and the nation’s overall economic performance.

With no fresh catalysts to drive the markets yesterday, we believe that investors remained willing to take more risk, as Q3 earnings continued to come in generally better than expected.

Yesterday, Tesla (NASDAQ:TSLA) rose 4.5% after Hertz ordered 100,000 of its electric cars, providing the most significant boost to the S&P 500 and the NASDAQ, followed by PayPal (NASDAQ:PYPL), which abandoned plans to buy Pinterest (NYSE:PINS) for $45 billion.

During after hours, Facebook (NASDAQ:FB) reported better earnings but missed the revenue forecast.

Amazon (NASDAQ:AMZN) and Apple (NASDAQ:AAPL) report their results today. With no major data on the economic agenda, market participants may stay focused on equities and upcoming earnings reports.

Decent earnings announcements could help stock indices continue conquering new highs. This could mean that the latest supply shortages did not affect the global economy as many may have believed.

Despite the broader risk appetite, the US dollar managed to outperform most of its peers yesterday, suggesting a disconnection from the broader market sentiment.

Remember that the greenback has been acting as a safe-haven currency in the recent past, strengthening when participants were cautious and weakening during periods of market euphoria.

Macro data and earnings suggested that the US economy was not affected by the latest bottlenecks to the extent many had expected.

Investors considered the case of tapering at next week’s Fed gathering a done deal and may have also brought forth their expectations regarding when the first rate increase could take place.

That’s why they were willing to buy even more dollars. The Fed funds futures now anticipate a 25 bps hike to be delivered in October 2022.

A few weeks ago, such a move was priced in for the first months of 2023. At this point, we believe that a lot on that front may depend on the first estimate of the US GDP for Q3, due on Thursday.

NASDAQ 100 – Technical Outlook

The NASDAQ 100 cash index traded higher yesterday, breaking above last week’s high, at around 15500, thereby confirming a forthcoming higher high.

The index remains above the last downside resistance line drawn from the high of Sept. 7 and above the upside one taken from the low of Oct. 4. Therefore, we will consider the outlook to be positive.

NASDAQ is the only Wall Street index that did not hit a new record yet, but it is getting closer it the highest level it ever touched, at 15710.

It hit that level on Sept 6. If investors are willing to enter the uncharted territory soon, then we could see them setting the stage for the psychological round figure of 16000.

We will abandon the bullish case and start examining deeper declines only if we see a drop below the 14915 barrier, marked by the inside swing high of Oct. 11.

This could confirm the index’s return below the aforementioned diagonal lines and pave the way towards the 14600 zone, which acted as a support on Oct. 12 and 13.

If that area cannot stop the slide, we could see extensions towards the low of Oct. 4, at around 14390.

EUR/USD – Technical Outlook

EUR/USD turned south yesterday, breaking below the critical support (now turned into resistance) barrier of 1.1618.

That move signaled that the corrective recovery, which started on Oct. 12, is over, and the prevailing downtrend, marked by the downside line taken from the high of May 25, has now resumed.

The rate is now getting closer to the 1.1587 zone, where a dip could carry larger bearish implications, perhaps see scope for extensions towards the low of Oct. 12, at 1.1524.

If the bears are unwilling to stop there, we could see a test at the psychological 1.1500 zone, the break of which could extend the fall towards the 1.1465 zone, defined as a support by the inside swing high of July 20 2020.

On the upside, a break above 1.1749 may trigger a trend reversal, a level that provided strong resistance between Sept. 21 and 24. The rate would already be above the downside line and may travel towards the 1.1790 or 1.1837 zones.

If neither territory can stop the bulls, a break above 1.1837 may see scope for extensions towards the high of Sept. 7, at 1.1885.

As for Today’s Events

As yesterday, the economic calendar remains light today as well. We get the only relatively important data is the US Conference Board consumer confidence index for October and the new home sales for September.

The CB index is expected to have slid fractionally, but new home sales could increase somewhat.

Tonight, during the Asian session Wednesday, we have New Zealand’s trade balance for September and Australia’s CPIs for Q3. No forecast is available for New Zealand’s trade balance, while Australia’s CPI could slow to +3.1% yoy from +3.8%.

The trimmed mean and weighted mean rates are forecast to inch slightly higher, but they could remain below the lower end of the Reserve Bank of Australia (RBA) target range of 2-3%.

This is likely to add credence to the RBA’s view that interest rates are unlikely to start rising before 2024, despite market participants seeing the official cash rate hitting 0.50% by the end of next year, at least according to the ASX 30-day Interbank Cash Rate Futures Yields Curve.

As for the Aussie, slowing inflation could result in some selling, but considering that the currency is driven by developments surrounding the broader market sentiment, we don’t expect a significant trend reversal.

As long as investors generally remain optimistic, this risk-linked currency could stay in an uptrend mode. Any CPI-related retreat could be just a temporary correction.

As for the speakers, today, we will get to hear from ECB Supervisory Board Chair Andrea Enria.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.