U.S. Dollar Bulls Take Firm Control

MarketPulse | May 07, 2018 06:53AM ET

Monday May 7: Five things the markets are talking about

The US dollar remains in the ‘black’ ahead of the open stateside, reversing most of its earlier losses in the overnight session. Euro stocks are trading sideways following a muted Asian session, as oil extends its recent gains to new heights.

Note: In Europe, trading volumes remain light due to the May Day Bank holiday in the U.K.

In currencies, the yen weakened as capital markets returned from Golden Week holidays, while the euro was also weaker.

In commodities, WTI crude pushed above the psychological +$70 a barrel for the first time in nearly four years as the market braces for the re-imposition of US sanctions on Iran.

Expect geopolitics to remain in focus this week with US President Donald Trump expected to decide by May 12 whether the US stays in or pulls out of the Iran nuclear deal.

Elsewhere, US earnings season continues, and on the economic front, traders will watch out for an expected acceleration in US CPI (May 10, 08:30 am EDT).

On Tap this week: Nafta talks resume again in Washington today – it’s a critical period and the US is still pushing a hardline. China trade data will be the markets focus on Tuesday, along with Australia’s annual budget. On Thursday, the BoE takes center stage with its rate announcement, while US inflation data for April is due the same day.

1. Stocks mixed results, investors looking for substance

In Japan, the Nikkei share average ended flat in choppy trade overnight as hopes that the BoJ would buy ETF’s to offset weakness in financials, which were hit by falling US yields. The Nikkei ended little changed, while the broader TOPIX added +0.1%.

Note: Japanese markets were closed from Wednesday through Friday for Golden Shower week.

Down-under, Aussie shares ended higher on Monday, as a rise in materials stocks pushed the benchmark higher, although gains were capped as financials eased from intraday highs ahead of tomorrow’s 2018 annual budget. The S&P/ASX 200 index rose +0.36% at the close of trade. The benchmark fell -0.6% on Friday. In South Korea, the KOSPI closed out down -1.04%.

In Hong Kong, stocks rallied overnight, as fears of a full-blown Sino-US trade war receded ahead of a plethora of Chinese economic data in the coming weeks. The Hang Seng index rose +0.2%, while the China Enterprises Index gained +0.6%.

In China, stocks rebounded sharply on Monday amid optimism about robust April economic data despite lingering trade tensions. The blue-chip CSI300 index rose +1.6%, while the Shanghai Composite Index gained +1.5%.

In Europe, markets have opened flat and trade slightly higher. It’s not surprising to see trading volumes light with the UK and Ireland closed for a bank holiday. Elsewhere, energy stocks are being supported with WTI topping +$70 a barrel.

US stocks are set to open in the ‘black.’

Indices: STOXX 50 flat at 3,548, FTSE 100 closed, DAX +0.3% at 12,860, CAC 40 flat at 5,515; IBEX 35 +0.3% at 10,138, FTSE MIB +0.3% at 24,400, SMI +0.2% at 8922, S&P 500 Futures +0.3%

2. Oil higher on Venezuela and Iran worries

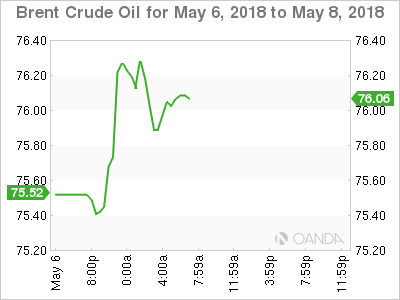

Crude oil prices have rallied +1% overnight to their highest levels since late-2014, pushed up by a deepening economic crisis in Venezuela and a looming decision on whether the US will re-impose sanctions against Iran.

Note: President Trump has until May 12 to decide whether to restore the sanctions on Iran that was lifted after an agreement over its disputed nuclear program.

Brent crude oil futures are at +$75.57 per barrel, up +70c, or +0.9%, from Friday’s close. Earlier in the session, they touched their highest since November 2014 at +$75.89 a barrel. US West Texas Intermediate (WTI) crude futures rose +70c, or +1% to +$70.42 per barrel.

Note: China’s Shanghai crude oil futures, launched in March, broke their dollar-converted record-high of +$71.32 per barrel by rising as far as $72.54 on Monday. Open interest and traded volumes for Shanghai crude also hit a fresh record overnight.

Nevertheless, helping to cap crude oil prices a tad, is an increase in US production – weekly rig counts from Baker Hughes’s – and last week’s US inventory reports (EIA and DoE) showed a weekly build up in supplies.

Ahead of the US open, gold prices have shed their earlier gains to edge lower, as the ‘big’ dollar holds near its four-month peak, dampening the appeal of bullion. Spot gold is down -0.2% at +$1,311.91 an ounce. US gold futures for June delivery slipped -0.2% to +$1,312.60 per ounce.

Note: Earlier in the session, it touched +$1,318.85, its highest since April 30.

3. BoE rate rise expectations collapse

Expectations for a rate increase by the Bank of England (BoE) this Thursday have collapsed (07:00 am EDT) since Governor Carney raised the alarm at the end of April.

Even PM Theresa May’s government has been able to cast some doubt over the timing, as too have UK rate ‘hawks,’ who suggest that the recent set of soft U.K data also appears to speak against a rate raise anytime soon.

Market consensus believes that the BoE can afford to hold fire to buy time and see how things in consumer credit and retail space play out. However, the outlier remains U.K wage growth that continues to show signs of life, the BoE’s preference might remain for tighter monetary policy, and a hike in August is still a possibility.

The yield on US 10-year Treasuries has backed up +1 bps to +2.96%. In Germany, the 10-year Bund yield has dipped -1 bps to +0.53%, while in the UK, the 10-year Gilt yield has climbed +1 bps to +1.4%.

4. Dollars rise to continue

The US dollar continues its rise ahead of the open stateside, pushing EUR/USD (€1.1923) to its lowest in nearly four-months. Weaker Euro data (see below) is not helping the ‘single units’ cause.

Despite Friday’s US jobs data miss, dollar ‘bulls’ believe the ‘buck’ still has some catching up to do. The DXY dollar index is up +0.1% at 92.70, close to it’s highest since late 2017.

Note: The DXY has fallen from a peak above 95 in mid-November, however, the market has priced in almost two additional Fed rate rises for 2018 and almost two for 2019.

Sterling traders will be focusing on Thursday’s BoE rate decision and whether it could be a ‘hawkish’ hold, which could help the pound (£1.3526) regain some of its shine.

Emerging market currencies remains weak – Turkey Central Bank (CBRT) has changed its reserve option mechanism to combat recent FX weakness. In Argentina, overnight rates have been aggressively hiked to +40% since last week, to stem the outflow capital from the country.

5. German manufacturing orders drop along with euro confidence

German manufacturing orders dropped for the third consecutive month in March, a further sign of cooling activity in German industry.

Total manufacturing orders fell -0.9% from the month before, which marks the third straight monthly decline. Market expectations had forecasted an increase of +0.5%.

Today’s data add to evidence that Europe’s largest economy has shifted down a gear, following strong growth in Q4, 2017.

Digging deeper, domestic orders for German manufacturing goods rose +1.5% from February, however, foreign demand was down sharply by -2.6%.

Other data this morning showed that the Sentix economic index for the euro zone fell for the fourth consecutive month in May and reached 19.2 points, its lowest level in 18-months. The situation and expectations also both fell slightly.

When is US punitive tariffs coming? The decision has not yet been made and it is therefore not surprising that the Sentix economic indices hardly changed in May.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.