US Dollar Breakout Has Room to Run: Critical Levels to Watch in EUR/USD, USD/JPY

Investing.com | Feb 05, 2024 06:40AM ET

- The US dollar surged to an 8-week high last week, fueled by robust economic data and a hawkish stance from the Fed.

- After strong data, the Fed might reconsider the three-rate cut plan for 2024, strengthening the dollar against major currencies.

- Technically, the DXY may target 105.8 as EUR/USD faces challenges, and USD/JPY eyes a move above 150 amid sustained dollar strength.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool.

In his press conference that followed last week's FOMC meeting, J. Powell nearly ruled out the possibility of a rate cut in March, propelling the US dollar to an 8-week high last week.

Consequently, the expectation of a March rate cut dropped to 20%, down from 50% the previous week.

The decrease in the rate cut expectation was reinforced by robust economic data as, on Friday, the US nonfarm payrolls exceeded expectations, showing a robust labor market.

Nonfarm payrolls rose by 353,000 in January, and average hourly earnings surpassed expectations. The latter remains a crucial factor in the Fed meeting its inflation target.

The upward trend in wages, coupled with increased employment, paints a positive outlook for the US economy. This development suggests that the Fed may reconsider its three-rate cut plan for 2024, as mentioned in December.

In response to recent developments, the US dollar intensified its pressure on major currencies.

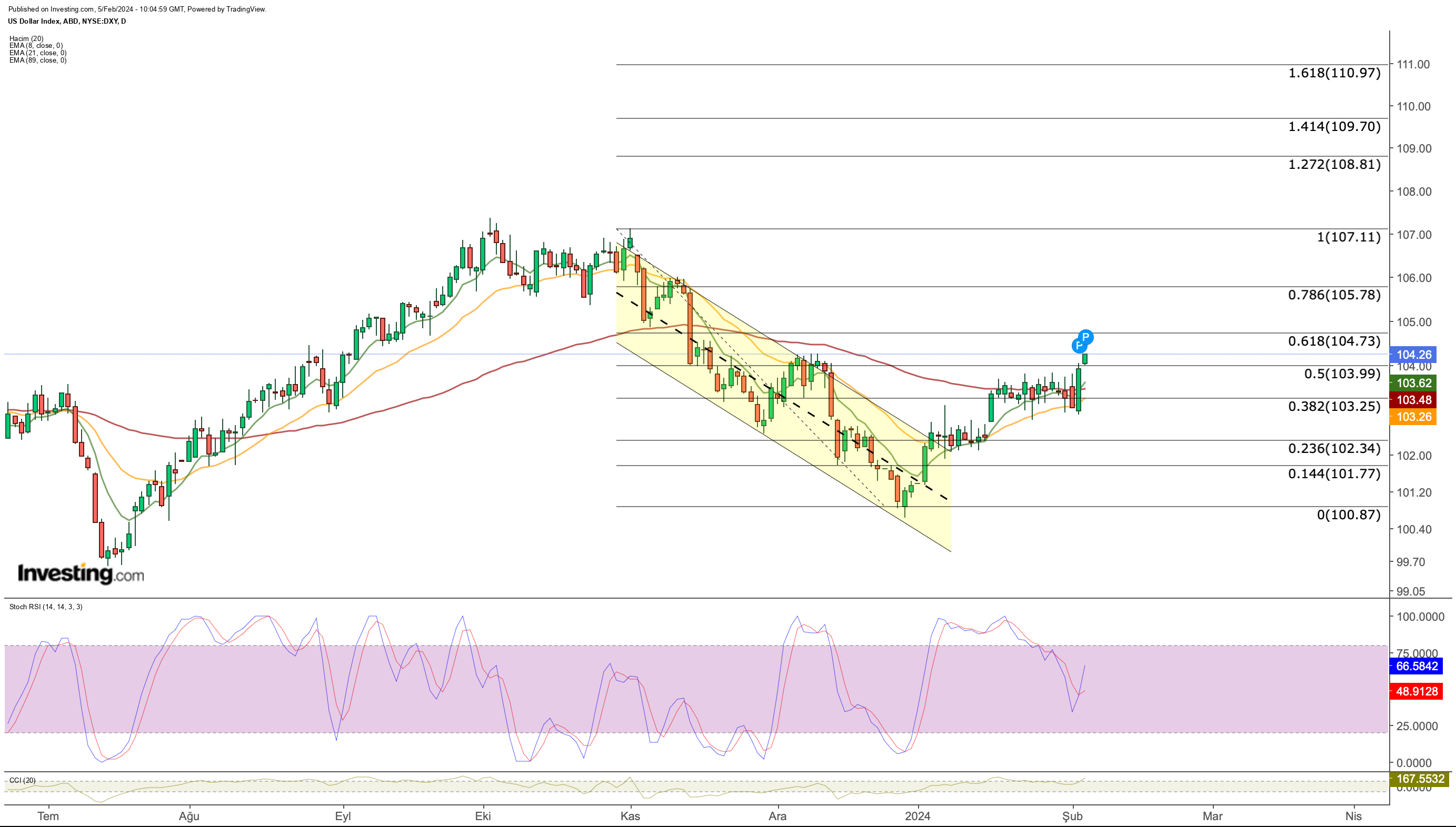

DXY Technical View

The DXY continued its upward momentum, re-entering the 104 band, which it had reached in December. The current drivers behind the dollar's strength are strong economic data and the Fed's commitment to maintaining a tight monetary policy.

In this scenario, a weakening dollar is anticipated only if there are signs of economic cooling in the US and a strong indication from the Fed about initiating interest rate cuts.

As things stand, the dollar is likely to sustain its strength at least until the second quarter of the year.

If we look at the DXY technically, we can see that the reversing trend with the entry of 2024 has taken the Fib 0.618 value on its radar, which is at 104.7 this week.

Measured against the recent bearish momentum, this level could be a solid resistance for the index.

However, the short-term EMAs signal that we are still at the beginning of a bullish wave. Also, the Stochastic RSI on the daily chart hints that there is more room on the bullish path.

The latter could lead the DXY to test 105.8 on a weekly close above 104.7 and then 107, its recent short-term peak.

In the medium term, the target zone remains in the 108 - 110 range according to Fibonacci levels.

In case the resistance at the 104 level cannot be broken this week, the formation of a solid support in the 103 region indicates that the possible retreat in the dollar index may remain limited.

EUR/USD: Pair Likely to Slide Much Lower

The more challenging economic conditions in the Eurozone compared to the US continue to support the rhetoric that the interest rate cut in Europe may start earlier.

The data to be released in the Eurozone this week will provide clearer information on the economic outlook.

In particular, data from Germany and the speeches of ECB members during the week may provide important clues about when to start interest rate cuts in the Eurozone.

When we look at the EUR/USD parity, in parallel with the strengthening in the dollar, the exchange rate has depreciated by more than 2.5% since the beginning of the year, falling as low as $ 1.075 at the beginning of the week.

The Stochastic RSI, which remains in oversold territory on the daily chart and remains weak, and the short-term exponential moving average values, which have turned down, also support the downward movement of EUR/USD.

While EUR/USD is expected to regain the 1.08 level to see a possible recovery, we can see that the hard resistance line formed especially in the 1.087 band may continue to suppress the pair in the short term.

Fundamental data has hinted that the dollar may remain strong for a while.

Technically, the 1.07 limit stands out as the closest and most important support for EUR/USD. If there is no support from this point, the pair is likely to slide towards the 1.05 band.

USD/JPY Breaks Out: A Move Above 150 Is in the Offing

While the USD/JPY pair has made partial gains against the dollar for the last two weeks, it quickly gave back these gains with strong data from the US last week.

USD/JPY, which fell as low as 145 last week, quickly turned its direction upwards as US employment came in well above expectations and rose to the short-term resistance at 148.4 against the dollar demand.

Since the second half of January, USD/JPY has maintained a flat trajectory. The pivotal point in this phase has been the 147.5 level, corresponding to Fib 0.618.

With a bullish start to the week, an upward move towards the 149 level could break the horizontal outlook, potentially entering the 150 band once again.

On the downside, 147.55 serves as the initial support, followed by a second support line at 146.25.

Anticipating a sustained dollar strengthening, there's an increasing possibility that USD/JPY might extend its trend until the second half of the year, reaching the range of 154 - 158.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

for an extra 10% discount on the by-yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.