US Data And Ongoing Brexit Disagreements

JFD Team | Nov 26, 2020 03:27AM ET

Change Of Tone In Brexit Deal

Yesterday, the day was filled with data and various news from around the world. One of the main news out of the European political life was surrounding the Brexit deal negotiations. If Monday was full of positive headlines that there is progress in the Brexit talks, on Wednesday it was a different picture. The air was filled with skepticism that a deal could be reached. Boris Johnson reassured that UK’s position on fisheries has not changed and that there won’t be any extension of the transition period.

The European Commission president, Ursula von der Leyen, tweeted:

“Later on, we will get the minutes from the last FOMC meeting. Investors will try to seek clarity on how policymakers are willing to proceed further. During the previous meeting, the Fed decided to take a wait-and-see approach, because of the uncertainty surrounding the US elections. The Committee had state last time that they are ready to use all available tools to support the US economy”.

However, once again, the Irish Prime Minister tried to clear up the tensed air by stating that he believes a deal could be reached, but maybe on a “staged basis”, and that good results can be achieved in extra time. This, of course, suggests that Ireland could consider an extension, if needed.

In our Tuesday’s report we said that the “95%-agreement”, which has been praised in the beginning of this week by both sides, is not something to be very happy about, as it misses out some important topics like fishing, governance and dispute resolution. And as we already know, neither of the sides are willing to back off from their positions. The pound could still remain under slight buying interest, especially against the currently-weaker US dollar, as there are still no big official negative headlines that are hitting the wires.

GBP/USD Technical Analysis

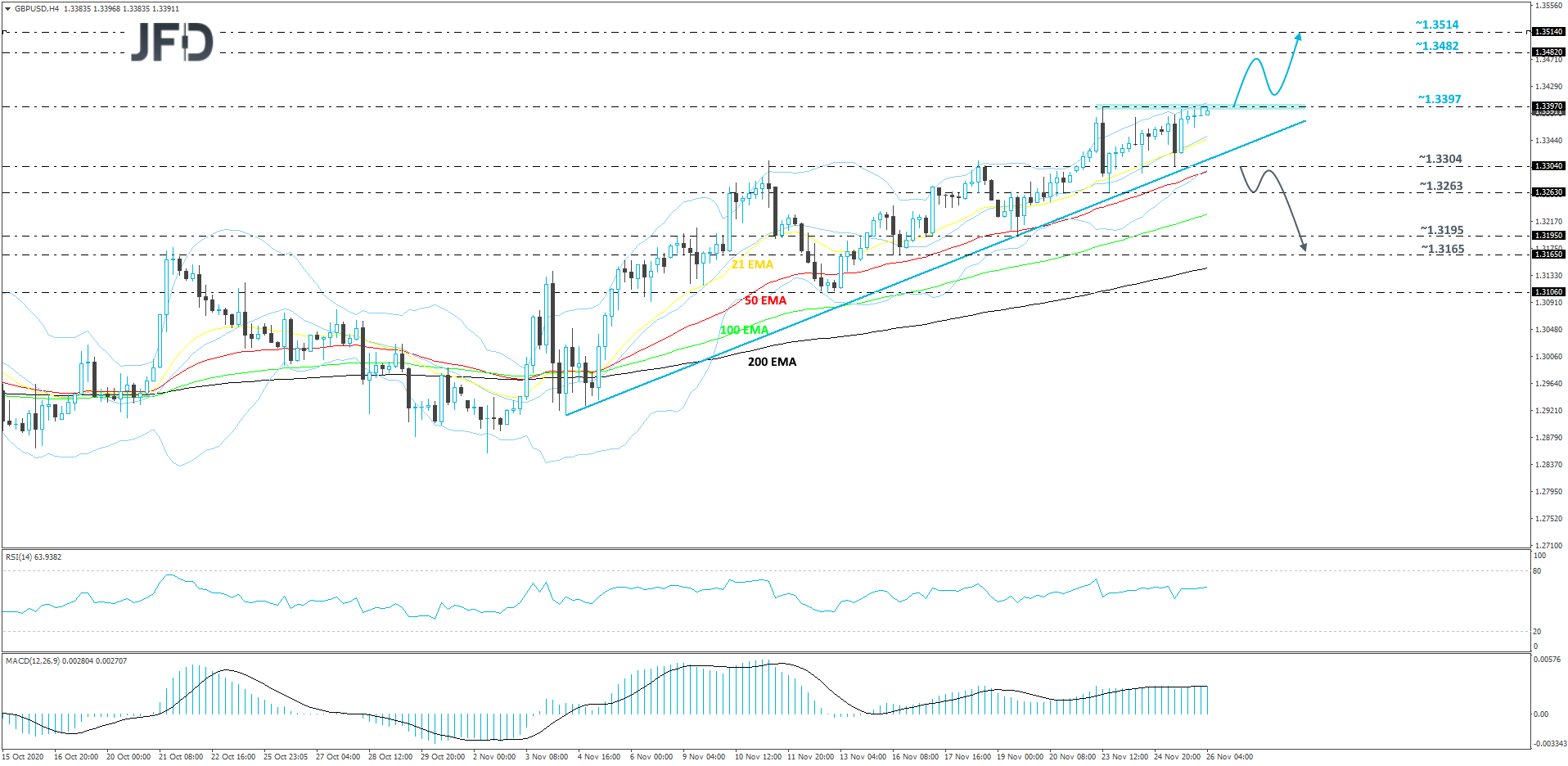

Looking at the technical picture of GBP/USD this morning, we can see that the rate is already knocking on the door of its key resistance barrier, at 1.3397, which is currently the highest point of November. At the same time the pair continues to balance above a short-term upside support line drawn from the low of Nov. 4. Although everything is pointing towards a continuation move higher, in order to get comfortable with higher areas, at least in the near term, we would prefer to wait for a move above that 1.3397 hurdle first. Until then, we will remain somewhat positive.

If, eventually, the pair does pop above that 1.3397 zone, this move may clear the path for a further uprise, possibly targeting the 1.3482 area, marked by the highest point of September. The rate might stall there for a bit, or even correct back down. That said, if GBP/USD continues to trade above the aforementioned upside line, we could see the bulls stepping in again. If so, another push higher, and this time a break of the 1.3482 obstacle, could send the pair to the highest point of December 2019, at 1.3514.

Alternatively, if the previously-discussed upside line breaks and the rate slides below the 1.3304 hurdle, marked by the low of November 25th, that may scare the bulls from the field temporarily and allow more bears to join in. GBP/USD may then travel to the 1.3263 zone, which is the current low of this week, where the pair could stall temporarily. However, if the sellers are still strong, a break of that zone may result in GBP/USD falling to the 1.3195 hurdle, or the 1.3165 level, marked by the lows of November 19th and 16th respectively.

US Data Release

With the US markets closed today and having a half day on Friday, the country dropped a pile of data yesterday for the market to digest. Also, on the US political side, the new president-elect Joe Biden was in a rush this week to deliver his nominees for different cabinets.

But one of the most important news from all that was the fact that Joe Biden nominated and confirmed Janet Yellen as the next head of the Federal Reserve. Before Jerome Powell was assigned by Donald Trump in 2018, Janet Yellen was already the head of the Federal Reserve and held that position for 4 years, between 2014 and 2018. Investors took the news positively, as Yellen is a key supporter of keeping interest rates low, in order to continue supporting the economy.

On the data front, the US released a bunch of key economic indicators, where some came out as a disappointment. The core PCE MoM price index came out slightly lower than expected, at 0.0%, whereas the expectation was for a +0.1% figure. The headline PCE MoM price index also showed up at 0.0%, however there was no initial forecast available, but the previous number was at +0.2%. New home sales declined and personal income dropped, however, personal spending increased slightly. Another disappointment was the preliminary QoQ Q3 GDP figure, which came out as previous +33.1%, missing the initial forecast by a tenth of a percent. But, probably, the biggest setbacks were the initial and continuing jobless claims figures. Initial claims showed up at 778k, which is higher than the forecast of 730k and the previous 748k. Continuing jobless claims were above the forecast, but below the previous, coming out at 6071k. The Dow and the S&P 500 took a slight hit, however the technology sector was still at its best, helping NASDAQ to close slightly in the positive territory.

NASDAQ 100 Technical Outlook

This week, NASDAQ 100 continues to slowly grind higher, trying to get closer to its all-time high on the cash index, at 12465. The index is also trading above a short-term tentative upside support line drawn from the low of Nov.10. For now, the price may continue slowly drifting higher, as long as it continues to trade above 12091 hurdle, which is the high of last week.

A further push north could bring the price closer to the 12257 barrier, marked by the high of Oct. 13 and an intraday swing low of Nov. 9. NASDAQ 100 might get held there temporarily, however, if the buyers are still feeling comfortable, they may overcome that obstacle and target the 12415 barrier, marked by the current highest point of September. Slightly above it lies the all-time high, at 12465, which could get tested as well.

On the downside, if the price breaks the previously discussed upside line and also slides below the 11875 hurdle, marked by the lows of Nov. 20 and 24, that could open the gate for a further slide. NASDAQ 100 might then drift to the 11800 obstacle, or even to the 11705 zone, marked by the current low of this week and an intraday swing high of Nov. 11 respectively. The index may get halted around there for a bit, but if the sellers are still active, the next possible target might be at 11511, which is the low of Nov. 10.

As For The Rest of Today's Events

During the early hours of the European morning on Thursday, the Swedish central bank will take center stage, as it will deliver its interest rate decision. In the latest monetary policy report delivered by the Riksbank, it states that the Swedish economy has managed to recover somewhat after the sharp decline experienced in spring of this year. The Bank will continue providing support to the economy and it is believed that the repo rate will stay the same, at 0.0%.

Later on, the ECB will publish its account of monetary policy meeting minutes from its October meeting, which might show further monetary easing, in order to continue supporting the eurozone.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.