U.S. Current Inflation Outlook Explained

James Picerno | Nov 06, 2019 07:13AM ET

Confused about the outlook for US inflation? Yesterday’s conflicting news isn’t helping.

The New York Fed’s monthly survey of consumers in October finds that “short-term inflation expectations have declined to their lowest level since the start of the series in June 2013.” The view from Main Street slipped 0.2 percentage points to an annual 2.3% pace. “The decline in one-year ahead inflation expectations was more pronounced for respondents above age 40 and those with household incomes above $50,000.”

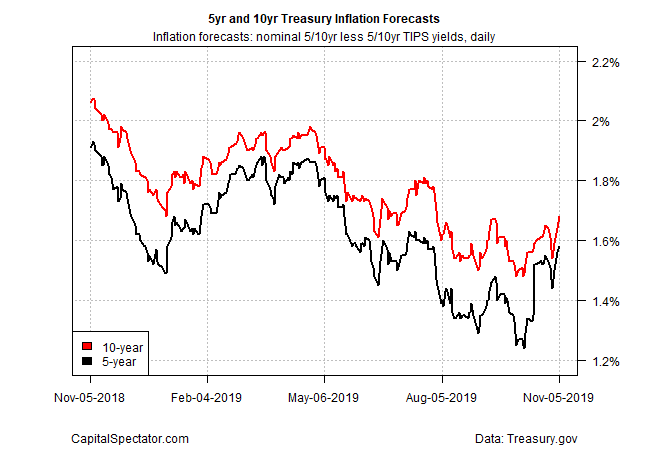

In the Treasury market, however, the crowd is revising inflation expectation up sharply. The implied outlook via the yield spread on the nominal 5-year maturity less its inflation-indexed counterpart, for example, shot up to 1.58% in yesterday’s trading (Nov. 5), a three-month high. That’s still well below the Federal Reserve’s 2.0% inflation target.

Nonetheless, the sudden directional shift if striking and it implies that the market is rethinking the case for low inflation as far as the eye can see.

Further complicating inflation analysis and policy prescriptions these days is a new report that rising prices are squeezing low-income folks. “Prices have risen more quickly for people at the bottom of the income distribution than for those at the top—a phenomenon dubbed ‘inflation inequality,’” according to report published this month by the Center on Poverty & Social Policy at Columbia University and the Groundwork Collaborative. “An implication of this new finding is that we may be underestimating income inequality and poverty rates in the United States—two national statistics that rely heavily on the annual inflation rate as part of their calculation.”

From the vantage of monetary policy, however, the goal is still one of pushing inflation higher. Emphasizing the objective, Neel Kashkari, president of the Minneapolis Fed, told CNBC earlier this week that the Federal Reserve should take a pass on future rate hikes until inflation rises from current levels. “Make an announcement today that we will not raise rates until we get core inflation back to our 2% target,” he said. “That’s not a commitment to cut rates, that’s not a commitment to hold forever, it’s simply saying we’re not going to raise rates prematurely.”

In fact, the Core reading of the Consumer Price Index (which strips out energy and food prices for a more reliable measure of the trend) is showing signs of strengthening in recent months. Core CPI (in unadjusted terms) rose at an annual 2.4% rate in August and September, the fastest gains since the recession ended in 2009. The upswing implies that headline inflation will soon follow.

Or will it? Many analysts are befuddled when it comes to analyzing and understanding the inflation dynamics of late. But it’s getting easier to assume that inflation may have a tough time rebounding in the wake of recent numbers that suggest the macro trend has decelerated. There’s still no sign of an imminent recession risk, based on a broad reading of indicators. But there’s also mounting evidence that slow growth will continue to slow.

Yesterday’s GDP nowcast for the fourth quarter via the Atlanta Fed’s GDPNow model estimated output at a weak 1.0% increase – down from 1.9% in Q3. If that’s accurate, the softer trend may put new downward pressure on inflation in the months ahead.

In short, there’s still a number of conflicting signals for the inflation outlook. From a policy perspective at the Fed, however, a bias for higher pricing pressure is conspicuous.

“We need an inflation rate that gives us nominal rates that are high enough and give us more police space,” San Francisco Fed President Mary Daly said on Monday.

All eyes will be on the Nov. 13 release of October’s consumer price index to learn if the hard data aligns with Daly’s policy wish list.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.