US Coal Production Declines As The Industry Faces Further Stress

Sober Look | Mar 29, 2012 05:42AM ET

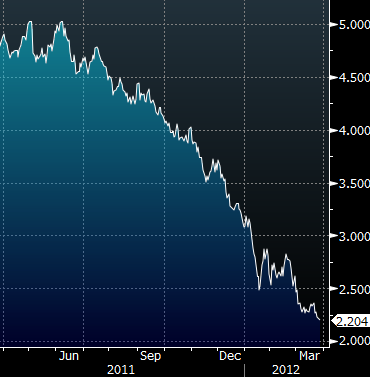

Here is a follow-up to the post on the declining US coal demand. As natural gas hits a new low today, the pressure on US coal industry increases further.

Natural gas nearby futures contract (Bloomberg)

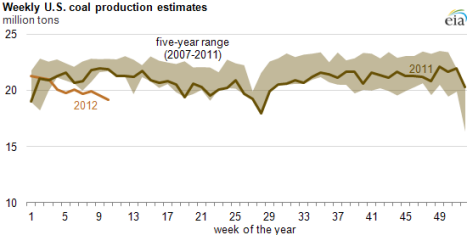

The impact is unmistakable. The latest data from EIA is showing 2012 coal production levels materially below the 5-year range for this time of the year.

Making things even worse for the coal industry is the new EPA proposal to reduce carbon emissions by electricity companies. This proposal would turn the new coal-fired power plants into money losing investments.

Reuters: The first-ever U.S. proposal to restrict carbon dioxide emissions would have once been a major shock to electricity companies by making it uneconomic to build new coal-fired power plants.

But the irony is that the essence of the EPA's proposal has effectively already been usurped by low natural gas prices, which also turn coal-fired plants uneconomic.

Reuters: But the discovery of abundant supplies of cheap natural gas means that many of those plants won't get built anyway - making the Obama administration's plan, while painful for the coal industry, much less relevant.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.