When A Global Crisis Is Actually A Market Opportunity

Joseph L. Shaefer | Jul 20, 2016 06:01AM ET

Summary- “Brexit” was not a crisis.

- Turkey is not a crisis.

When is a crisis a crisis—and when is it an opportunity?

"Brexit" was not a crisis. Turkey is not a crisis. It could become one, although that would occur based on what is happening since the coup, not the coup itself. (More on this below.)

A crisis, from an investment standpoint, is a series of events that lead to continuing hardship for a large percentage of the population, typically contiguous to or immediately followed by recession (or worse) that continues for some time. A plague, famine, warfare in the homeland, ubiquitous Islamist terrorism—The Four Horsemen of the Apocalypse stuff—now those are crises.

World war, pandemics, civil war that goes on for years draining the economy, and the knows-no-bounds stupidity of bankers and politicians, have all contributed to regional, and sometimes global, crises. From an investment standpoint, the 53% decline investors withstood from October 2007 to March 2009, coupled with joblessness, home foreclosures, and a loss of confidence in leadership was a crisis—the water torture kind.

But Brexit? Brexit was no investment crisis...it was an investment opportunity. One-off events, unlike recessions, depressions, war in the homeland, etc., tend to emotionally terrify market participants who sell blindly into the panic. Over the next few weeks or months, however, those with cash on the sidelines decide to start buying the now-bargain-priced issues and soon those who swore off the market join them.

The only difference between such hair-pulling and teeth-gnashing in the past is that today media dissemination is more immediate, more in-your-face and more hyperbolic than in the past. In addition, anyone with an axe to grind can set up a blog for free and spread rumor and panic more quickly than ever before. So the speed and the intensity of the declines and rebounds are faster. It "feels" worse because everyone is SnapChatting and Facebooking and Tweeting and Twittering about it. Take Brexit as a case in point. I believed all along that Brexit would carry the day and, indeed, if I were a Brit, that's how I would have voted.

My money is on the British. And so, it seems, are others'. On June 27 Burberry (OTCPK:OTC:BURBY) was at $14, Glaxo Smith Kline (NYSE:GSK) was selling for $40, and ARM Holdings (NASDAQ:ARMH) was selling for $41. All are higher today.

And with SoftBank (OTC:SFTBY) just initiating a takeover of ARMH, clearly it found just such a bargain. I also suggested some Irish companies for your due diligence here, with a suggestion that the New Ireland Fund (NYSE:IRL) was a great way to diversify into Ireland. It seemed passing strange to me that Ireland, still a member of the EU, would fall in concert with the UK, but it did.

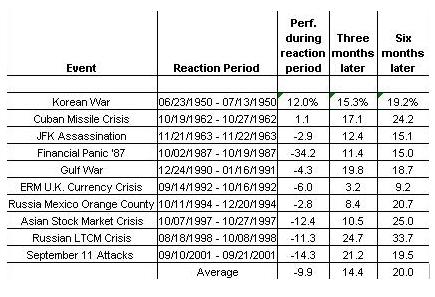

So where does this "crisis" (and recovery!) leave us from an investment standpoint? The chart below, courtesy of Ned Davis Research and T Rowe Price, tells an interesting story. It's a bit dated; I used it in the spring of 2009 to show that the reaction to all crises ends at some point—but subsequent crises have always followed the same pattern.

Note the declines during the "reaction period" and how things looked just a few months later:

The world goes on. So do the markets.

If you doubt it, take a look at this chart of the British stock market from 1770—you read that right—to 1790. After an initial reaction to the Boston Massacre, came a sense of "something not right," followed by confirmation after the battles of Lexington and Concord.

Doing without the New World colonies' tobacco and cotton and not having a bulwark against the French and Spanish would be worrisome. But of course the British Navy and Army will quell this little disruption, right?

I promised I would comment on the latest crisis, the alleged coup in Turkey. Are there investments you might consider, given how most such crises are short-lived and typically provide a fine buying opportunity as investors sell off in a panic? Sadly, I must say no. It's true, if you are a scalper and want to trade the closed-end Turkish Investment Fund (NYSE:TKF) or some of Turkey's biggest firms like Akbank (OTC:AKBTY) or Turkcell (NYSE:TKC), you might find success.

But long term? I don't doubt there was a poorly-executed coup. But my guess is that (Turkish president and strongman) Erdogan's secret police knew all about it beforehand and might even have fed the coup planners false information that x number of units were prepared to join in.

As he said himself, "This coup was a gift from Allah." It was indeed. It allows Erdogan to tighten his autocratic grip on the nation and remove or kill thousands of judges, lawyers, military officers and police officials who do not share his Islamic-state aspirations.

The day Turkey returns to its democratic and secular roots however, I will be happy to invest in what could be one of the world's great nations. Stay tuned.

3 Firms, Worthy of Due Diligence

Since, in crisis there is always opportunity, here are three Irish firms I find worthy of your due diligence:

Most readers already know this, but if you need to explain it to others, the following geopolitical reminder may be helpful: Ireland is Not Part of the UK.

Nor is it part of Great Britain. It is merely, geographically, situated within the British Isles, just as Belgium is part of what we call the Low Countries or the US is in North America.

The geographic term for the large contiguous island (and about 5000 smaller islands offshore,) comprising England, Scotland and Wales is "Great Britain." The nation called the UK (the "United Kingdom of Great Britain and Northern Ireland") includes the island of Great Britain as well as Northern Ireland to the west.

Ireland comprises the bottom 3/4 or so of the island where there are two nations: Ireland and (as part of the UK) Northern Ireland.

Given its location, you might think Ireland would conduct the bulk of its trading with the UK. Apparently a lot of investors think so, too, since Irish shares have been hard hit ever since June 24th. But in fact, Ireland, the 33rd-largest exporting country in the world, actually only derives 15% of its export revenues from the UK.

Ireland is still a member of the EU, uses the euro, and derives most of its export revenue from the member states of the EU. (Though its largest percent to a single country is the USA, at 22%.) Ireland also has one of the lowest corporate tax rates in the world, at 12.5%, a fact which has attracted many entrepreneurial firms to the country, particularly in the pharmaceuticals, aerospace and technology fields. (By comparison, the top marginal rate in the US is 39%, highest in the world after only the United Arab Emirates and Chad.)

So the big question is, which firms in Ireland are likely to be least affected by Brexit, yet still sold off on June 24?

The first company that comes to mind is NYSE ADR-listed CRH PLC (NYSE:CRH). CRH is the second-biggest building materials company in the world and #1 in the US and Canada.

In 2015, 37% of the company's sales and 27% of EBITDA were derived from European operations. They still will be. But as the #1 building materials company in North America, they are also the top supplier of product for highway repair and maintenance in the US, with operations in all 50 U.S. states and 9 Canadian provinces. They still will be. Brexit will have some effect, but basically the selloff in CRH is a knee-jerk reaction. This company is global, with global revenues and global earnings, that has been sold in fear, but fear not grounded in reality.

Basic materials producers' profitability depends not only on their marketing and product quality but, like real estate, also on location, location and location. Aggregates, concrete products, asphalt, etc. are all heavy and cost a lot to move from point A to point B. CRH has the right basic boring rocks and such in the closest proximity to the biggest users. Therein lies their edge. CRH employs some 44,000 people in the Americas (they have facilities in Brazil, as well), in nearly 1800 locations. Brexit doesn't change that.

The next big outfit that sold off in the run-up to Brexit and fell big on that day is discount airline Ryanair (NASDAQ:RYAAY). Ryanair, Europe's biggest airline and one of the biggest in the world, offers some 1600 flights per day all over Europe on 315 Boeing 737 aircraft. Could they be harmed if Britain follows through and exits the EU? I doubt it.

It's true that Ryanair's largest hub is at Stansted, outside London. Way outside, but that's Ryanair's cheapskate business model. (See here for a delightful spoof of Ryanair's "low fares." Yet more and more people keep flying them…)

Is it in the UK's interest to continue to have Ryanair at this hub? Of course it is. Is it in Ryanair's interest? You're darn tootin'. Could the EU bureaucrats, with their noses snootily out of whack, try to punish Ireland or Ryanair for consorting with the Brits? They could, but my guess is that they would be rebuffed. Despite Ryanair's legendary rotten service and hidden fees, the citizens of most every EU nation benefit from those low fares.

My guess is that Ryanair (and CRH, no doubt) is already discussing continuing business relationships with the UK. With its fleet of 737s and efficient, if less than passenger-friendly, operations, Ryanair is basically a copy of Southwest Airlines (NYSE:LUV) in terms of operating efficiency (though more like US cable companies in terms of customer service!)

Last but not least is Smurfit Kappa Group PLC (OTC:SMFKY), another ADR. Now there's a name that just rolls off the tongue! But what they lack in techie jargon they make up for in sustained excellence. (And excellent sustainability—they grow it, they use it, they replant it.)

Smurfit Kappa (the name comes from the merger of two companies in 2005) is one of the leading producers of paper-based packaging in the world, with around 44,000 employees in approximately 370 production sites across 34 countries. 77% of their business comes from Europe and 23% from the Americas.

Their forte, the paperboard market, is the fastest growing segment of the packaging market as a whole, at nearly 5% per annum. Whatever I buy from Amazon (NASDAQ:AMZN) comes in a box (or 2 or 3) and that box is made by a paperboard / container manufacturer.

SMFKY just happens to the biggest supplier of paperboard packaging in Europe, where online retail still has plenty of room for growth.

Smufit's products are not in themselves high margin. Like CRH, which pays lots of money to ship rock and cement over large distances, Smurfit and all its competitors face the same problem. Their stuff is heavy to ship in bulk, but low-cost by the piece. That's why the company that has the most efficient plants near the biggest customers has an edge over the competition. That sounds like a description of Smurfit to me.

Their acquisition strategy is to buy small competitors that are well-located. The company has consistently chosen margins over volume. They don't care about being the biggest, they care about being among the most profitable. As a result, they've had an 8% compound annual growth rate since they fully integrated the two companies a few years back. This from a boring product line—but one that is growing steadily...

So what does a company with a boring line of products (that are essential to commerce) do to enhance its margins? It innovates.

It produces what is called "retail ready packaging" as a custom feature for its clients. You've seen this in stores, where the box is opened "on the dotted line" and features pictures and words extolling the virtues of the food or whatever, without having to be stacked on the shelf individually. And they are working with e-commerce firms to provide more colorful boxes that act as advertising for the seller.

I think of Smurfit in the same way King Gillette thought of razors and razor blades. Sure, individuals recycle the containerboard boxes, or use them under the car, or re-purpose them to send a gift to a relative or friend, but the big shippers who buy Smurfit's product have to buy a new one for every new order placed by a customer.

Just like razor blades.

Disclaimer: Since I cannot know the personal financial situation of every reader, the information contained herein represents my opinions and should not be seen as "personalized" investment advice. I write the monthly investment letter Investors Edge® in which I suggest purchases and sales for our readers' consideration, and from which some of my articles are published after subscribers have read them.

I encourage you to do your own due diligence on issues I discuss to see if they might be of value in your own investing. I do my best to get it right, and often buy the investments I write about as a show of my faith in their quality, but unlike the hype you receive daily from people trying to sell you something, I recognize that I could be wrong!

Past performance is no guarantee of future results, rather an obvious statement but clearly too often unheeded judging by the number of investors who buy the current #1 mutual fund one year only to watch it plummet the following year.

Disclosure: I am/we are long IRL, CRH.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.