Undercover Yields Up To 8.3% The Computers Overlooked

Contrarian Outlook | Aug 02, 2019 05:30AM ET

Monmouth’s portfolio is an easily recognizable blend of traditional warehouse needs and beneficiaries of the new retail environment. It has tenants such as Coca-Cola (NYSE:KO) and Milwaukee Tool, but also retailers such as Ulta Beauty (NASDAQ:ULTA), Best Buy (NYSE:BBY) and Home Depot (NYSE:HD) … not to mention numerous FedEx (NYSE:FDX) facilities.

We buy real estate investment trusts (REITs) for their yields first and foremost. Show us the money!

Dividend growth is good, too. A 4% yield looks twice as nice if we believe our income will double in just a few years.

After all, a 4% payer that boosts its dividend by 10% won’t yield 4.4% for very long. Investors will buy its price up and in doing so bid its payout per share back down. And that’s OK. This dividend-powered appreciation is actually the easiest way for us to double our money with safe REITs!

But dividend safety really is the key here.

High yields and payout growth are great, but they mean nothing if the company is living beyond its means and setting itself up for a dividend cut (or worse, a suspension!) in just a few years, leaving you in the lurch. So to avoid this form of retirement-killer, many experts suggest looking at the payout ratio.

However, there’s a catch: You have to make sure you’re looking at the right payout ratio. And this is where most folks make a costly mistake.

When it comes to “normal” stocks— Pfizer (NYSE:PFE), Exxon Mobil (NYSE:XOM) and the like—you get the payout ratio by dividing the annual dividend payout by the company’s earnings per share (EPS). However, you’ll get an even more accurate result if you use free cash flow (FCF) per share, which is much less prone to manipulation than EPS. (In fact, FCF is so important that it’s one of the metrics used by the DIVCON system to determine dividend safety.)

In these “regular” stocks, I demand a payout ratio of less than 50%. Any higher, and you risk a dividend cut—not to mention a near-automatic price crash when that bad news hits.

Just like price charts don’t tell a REIT’s whole story , however, EPS and FCF payout ratios don’t do the job with real estate, either.

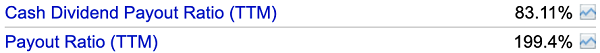

Here’s an example, Let’s dial-up Physicians Realty Trust (NYSE:DOC), which rents space to doctors and pays a nice 5%-plus dividend. Stock screener, Ycharts gives us this:

Ouch.

If you go by this Ycharts screen, DOC has paid out more than twice its cash flow as dividends in the last 12 months, and four times EPS.

Luckily for us, those aren’t the right numbers.

The number to know with REITs funds from operations (FFO). It’s a critical REIT measure of profitability that accounts for the fact that real estate tends to increase in value over time, and backs out any asset sales because (naturally) you can’t rely on asset sales to be part of your core operations every quarter.

Now if we look at DOC again, we see that it generated $1.09 per share in FFO over the past four quarters. Since it paid out 92 cents per share in dividends, its real payout ratio is 84%.

“Wait, isn’t 84% still unsafe?”

That’s the last difference you need to know when evaluating REITs: Well-run real estate owners such as Physicians Realty Trust can easily manage ratios up to 90%. To be honest, figures that high are pretty common because of the nature of the business: REITs collect steady rent checks, take what they need to keep the lights on and send the rest of the money to you.

Lesson learned: Don’t be fooled.

These three high-yielding REITs, for instance, would send up a warning flare on any basic screener. But I’ll show you that they’re actually quite safe when you do this vital “second-level” math.

Realty Income (O)

Dividend Yield: 3.9%

Realty Income (O) leases out single-tenant properties to a number of hardy tenants, including the likes of Walgreens (NASDAQ:WBA), 7-Eleven, LA Fitness and AMC Theaters (AMC). It does so on a net-lease basis, which means net of property taxes, insurance and maintenance, resulting in a much more predictable revenue stream than your typical REIT.

Realty Income also is the standard-bearer for monthly dividend stocks . So much so, in fact, that it proudly splashes its self-given nickname—“The Monthly Dividend Company”—all over its website. It has earned that nickname, however, amassing a pile of 588 consecutive monthly dividend distributions, including 87 straight quarterly payout hikes.

You can’t ask for a better reputation among REIT investors, but newer investors to the retail space could understandably be scared away.

After all, Realty Income pays out almost twice as much in dividends as it earns in net income. In fact, if you ask FinViz—one of the best free stock screeners—Realty Income has one of the five highest payout ratios among retail REITs.

The reality, fortunately, is much kinder.

A closer look, via Ycharts, shows that Realty Income passes the cash dividend payout ratio test, which is a small relief in itself. More importantly, FFO easily covers the dividend and then some. Realty Income has raked in $3.22 per share in funds from operations over the trailing 12-month period but paid out only $2.653 in dividends. That’s a comfortable 82% FFO payout ratio.

Just note that Realty Income doesn’t deliver a screamingly high yield, and you’re paying dearly for the REIT at the moment. O shares trade at almost 22 times FFO at the moment, when so many others trade in the teens.

Monmouth Real Estate Investment (NYSE:MNR)

Dividend Yield: 4.9%

Monmouth Real Estate Investment Corporation (MNR) is another net-lease REIT, but in this case, the focus is industrial properties.

Warehouses have always been a familiar sight across the company, but they’ve bloomed in the age of Amazon.com (NASDAQ:AMZN) and e-commerce. As internet retailers—and traditional retailers doing more of their sales online—have grown, so too has the need to stockpile products in these facilities for eventual delivery to consumers’ homes.

Monmouth’s portfolio is an easily recognizable blend of traditional warehouse needs and beneficiaries of the new retail environment. It has tenants such as Coca-Cola (NYSE:KO) and Milwaukee Tool, but also retailers such as Ulta Beauty (NASDAQ:ULTA), Best Buy (NYSE:BBY) and Home Depot (NYSE:HD) … not to mention numerous FedEx (NYSE:FDX) facilities.

This REIT has had a volatile past few years including a nasty dropoff in 2018 that saw it lose about a third of its value. Shares have bounced back a bit in 2019, however, and they’ve still outperformed the Vanguard Real Estate ETF (VNQ) on a total-return basis across most significant time frames.

Again, though, MNR’s payout ratios would seem to indicate a nasty financial situation that, according to the cash dividend payout ratio, includes negative cash.

But much of that can be chalked up to a new accounting rule that forced Monmouth to account for unrealized gains and losses from its securities investments. Again, though, if you look at its adjusted funds from operations, MNR boasts a nice, low payout ratio of just 77% that should make investors feel much more secure about the durability of this industrial REIT’s dividend.

MGM Growth Properties LLC (NYSE:MGP)

Dividend Yield: 6.2%

Let’s shift briefly to a REIT that I tackled recently when I discussed another important rule: Don’t get spooked by REITs’ price charts.

MGM Growth Properties (MGP) is a Las Vegas-based gaming REIT that also has properties in New York, New Jersey and D.C., among other places. And it has a misleading price chart that obscures a market-beating total return since coming public in 2016 .

Its payout profile is just as deceptive.

In reality, MGP’s dividends are easily covered by its operational funds. Its AFFO payout ratio over the past year has come in around 78%, and in fact, MGM Growth Properties is in such good shape that management has felt empowered to hike the dividend every quarter since Q2 2017.

Starwood Property Trust (STWD)

Dividend Yield: 8.3%

Mortgage REITs—which, instead of FFO, typically use a form of “core earnings” that back out unrealized gains, gains from financial derivatives and other figures—are no exception to this payout ratio rule. The screeners just can’t quite get their pulse.

Take Starwood Property Trust Inc (NYSE:STWD): an mREIT whose primary business is first mortgages but is happy to deal in other financing such as bridge loans, subordinate debt and even preferred equity, among other instruments. It has exposure to a wide range of industry, too. Offices and retail each makeup roughly a third of the portfolio, but Starwood also has its claws in lodging, multifamily residences, industrial companies and even self-storage.

Starwood admittedly has been rangebound for several years, though once you factor in its sizable dividend, its returns look much more respectable. But again, a screener might convince you that its dividend is imperiled.

In fact, even a quick look at its trailing-12-month payout ratio isn’t promising.

That 171% core earnings payout ratio came in its most recent quarter. And if it were the start of a longer-term trend, STWD shareholders would have every reason to sweat.

However, that lousy result came courtesy of a massive writedown of Starwood’s interest in struggling regional malls. Starwood isn’t necessarily in the clear yet, but the quarter clearly is an anomaly—one that skewed its otherwise perfectly acceptable ratio that averaged just under 90% for the prior three quarters.

Again: It pays to look before you panic.

Urgent REIT Alert: 2 Picks for 100%+ Gains and 8.9% Yields

Real estate investment trusts (REITs) are such a powerful dividend tool that they can make the difference between just getting by in retirement… and breezing by.

Retirees that have a healthy allocation to REITs clip vacation pictures for their photo albums.

Retirees, that don’t? They greet you at Walmart (NYSE:WMT).

But the need to buy REITs for your retirement portfolio has gone from “pressing” to “urgent.” Because my Triple-Digit Profit System just did something it hasn’t done since 2015: It tripped its final indicator for us to dive into a totally ignored corner of the market.

The last time all five of my indicators flashed green (like they are this very minute), the group of stocks I want to show you in my 2019 REIT Playbook – where cash dividends of 6%, 7% and even 8% are commonplace – started red-hot rallies that resulted in triple-digit profits.

One member of this snubbed group of stocks – a rock-steady “landlord” spinning off a 7%-plus cash dividend – did something that income plays just aren’t supposed to do:

It soared for a market-crushing 580% return.

Doubling the Market With Real Estate Sounds Crazy, But …

It wasn’t alone. Another one of these overlooked cash machines produced a total return (so, including dividends) of 379% in just more than six years. You’re lucky to get 100% out of the market in that amount of time.

And because this stock had such a large dividend, a big slice of those returns were in cold, hard cash.

That was four years ago. Fast-forward to today, and the Federal Reserve has put its hand on the easy-money spigot, triggering the last of my five buy signals. And now, I have another pair of urgent REIT buys–boasting triple-digit price potential and yields of nearly 9%–that I want to email to you now.

The payouts are simply “going parabolic,” but it’s important that you add these stocks to your retirement portfolio now. Because when their prices go out, you won’t just miss out on their triple-digit gains–but those dividends will shrink on new buyers by the day.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

This REIT has had a volatile past few years including a nasty dropoff in 2018 that saw it lose about a third of its value. Shares have bounced back a bit in 2019, however, and they’ve still outperformed the Vanguard Real Estate ETF (VNQ) on a total-return basis across most significant time frames.

Again, though, MNR’s payout ratios would seem to indicate a nasty financial situation that, according to the cash dividend payout ratio, includes negative cash.

But much of that can be chalked up to a new accounting rule that forced Monmouth to account for unrealized gains and losses from its securities investments. Again, though, if you look at its adjusted funds from operations, MNR boasts a nice, low payout ratio of just 77% that should make investors feel much more secure about the durability of this industrial REIT’s dividend.

MGM Growth Properties LLC (NYSE:MGP)

Dividend Yield: 6.2%

Let’s shift briefly to a REIT that I tackled recently when I discussed another important rule: Don’t get spooked by REITs’ price charts.

MGM Growth Properties (MGP) is a Las Vegas-based gaming REIT that also has properties in New York, New Jersey and D.C., among other places. And it has a misleading price chart that obscures a market-beating total return since coming public in 2016 .

Its payout profile is just as deceptive.

In reality, MGP’s dividends are easily covered by its operational funds. Its AFFO payout ratio over the past year has come in around 78%, and in fact, MGM Growth Properties is in such good shape that management has felt empowered to hike the dividend every quarter since Q2 2017.

Starwood Property Trust (STWD)

Dividend Yield: 8.3%

Mortgage REITs—which, instead of FFO, typically use a form of “core earnings” that back out unrealized gains, gains from financial derivatives and other figures—are no exception to this payout ratio rule. The screeners just can’t quite get their pulse.

Take Starwood Property Trust Inc (NYSE:STWD): an mREIT whose primary business is first mortgages but is happy to deal in other financing such as bridge loans, subordinate debt and even preferred equity, among other instruments. It has exposure to a wide range of industry, too. Offices and retail each makeup roughly a third of the portfolio, but Starwood also has its claws in lodging, multifamily residences, industrial companies and even self-storage.

Starwood admittedly has been rangebound for several years, though once you factor in its sizable dividend, its returns look much more respectable. But again, a screener might convince you that its dividend is imperiled.

In fact, even a quick look at its trailing-12-month payout ratio isn’t promising.

That 171% core earnings payout ratio came in its most recent quarter. And if it were the start of a longer-term trend, STWD shareholders would have every reason to sweat.

However, that lousy result came courtesy of a massive writedown of Starwood’s interest in struggling regional malls. Starwood isn’t necessarily in the clear yet, but the quarter clearly is an anomaly—one that skewed its otherwise perfectly acceptable ratio that averaged just under 90% for the prior three quarters.

Again: It pays to look before you panic.

Urgent REIT Alert: 2 Picks for 100%+ Gains and 8.9% Yields

Real estate investment trusts (REITs) are such a powerful dividend tool that they can make the difference between just getting by in retirement… and breezing by.

Retirees that have a healthy allocation to REITs clip vacation pictures for their photo albums.

Retirees, that don’t? They greet you at Walmart (NYSE:WMT).

But the need to buy REITs for your retirement portfolio has gone from “pressing” to “urgent.” Because my Triple-Digit Profit System just did something it hasn’t done since 2015: It tripped its final indicator for us to dive into a totally ignored corner of the market.

The last time all five of my indicators flashed green (like they are this very minute), the group of stocks I want to show you in my 2019 REIT Playbook – where cash dividends of 6%, 7% and even 8% are commonplace – started red-hot rallies that resulted in triple-digit profits.

One member of this snubbed group of stocks – a rock-steady “landlord” spinning off a 7%-plus cash dividend – did something that income plays just aren’t supposed to do:

It soared for a market-crushing 580% return.

Doubling the Market With Real Estate Sounds Crazy, But …

It wasn’t alone. Another one of these overlooked cash machines produced a total return (so, including dividends) of 379% in just more than six years. You’re lucky to get 100% out of the market in that amount of time.

And because this stock had such a large dividend, a big slice of those returns were in cold, hard cash.

That was four years ago. Fast-forward to today, and the Federal Reserve has put its hand on the easy-money spigot, triggering the last of my five buy signals. And now, I have another pair of urgent REIT buys–boasting triple-digit price potential and yields of nearly 9%–that I want to email to you now.

The payouts are simply “going parabolic,” but it’s important that you add these stocks to your retirement portfolio now. Because when their prices go out, you won’t just miss out on their triple-digit gains–but those dividends will shrink on new buyers by the day.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

We buy real estate investment trusts (REITs) for their yields first and foremost. Show us the money!

We buy real estate investment trusts (REITs) for their yields first and foremost. Show us the money!

Dividend growth is good, too. A 4% yield looks twice as nice if we believe our income will double in just a few years.

After all, a 4% payer that boosts its dividend by 10% won’t yield 4.4% for very long. Investors will buy its price up and in doing so bid its payout per share back down. And that’s OK. This dividend-powered appreciation is actually the easiest way for us to double our money with safe REITs!

But dividend safety really is the key here.

High yields and payout growth are great, but they mean nothing if the company is living beyond its means and setting itself up for a dividend cut (or worse, a suspension!) in just a few years, leaving you in the lurch. So to avoid this form of retirement-killer, many experts suggest looking at the payout ratio.

However, there’s a catch: You have to make sure you’re looking at the right payout ratio. And this is where most folks make a costly mistake.

When it comes to “normal” stocks— Pfizer (NYSE:PFE), Exxon Mobil (NYSE:XOM) and the like—you get the payout ratio by dividing the annual dividend payout by the company’s earnings per share (EPS). However, you’ll get an even more accurate result if you use free cash flow (FCF) per share, which is much less prone to manipulation than EPS. (In fact, FCF is so important that it’s one of the metrics used by the DIVCON system to determine dividend safety.)

In these “regular” stocks, I demand a payout ratio of less than 50%. Any higher, and you risk a dividend cut—not to mention a near-automatic price crash when that bad news hits.

Just like price charts don’t tell a REIT’s whole story , however, EPS and FCF payout ratios don’t do the job with real estate, either.

Here’s an example, Let’s dial-up Physicians Realty Trust (NYSE:DOC), which rents space to doctors and pays a nice 5%-plus dividend. Stock screener, Ycharts gives us this:

Ouch.

If you go by this Ycharts screen, DOC has paid out more than twice its cash flow as dividends in the last 12 months, and four times EPS.

Luckily for us, those aren’t the right numbers.

The number to know with REITs funds from operations (FFO). It’s a critical REIT measure of profitability that accounts for the fact that real estate tends to increase in value over time, and backs out any asset sales because (naturally) you can’t rely on asset sales to be part of your core operations every quarter.

Now if we look at DOC again, we see that it generated $1.09 per share in FFO over the past four quarters. Since it paid out 92 cents per share in dividends, its real payout ratio is 84%.

“Wait, isn’t 84% still unsafe?”

That’s the last difference you need to know when evaluating REITs: Well-run real estate owners such as Physicians Realty Trust can easily manage ratios up to 90%. To be honest, figures that high are pretty common because of the nature of the business: REITs collect steady rent checks, take what they need to keep the lights on and send the rest of the money to you.

Lesson learned: Don’t be fooled.

These three high-yielding REITs, for instance, would send up a warning flare on any basic screener. But I’ll show you that they’re actually quite safe when you do this vital “second-level” math.

Realty Income (O)

Dividend Yield: 3.9%

Realty Income (O) leases out single-tenant properties to a number of hardy tenants, including the likes of Walgreens (NASDAQ:WBA), 7-Eleven, LA Fitness and AMC Theaters (AMC). It does so on a net-lease basis, which means net of property taxes, insurance and maintenance, resulting in a much more predictable revenue stream than your typical REIT.

Realty Income also is the standard-bearer for monthly dividend stocks . So much so, in fact, that it proudly splashes its self-given nickname—“The Monthly Dividend Company”—all over its website. It has earned that nickname, however, amassing a pile of 588 consecutive monthly dividend distributions, including 87 straight quarterly payout hikes.

You can’t ask for a better reputation among REIT investors, but newer investors to the retail space could understandably be scared away.

After all, Realty Income pays out almost twice as much in dividends as it earns in net income. In fact, if you ask FinViz—one of the best free stock screeners—Realty Income has one of the five highest payout ratios among retail REITs.

The reality, fortunately, is much kinder.

A closer look, via Ycharts, shows that Realty Income passes the cash dividend payout ratio test, which is a small relief in itself. More importantly, FFO easily covers the dividend and then some. Realty Income has raked in $3.22 per share in funds from operations over the trailing 12-month period but paid out only $2.653 in dividends. That’s a comfortable 82% FFO payout ratio.

Just note that Realty Income doesn’t deliver a screamingly high yield, and you’re paying dearly for the REIT at the moment. O shares trade at almost 22 times FFO at the moment, when so many others trade in the teens.

Monmouth Real Estate Investment (NYSE:MNR)

Dividend Yield: 4.9%

Monmouth Real Estate Investment Corporation (MNR) is another net-lease REIT, but in this case, the focus is industrial properties.

Warehouses have always been a familiar sight across the company, but they’ve bloomed in the age of Amazon.com (NASDAQ:AMZN) and e-commerce. As internet retailers—and traditional retailers doing more of their sales online—have grown, so too has the need to stockpile products in these facilities for eventual delivery to consumers’ homes.

Dividend growth is good, too. A 4% yield looks twice as nice if we believe our income will double in just a few years.

After all, a 4% payer that boosts its dividend by 10% won’t yield 4.4% for very long. Investors will buy its price up and in doing so bid its payout per share back down. And that’s OK. This dividend-powered appreciation is actually the easiest way for us to double our money with safe REITs!

But dividend safety really is the key here.

High yields and payout growth are great, but they mean nothing if the company is living beyond its means and setting itself up for a dividend cut (or worse, a suspension!) in just a few years, leaving you in the lurch. So to avoid this form of retirement-killer, many experts suggest looking at the payout ratio.

However, there’s a catch: You have to make sure you’re looking at the right payout ratio. And this is where most folks make a costly mistake.

When it comes to “normal” stocks— Pfizer (NYSE:PFE), Exxon Mobil (NYSE:XOM) and the like—you get the payout ratio by dividing the annual dividend payout by the company’s earnings per share (EPS). However, you’ll get an even more accurate result if you use free cash flow (FCF) per share, which is much less prone to manipulation than EPS. (In fact, FCF is so important that it’s one of the metrics used by the DIVCON system to determine dividend safety.)

In these “regular” stocks, I demand a payout ratio of less than 50%. Any higher, and you risk a dividend cut—not to mention a near-automatic price crash when that bad news hits.

Just like price charts don’t tell a REIT’s whole story , however, EPS and FCF payout ratios don’t do the job with real estate, either.

Here’s an example, Let’s dial-up Physicians Realty Trust (NYSE:DOC), which rents space to doctors and pays a nice 5%-plus dividend. Stock screener, Ycharts gives us this:

Ouch.

If you go by this Ycharts screen, DOC has paid out more than twice its cash flow as dividends in the last 12 months, and four times EPS.

Luckily for us, those aren’t the right numbers.

The number to know with REITs funds from operations (FFO). It’s a critical REIT measure of profitability that accounts for the fact that real estate tends to increase in value over time, and backs out any asset sales because (naturally) you can’t rely on asset sales to be part of your core operations every quarter.

Now if we look at DOC again, we see that it generated $1.09 per share in FFO over the past four quarters. Since it paid out 92 cents per share in dividends, its real payout ratio is 84%.

“Wait, isn’t 84% still unsafe?”

That’s the last difference you need to know when evaluating REITs: Well-run real estate owners such as Physicians Realty Trust can easily manage ratios up to 90%. To be honest, figures that high are pretty common because of the nature of the business: REITs collect steady rent checks, take what they need to keep the lights on and send the rest of the money to you.

Lesson learned: Don’t be fooled.

These three high-yielding REITs, for instance, would send up a warning flare on any basic screener. But I’ll show you that they’re actually quite safe when you do this vital “second-level” math.

Realty Income (O)

Dividend Yield: 3.9%

Realty Income (O) leases out single-tenant properties to a number of hardy tenants, including the likes of Walgreens (NASDAQ:WBA), 7-Eleven, LA Fitness and AMC Theaters (AMC). It does so on a net-lease basis, which means net of property taxes, insurance and maintenance, resulting in a much more predictable revenue stream than your typical REIT.

Realty Income also is the standard-bearer for monthly dividend stocks . So much so, in fact, that it proudly splashes its self-given nickname—“The Monthly Dividend Company”—all over its website. It has earned that nickname, however, amassing a pile of 588 consecutive monthly dividend distributions, including 87 straight quarterly payout hikes.

You can’t ask for a better reputation among REIT investors, but newer investors to the retail space could understandably be scared away.

After all, Realty Income pays out almost twice as much in dividends as it earns in net income. In fact, if you ask FinViz—one of the best free stock screeners—Realty Income has one of the five highest payout ratios among retail REITs.

The reality, fortunately, is much kinder.

A closer look, via Ycharts, shows that Realty Income passes the cash dividend payout ratio test, which is a small relief in itself. More importantly, FFO easily covers the dividend and then some. Realty Income has raked in $3.22 per share in funds from operations over the trailing 12-month period but paid out only $2.653 in dividends. That’s a comfortable 82% FFO payout ratio.

Just note that Realty Income doesn’t deliver a screamingly high yield, and you’re paying dearly for the REIT at the moment. O shares trade at almost 22 times FFO at the moment, when so many others trade in the teens.

Monmouth Real Estate Investment (NYSE:MNR)

Dividend Yield: 4.9%

Monmouth Real Estate Investment Corporation (MNR) is another net-lease REIT, but in this case, the focus is industrial properties.

Warehouses have always been a familiar sight across the company, but they’ve bloomed in the age of Amazon.com (NASDAQ:AMZN) and e-commerce. As internet retailers—and traditional retailers doing more of their sales online—have grown, so too has the need to stockpile products in these facilities for eventual delivery to consumers’ homes.

Monmouth’s portfolio is an easily recognizable blend of traditional warehouse needs and beneficiaries of the new retail environment. It has tenants such as Coca-Cola (NYSE:KO) and Milwaukee Tool, but also retailers such as Ulta Beauty (NASDAQ:ULTA), Best Buy (NYSE:BBY) and Home Depot (NYSE:HD) … not to mention numerous FedEx (NYSE:FDX) facilities.

This REIT has had a volatile past few years including a nasty dropoff in 2018 that saw it lose about a third of its value. Shares have bounced back a bit in 2019, however, and they’ve still outperformed the Vanguard Real Estate ETF (VNQ) on a total-return basis across most significant time frames.

Again, though, MNR’s payout ratios would seem to indicate a nasty financial situation that, according to the cash dividend payout ratio, includes negative cash.

But much of that can be chalked up to a new accounting rule that forced Monmouth to account for unrealized gains and losses from its securities investments. Again, though, if you look at its adjusted funds from operations, MNR boasts a nice, low payout ratio of just 77% that should make investors feel much more secure about the durability of this industrial REIT’s dividend.

MGM Growth Properties LLC (NYSE:MGP)

Dividend Yield: 6.2%

Let’s shift briefly to a REIT that I tackled recently when I discussed another important rule: Don’t get spooked by REITs’ price charts.

MGM Growth Properties (MGP) is a Las Vegas-based gaming REIT that also has properties in New York, New Jersey and D.C., among other places. And it has a misleading price chart that obscures a market-beating total return since coming public in 2016 .

Its payout profile is just as deceptive.

In reality, MGP’s dividends are easily covered by its operational funds. Its AFFO payout ratio over the past year has come in around 78%, and in fact, MGM Growth Properties is in such good shape that management has felt empowered to hike the dividend every quarter since Q2 2017.

Starwood Property Trust (STWD)

Dividend Yield: 8.3%

Mortgage REITs—which, instead of FFO, typically use a form of “core earnings” that back out unrealized gains, gains from financial derivatives and other figures—are no exception to this payout ratio rule. The screeners just can’t quite get their pulse.

Take Starwood Property Trust Inc (NYSE:STWD): an mREIT whose primary business is first mortgages but is happy to deal in other financing such as bridge loans, subordinate debt and even preferred equity, among other instruments. It has exposure to a wide range of industry, too. Offices and retail each makeup roughly a third of the portfolio, but Starwood also has its claws in lodging, multifamily residences, industrial companies and even self-storage.

Starwood admittedly has been rangebound for several years, though once you factor in its sizable dividend, its returns look much more respectable. But again, a screener might convince you that its dividend is imperiled.

In fact, even a quick look at its trailing-12-month payout ratio isn’t promising.

That 171% core earnings payout ratio came in its most recent quarter. And if it were the start of a longer-term trend, STWD shareholders would have every reason to sweat.

However, that lousy result came courtesy of a massive writedown of Starwood’s interest in struggling regional malls. Starwood isn’t necessarily in the clear yet, but the quarter clearly is an anomaly—one that skewed its otherwise perfectly acceptable ratio that averaged just under 90% for the prior three quarters.

Again: It pays to look before you panic.

Urgent REIT Alert: 2 Picks for 100%+ Gains and 8.9% Yields

Real estate investment trusts (REITs) are such a powerful dividend tool that they can make the difference between just getting by in retirement… and breezing by.

Retirees that have a healthy allocation to REITs clip vacation pictures for their photo albums.

Retirees, that don’t? They greet you at Walmart (NYSE:WMT).

But the need to buy REITs for your retirement portfolio has gone from “pressing” to “urgent.” Because my Triple-Digit Profit System just did something it hasn’t done since 2015: It tripped its final indicator for us to dive into a totally ignored corner of the market.

The last time all five of my indicators flashed green (like they are this very minute), the group of stocks I want to show you in my 2019 REIT Playbook – where cash dividends of 6%, 7% and even 8% are commonplace – started red-hot rallies that resulted in triple-digit profits.

One member of this snubbed group of stocks – a rock-steady “landlord” spinning off a 7%-plus cash dividend – did something that income plays just aren’t supposed to do:

It soared for a market-crushing 580% return.

Doubling the Market With Real Estate Sounds Crazy, But …

It wasn’t alone. Another one of these overlooked cash machines produced a total return (so, including dividends) of 379% in just more than six years. You’re lucky to get 100% out of the market in that amount of time.

And because this stock had such a large dividend, a big slice of those returns were in cold, hard cash.

That was four years ago. Fast-forward to today, and the Federal Reserve has put its hand on the easy-money spigot, triggering the last of my five buy signals. And now, I have another pair of urgent REIT buys–boasting triple-digit price potential and yields of nearly 9%–that I want to email to you now.

The payouts are simply “going parabolic,” but it’s important that you add these stocks to your retirement portfolio now. Because when their prices go out, you won’t just miss out on their triple-digit gains–but those dividends will shrink on new buyers by the day.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement ."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.