U.S Dollar Dominant In Deluge Of Data

MarketPulse | Mar 02, 2015 06:58AM ET

- PBoC surprises Capital Markets with a cut

- AUD to be kept busy by RBA announcement

- Eurozone deflation pressures ease

- US jobs heading towards full employment

The Peoples Bank of China managed to get the jump on Capital Markets over the weekend. Chinese policyholders cut interest rates by -25bps for the second time in less than four-months. The Central Bank signaled out rising deflationary pressures as a trigger for the move, saying that plunging commodity prices world-wide “provided room” to spur growth by lowering interest rates. China now joins countries in the Eurozone and Japan in easing monetary policies due to deflationary pressures, while the U.S Fed is moving towards raising interest rates as their economy recovers.

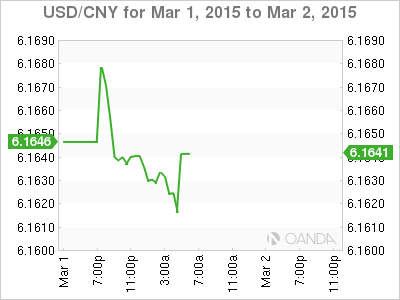

The PBoC reiterated that they are to be more appropriate, when possible on monetary policy, and to use comprehensive monetary tools to fine-tune their economy. Chinese policy makers lowered both the one-year loan rate and the one-year deposit rate by a quarter of a percentage point to +5.35% and +2.5% respectively. Disappointing Chinese PMI’s over the weekend is supporting the damage being done by a protracted slowdown there, feeding into a deteriorating outlook that has led to the surprise cut. The Chinese decision has allowed the U.S dollar to surge to a 11-year high against a number of major currencies this Monday morning on the back of further global monetary policy divergence. The dollar index is attempting to straddle its 12-year high (95.52) as investor’s head to the U.S open.

Central Bankers to keep markets guessing

Central Banks rate announcements (RBA, BoC, BoE and ECB) will be expected to dominate this weeks agenda, followed in hot pursuit by this Friday’s U.S non-farm payrolls release. China cutting rates was not on the cards. Their decision in particular will make for an interesting RBA meet tomorrow. Aussie policymakers meet on Tuesday and it will be critical for the AUD ($0.7786) especially in the wake of last week headline barrage of Banks calling for a RBA cut in the wake of disappointing personal CAPEX data. Nevertheless, market sentiment is undecided on tomorrows RBA announcement as there does not appear to be a great deal of conviction amongst traders one way or the other. With that in mind, the absence of an early rate cut could see a resumption of the short-term uptrend, and with a rate cut accompanied with dovish rhetoric a test of AUD$0.7700 is very possible

Bank of Canada Poloz not so ‘transparent’

Like Yellen, Governor Poloz from the BoC did not provide a clear signal about whether the Bank of Canada will again lower interest rates at this coming Wednesday’s policy meeting during a speech last week. He emphasized that last months -25bps cut (on the back of plummeting energy prices) buys time to see how the Canadian economy responds. The majority assumed it was a slam-dunk that the BoC would be easing again on March 4; however, the possibility of a potential pause has thrown an extra spanner into the Canada’s bear tool kit. The cut last month was aimed at taking out “some insurance” against these risks. Being proactive gives the governor confidence that the Canadian economy will return to capacity by the end of next year. Last months rate cut to +0.75% was the first since 2009. The Governor seems to have stepped away from “transparency” and has become rate “opaque.” The loonie dealers could be in for a wild ride now that the BoC has everyone guessing.

Eurozone deflation pressures ease

The ECB’s next meeting on March 5 will not match the January 22 meeting in terms of excitement. However, investors may be privy enough to getting some QE direction. The ECB might be in a position to reveal the exact starting date and list of agencies eligible for QE purchases. This would mean that Draghi’s press conference has the potential to spring surprises this Thursday. The expected weekly reports containing the “low-down” on purchases could produce some volatility over the coming weeks.

Already this morning as investors and dealers head to the U.S open the 19-member single currency (€1.1212) has seen a decline below last Friday’s low at €1.1176 before again consolidating. It still remains approximately a big figure higher from its January lows. The bulk of the bond yields in Europe continue to test record lows on reports that the ECB could begin its QE purchases on March 9th. Equity markets are still being pushed higher as investors look for a “return.”

Providing the EUR some support this morning are eurozone consumer prices (-0.3% y/y vs. -0.6% in January) and jobless rates (11.2% vs. 11.3%). Despite falling for a third consecutive month in February, although at a slower pace, coupled with jobless rates falling to their lowest level in three-years is providing the EUR some support (€1.1215). Positive data like this should provide some encouragement for the ECB as they prepare for their two-day meeting beginning Wednesday in Cyprus. Euro policy makers are committed to buying €1 trillion of mostly government bonds by September 2016 because of deflationary pressures. Policy makers do not want consumers and households to become accustomed to falling prices – this could lead to postponing future investment and consumption, which does nothing for an economy’s growth.

Will the USD get support or be side swiped by NFP?

Once Central Banks have delivered their rate decisions this week expect markets to quickly turn their attention to Friday’s U.S jobs market data. U.S Non-farm payrolls are the “granddaddy of economic indicators and everyone wants to know can the world’s largest economy continue to churn out a strong monthly report?

For the longest time it’s a report that has been driven mostly by the U.S consumer. Ms. Yellen and her fellow cohorts said such nice things about the U.S labor market on and off the “hill” last week. Will Friday’s numbers be able to lend U.S policy makers a helping hand? Will the mighty U.S dollar positive run continue? Last Friday, the USD index closed at it’s highest since August 2003. Will investors start to offload some of their ‘long’ dollar positions if U.S job landscape happens to change?

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.