U.S Dollar Deflated On Trump U-Turn

MarketPulse | Apr 27, 2017 07:18AM ET

April 27: Five things the markets are talking about

The not so ‘mighty’ U.S. dollar has pared gains overnight as investors digest details of the Trump administration’s tax-reform plan and deal with the Presidents U-turn on NAFTA.

The Presidents tax plan includes deep reductions in business taxes and major changes to the individual tax system. The administration also said it would introduce a one-time tax break meant to encourage U.S. corporations to repatriate earnings stashed overseas. However, the market has largely brushed off the plan, weighed by uncertainties over the timeline.

Sticking with uncertainties, Trump, for now, has done a U-turn on pulling out of NAFTA after talking with leaders from Mexico and Canada. Both currencies were able to take back much of yesterday’s intraday losses – +1.1% and +0.5% respectively.

On the central bank front, the ECB will set monetary policy later this morning (07:45 am EST rate announcement, 08:30 am press conference). With officials of late indicating little chance of a policy change, the focus will be on any signals from President Draghi that the central bank is debating an exit from its extraordinary stimulus. Overnight, The Bank of Japan (BoJ) remained on hold as expected.

Tomorrow, U.S. GDP is due and it’s projected to show the economy expanded at a +1.0% annualized rate in Q1, the weakest pace in a year.

1. Global equities mixed reaction

In Japan, stocks fell for the first time in six days, tracking the retreat on Wall Street’s disappointment over the U.S. tax plan. The Nikkei fell -0.2%, while the broader Topix dipped -0.05%. The BoJ kept its policies unchanged while lowering its inflation forecast and emphasizing that any exit from its monetary easing remains “far away.”

In Hong Kong, financials helped lift the Hang Seng (+0.5%) to its highest close in 20-months, but the Hang Seng China Enterprise (CEI) lost -0.6%.

In China, stocks ended higher with small caps bolstering sentiment. The blue-chip CSI300 index rose +0.1%, while the Shanghai Composite Index added +0.4%.

In Europe, equity indices are trading lower as market participants await the ECB’s monetary policy decision. Banking and financial stocks trading notably lower in the Eurostoxx, while energy stocks in the FTSE 100 are trading lower on oil price pull backs.

U.S stocks are set to open relatively flat.

Indices: Stoxx50 -0.5% at 3,560, FTSE -0.5% at 7,250, DAX -0.4% at 12,428, CAC 40 -0.4% at 5,264, IBEX 35 -0.9% at 10,668, FTSE MIB -0.6% at 20,703, SMI -0.2% at 8,815, S&P 500 Futures flat

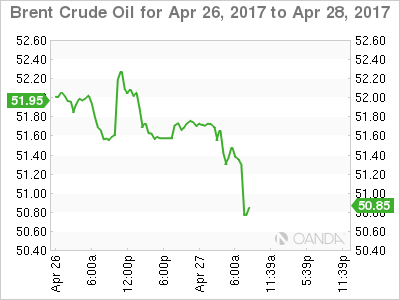

2. Oil prices fall on oversupply, gold steady

Oil prices again are on the back foot, weighed down by oversupply issues, but the losses remain somewhat contained on hopes that OPEC and non-OPEC members will agree to extend production cuts to try to rebalance the market.

Ahead of the U.S open, Brent crude futures are down -60c at +$51.22 a barrel, while U.S. light crude (WTI) is down -55c at +$49.07 – both benchmarks are down -10% from this month’s peak.

Inventory reports this week stated ample supplies in all key markets despite efforts led by OPEC and Russia to cut output by -1.8m bpd in H1.

OPEC is discussing extending its cuts into H2, but crude “bulls” are getting concerned as producers face an uphill battle with oil inventories atop of record levels in many parts of the world.

Yesterday’s EIA report showed a drop in crude oil stocks, but gasoline inventories surged as refiners produced more fuel than the market could consume.

Gold prices have edged down overnight as global risk sentiment diminishes, but scepticism over Trump’s tax reform plan has limited the losses. Spot gold is down -0.3% at +$1,264.60 per ounce.

3. Few surprises from Central Banks rate announcements

The ECB is expected to hold off any ‘hawkish’ tendencies ahead of France’s second round Presidential elections (May 7). Sweden’s Riksbank has extended QE for another six-months, while the BoJ did was expected and stood pat.

Sweden Central Bank (Riksbank) has surprised the market with its “dovish” stance – repo rate unchanged (+0.5%), however, it has extended its government bond buying for another six months citing global uncertainties. The policy statement noted that it would take longer before inflation stabilized around +2% and indicated that to support the upturn in inflation, monetary policy “needed to be somewhat more expansionary.” The program was set to expire next month.

In Governor Kuroda’s post BoJ rate decision press conference he noted that the economic cycle was strengthening and that BoJ would continue with QQE until prices hit its inflation target. He reiterated the view that they would achieve the +2% inflation target during the financial year 2018/19 and that they need to achieve this target before discussing ‘exit’ strategy.

Next up is the ECB.

4. U.S dollar deflated on Trump U-turn

Ahead of the ECB rate announcement, the EUR is steady trading atop of €1.0900. The focus of the ECB meeting is likely be on the recent run of stronger growth and inflation data out of the Eurozone and possibility that the taper argument could be revisited as the fundamental picture is improving. The consensus doesn’t believe that Draghi and co. will alter its policy language.

Note: The market is speculating that the ECB could discuss removing some of its easing biases in the June statement.

EUR/SEK (€9.6400) is trading +1% higher after the Riksbank surprised with an extension of its QE bond buying. The market was betting that monetary policy did not need to be more expansionary at this time.

Elsewhere, USD/JPY (¥113.35) is a tad higher after the BoJ announcement while the CAD (C$1.3576) and MXN ($19.00) are firmer after President Trump noted that he would “not” scrap NAFTA, but renegotiate the trade agreement.

5. Eurozone confidence hits post crisis high

Euro data this morning shows eurozone confidence was stronger than expected in this month, with the European Commission’s ESI measure jumping to 109.6 from 108.0 in March. It’s the highest level in a decade.

The market was expecting a modest rise to 108.1. The pickup suggests that the eurozone’s economic recovery is gaining momentum this year, and will reinforce the ECB’s view that the outlook has improved.

The survey also showed household inflation expectations have fallen back this month, reaching their lowest level in five-months – This will likely support the ECB’s caution over winding down its stimulus programs.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.