Turkish Lira Tanks In Asia

MarketPulse | Jan 11, 2017 03:34AM ET

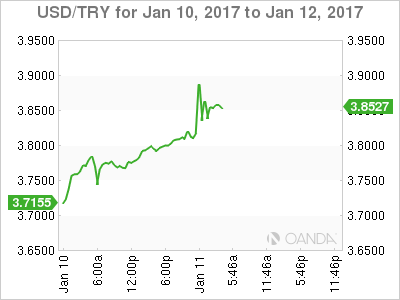

USD/TRY explodes higher to 3.8950 before falling back to 3.8450 as the shark’s circle.

The Turkish Lira hit a record low a short while ago against the US dollar. In the space of an hour jumping from 3.8170 to 3.8950 before an equally precipitous fall back to 3.8500. The ugly price action continues to heap woes up the beleaguered currency down nearly 10% for the first 11 days of 2017!

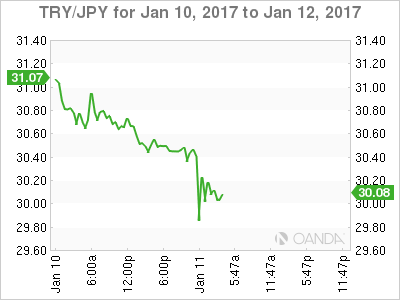

Amongst the backdrop of factors I will cover shortly, the action looks very stop loss driven by low liquidity. Given it has happened in the middle of the Japan trading day, I also think that some long-suffering TRY/JPY carry traders have been carried out as well so to speak. In case readers were wondering, with rates at over 8% in Turkey and 0% in Japan, Mrs Wattanabe can almost not help herself but get involved. Looking at the price action in the chart below it looks as if a few who thought they were buying the bottom have caught a falling knife.

So what is going on that has made the Turkish Lira the most unloved of currencies in the last six months? Well, there are a few factors at work. Readers for a start should dust off an old textbook and look up the term “stagflation.”

- As I have said ad nausea, with US interest rates on the way up finally, countries with high USD denominated debts and a high current account deficit (Turkey has a very high one), are potentially in a very bad place. Both the Government and especially corporate Turkey are in this spot. As the currency falls, those debts become more expensive to finance. As rates rise in the US, Turkish debt becomes less appealing, and investors require a higher premium (interest rate) to hold it. Which leads us to..

- The Central Bank of Turkey. Although they have announced some liquidity measures overnight, it is just tinkering. What they need to do is raise interest rates to support the currency. However, while inflation continues higher at over 8%, growth has been dropping. This is stagflation by the way, a particularly nasty macroeconomic part of the world and only mentioned in hushed whispers by economists and central banks alike. Raising interest rates will send growth even lower, and import costs higher thus raising inflation, etc. My guess is Turkey cut rates last year thinking the Federal Reserve would blink on rates themselves. Oops.

- Politics and wars. Coups are never good for business, nor are purges afterwards. Changing the constitution to concentrate power isn’t either. The tragic wars to the South of Turkey’s borders and the terrorist spillover inside sap investor confidence. Everyone loves the Game of Thrones, investors don’t like to see their invested countries run like them. Wars are very expensive as well.

Summary

Turkey is rapidly finding itself caught in a stagflationary rock and a hard place that inaction by the Central Bank will cause to get worse. The market is already speaking in this regard and that is reflected in the fall in the currency. In Turkey right now, the light at the end of the tunnel is the train coming the other way.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.