Tuesday's Sell Off Low Likely To Be Retested

Urban Carmel | May 28, 2015 01:56AM ET

Summary: Yesterday, stocks fell more than 1% on intense selling pressure. Trin spiked over 2 for the first time since early March. Declining volume was more than 8 times more than advancing volume. It would be very unusual for that level of selling pressure to dissipate immediately. More likely, Tuesday's low will be retested in the days ahead.

On Tuesday, US equities sold off hard. The S&P 500 dropped more than 1%. Of significance, selling pressure was intense: declining volume on the NYSE was more than 8 times greater than advancing volume, the highest since late January.

Moreover, Trin (also called the Arms Index) closed above 2.0 yesterday. Trin is a breadth indicator. It is derived by dividing the advance-decline ratio for issues by that for volume. A close over 2 means that down-volume was twice down-issues; in other words, stocks fell on relatively high volume.

A spike higher in Trin like yesterday's can often be near a low in the equities market. That is especially true if the market has been selling off for a week or more. In this case, a high in Trin marks capitulation. A relevant post on this indicator is here .

This makes today's action noteworthy. The S&P gapped up overnight and then rose nearly 1%; the NASDAQ rose 1.6%. Yesterday's low was not retested.

It would be unusual if Tuesday's low remains uncontested in the days ahead. Down momentum like yesterday's almost always takes more than one day to dissipate.

Let's look at recent examples.

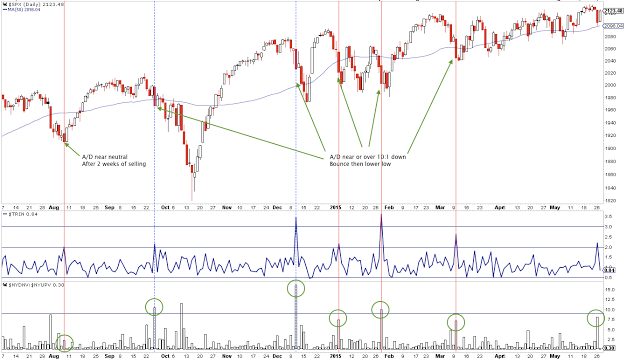

The first chart looks at the past year: the S&P is in the top panel, Trin is in the middle panel and declining volume relative to advancing volume is in the lowest panel. Every instance of a Trin spike higher involves at least one lower low in the S&P, even if it came after a strong bounce like today's (note September 2014 and January 2015).

The August 2014 low was a little different in two ways. The Trin spike came after two weeks of selling during which the S&P lost 4%; it marked capitulation of the move lower. Also, declining volume relative to advancing volume was very light at barely 2:1 down; there was not a lot of pressure behind the final sell off.

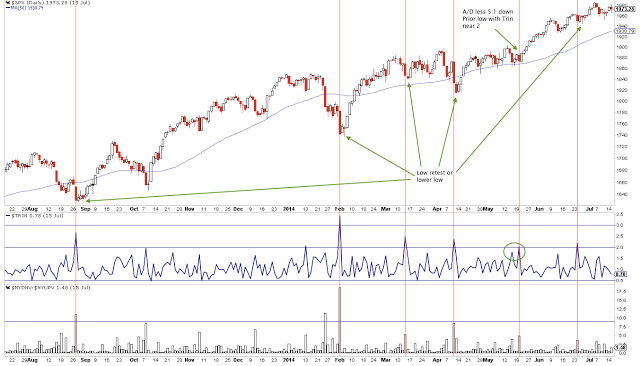

The next chart is set up the same except it covers the prior year (2013-14). There were five more instances like Tuesday that each had a retest of the low in the days ahead.

Only May 2014 is a little different as there were two Trin spikes within 4 days (circle) and the S&P was down less on the second day than the first day (0.6% versus 0.9%). The low on the second day was not retested.

The last chart covers the period two years ago (2012-13). There were ten more instances like Tuesday that each had a retest of the low in the days ahead. What we have highlighted (arrows) are cases where the spike in Trin occurred at a near term high in the S&P (like yesterday). Each of these four cases initiated more selling ahead. Note the strong bounce between the Trin spikes in April 2012.

In the past three years there have been more than 20 instances were Trin spiked over 2. In over 90% of these instances, the S&P at least retested the low in the days ahead. That was especially the case when the spike higher in Trin occurred when the S&P was near a high, like yesterday. The only two exceptions occurred after several days of selling and with declining volume that was relatively light. Neither case was similar to yesterday.

Today's bounce was impressive, especially since it was led by the Nasdaq which closed at a new 15 year high. It's possible that Tuesday's sell off marked the exact low but that would be a pattern very much unlike any other we have seen in the past three years. More likely, Tuesday's low will be retested in the days ahead.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.