TRYing (And Failing) To Find A Bottom

Matthew Weller | Apr 14, 2015 02:59PM ET

“The market hates uncertainty” is a dull cliché for experienced traders, but that doesn’t mean it isn’t useful. Of course, “uncertainty” is an unavoidable characteristic of all markets and it comes in many forms, from economic to geopolitical. For instance, the recent pause the strong dollar uptrend can, at its core, be chalked up to renewed uncertainty on when the Fed is planning to raise interest rates after the downturn in US economic data. In a different vein, some analysts argue that GBP/USD’s weakness of late is due to elevated uncertainty about the upcoming general election (See our free UK Election Special Report for more).

Along the same lines, the Turkish lira is in freefall on fears surrounding Turkey’s early-June general election. After hovering over a 20% lead for President Erdogan’s AKP party throughout March, recent opinion polls suggest that support is waning, with this weekend’s Metropoll finding that the lead has slipped to just 14%. While this is still a solid lead, Turkey’s dire economic situation requires the type of painful, long-term policies that may require near-mandate levels of public support, assuming the political will is available.

Technical View: USD/TRY

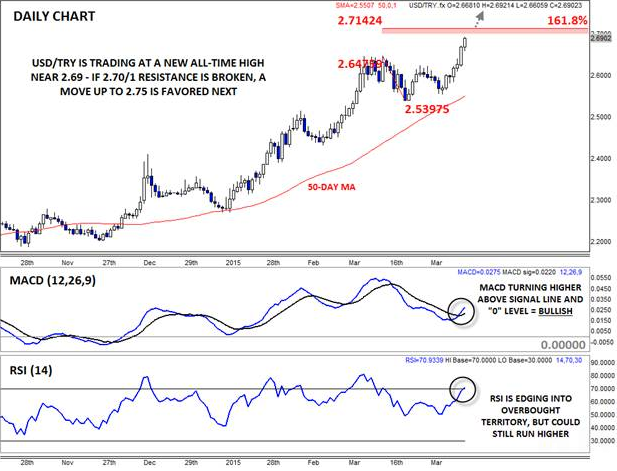

Regardless of the fundamental reasons for the move, USD/TRY has clearly blasted off into the stratosphere to start this week. Looking to the chart, the pair broke cleanly through its previous all-time high at 2.6475 last week and is trading all the way up near 2.69 as we go to press. Not surprisingly, both the MACD and RSI indicators have turned back higher, showing that the bullish momentum is returning once again.

The next hurdle for USD/TRY bulls is the confluence of psychological resistance at 2.70 and the 161.8% Fibonacci extension of the March pullback at 2.7140; if these levels are broken, a move up toward 2.75 or higher is likely heading toward May. Meanwhile, the established bullish trend, ongoing political uncertainty, and long-term economic concerns suggest that buyers should remain eager to step in on any dips back toward 2.60.

Source: FOREX.com

For more intraday analysis and market updates, follow us on twitter (@MWellerFX and @FOREXcom)

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.