TRY Jumped After Erdogan Win

MarketPulse | Jun 25, 2018 06:41AM ET

Monday June 25: Five things the markets are talking about

Global stocks remain under pressure, as investors continues to analyze the impact of a trade spat between the world’s two largest economies – US and China.

Markets are beginning to get very nervous by the prospect of a full-blown trade war, and this despite the tariffs so far announced by the US administration, and China’s retaliatory measures, amount only to a small amount of goods. It’s the contagion effect to other major economies that the markets are really worried about.

In China overnight, the People’s Bank of China (PBoC) sent a strong signal of policy easing by cutting their reserve requirement ratio (RRR) by -50 bps (as expected), to free up fresh liquidity for the real economy. This move may also fuel trade tensions between the US and China. The cut comes into effect on July 5, one day before the first round of US tariffs on Chinese goods begin.

Elsewhere, the Turkish lira (TRY) temporally surged after Erdogan claimed victory in this weekend’s Turkish presidential election.

On tap: The RBNZ meets on Thursday and a ‘dovish’ message is expected. Stateside, US consumer confidence (June 26), US durable goods and US final GDP (June 28) should provide some interest for investors.

In the UK and Canada, GDP data unfolds, while in Japan, retail sales, the unemployment rate and industrial production will pique markets' interest.

1. Stocks see red

Equities in Asia led the retreat overnight in the wake of reports that the Trump administration is preparing new curbs on Chinese investments.

In Japan, the Nikkei share average dropped as sellers targeted large caps as well as defensive stocks, while the mining sector outperformed after oil prices jumped on Friday. A stronger yen also fueled the selling pressure. The Nikkei fell -0.8%, extending the weekly drop of -1.6% in the past week. The broader Topix dropped -1%.

Down-under, A pullback in financials helped keep Australia’s stock indexes lower, but the S&P/ASX 200 continued to outperform. It fell -0.2% to notch a second consecutive modest drop. In S. Korea, the KOSPI closed higher, up +0.3%.

In Hong Kong, stocks touched a six-month low as the US plans China tech investment limits. The Hang Seng index fell -1.3%, while the Hang Seng China Enterprise (CEI) lost -1.2%.

Note: The US is drafting plans that would block firms with at least +25% Chinese ownership from buying US companies with “industrially significant technology."

In China, stocks reversed early gains to close lower overnight, as an expected RRR cut was largely offset by lingering trade war fears. The blue-chip Shanghai Shenzhen CSI 300 index fell -1.3%, while the Shanghai Composite Index slid -1.1%.

In Europe, stocks have opened lower as trade concerns continue to weigh on risk sentiment. A coalition disagreement in Germany is also leading to investor concerns.

US stocks are set to open in the ‘red’ (-0.6%).

Indices: STOXX 600 -0.8% at 381, FTSE -0.8% at 7619, DAX -1.0% at 12456, CAC 40 -0.8% at 5347; IBEX 35 -1.0% at 9689, FTSE MIB -1.2% at 21621, SMI -0.9% at 8539, S&P 500 Futures -0.6%

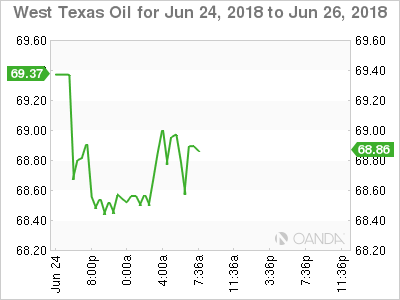

2. Oil prices drop on OPEC’s output deal, gold steady

Oil prices remain on the back foot as the market factors in an expected +1m bpd output increase in the wake of last week’s OPEC meeting.

Brent crude futures are at +$74.25 per barrel, down -1.7% from Friday’s close. US West Texas Intermediate (WTI) crude futures are at +$68.42 a barrel, down -0.2%, supported more than Brent by a slight drop in US drilling activity and a Canadian supply outage.

Note: Because of unplanned disruptions (Venezuela and Angola), OPEC’s output has been below the targeted cuts, which it now says will be reversed by supply increases, especially from Saudi Arabia.

Stateside, US energy companies last week cut one oil rig, the first reduction in three-months, lowering the total rig count to 862. While in Canada, an oil sands facility outage could leave North America short of -360K bpd of supply for all of July.

Ahead of the US open, gold prices have edged lower, pressured by a strong US dollar amid prospects of higher interest rates, while global trade tensions is keeping the ‘yellow’ metal above its six-month low print last week. Spot gold is down -0.3% at +$1,264.70 an ounce, while US gold futures for August delivery are -0.3% lower at $1,266.60 per ounce.

3. Yields fall on risk aversion trading

Global sovereign yields remain under pressure, mostly on trade tensions, but some for other reasons as well.

The yield on Germany’s 10-year Bund remains under pressure after E.U leaders failed to reach a deal over the weekend on a new approach to immigration. The 10-year Bund yield fell -2 bps to +0.31%. For directional cues, dealers will now look to the EU summit on immigration this Thursday and Friday as well as Friday’s release of eurozone inflation numbers, which could see core inflation, drop to +1%.

Elsewhere, the yield on 10-year Treasuries fell -2 bps to +2.87%, the lowest in more than three-weeks, while in the UK the 10-year Gilt yield fell -3 bps to +1.291%.

There is only one central bank meeting this week and its Thursday’s RBNZ monetary policy announcement where they are expected to deliver a ‘dovish’ tone and signal again that the next move could be “up or down.”

4. TRY temporarily jumped on Erdogan win

The TRY jumped after Recep Erdogan won yesterday’s presidential election, and his Justice and Development Party, together with Nationalist Movement Party, grabbed the majority of the seats in the parliament.

The initial moves saw USD/TRY trade down to its lowest in nearly two-weeks of $4.5373. However, TRY is again under pressure, revisiting the concerns that the currency had come under heading into the elections. The TRY ($4.6638) continually hit record lows on the perceived lack of independence of the CBRT bank after the elections.

Elsewhere, EUR/USD (€1.1645) has reversed some of its initial overnight losses despite the continuing disappointment of German data (see below).

5. German business sentiment falls in June

Data this morning showed that German business sentiment deteriorated further this month. According to the Ifo institute, German companies are “less satisfied” with their current business situation.

The Ifo business-climate index fell to 101.8 from 102.3 in May. It marks the lowest reading in 12-months.

Clemens Fuest, the president of the Ifo Institute said, “the tailwinds enjoyed by the German economy are subsiding.”

Note: The Ifo Institute last week scaled back its outlook for Europe’s largest economy, forecasting growth of +1.8% in 2018 and again in 2019. Previously, it had predicted growth of +2.6% in 2018 and +2.1% in 2019.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.