Triple Witching Day: How To Take Advantage Of It In Practice

Dimitri Speck | Sep 15, 2019 03:06AM ET

Four times a year on the third Friday of March, June, September and December, contracts for stock index futures, stock index options and equity options expire concurrently. Derivatives contracts are not only expiring in the US on these days, but also at a number of international futures exchanges, such as for instance Eurex in Europe.

At specific times on this Friday reference prices are determined, which are then used to value and settle expiring futures and options contracts.

Triple witching days often generate increased trading activity, as dealers either close out or roll over contracts. Manipulation has also been detected around reference periods, with prices being driven close to desired levels (“pinning”). After all, the reference price is decisive in determining profits and losses in expiring options and futures.

September 20 2019: the next big expiration date lies directly ahead!

On September 20 it will happen again: many derivatives contracts will expire at the same time. How does this impact stock prices?

While most investors, pundits and academic studies are focused on triple witching day itself, we want to examine a period of several trading days before and after the expiration date.

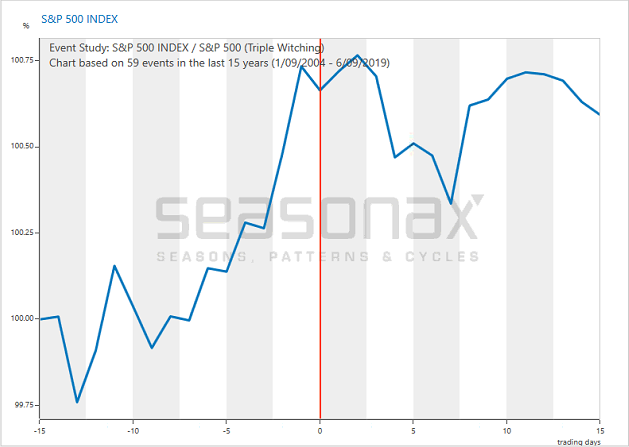

The chart below illustrates the average move in the S&P 500 Index in the 15 trading days before and after triple witching day. The calculation is based on data of the past fifteen years, which include a total of 59 triple witching expiration days. The horizontal axis shows the number of days before and after the event, the vertical axis the average price move in percentage points.

Average price move of the S&P 500 Index in the 15 days before and after triple witching day, based on 59 events between 2004 and 2019

The S&P 500 Index typically rallies ahead of triple witching expiration days!

One can right away see that the S&P 500 Index typically rallied between the ninth day and the day immediately preceding the triple witching expiration. The average gain over these eight trading days amounted to 0.82 percent. A particularly steep increase in prices tended to occur between the third day and the day immediately preceding triple witching expiration days. The average gain in these two trading days was 0.47 percent, which is equivalent to a very large annualized gain of 134.59 percent!

This is more than 25 times the average annualized gain of the S&P 500 Index recorded over the entire 15 year period under review. Investors can take advantage of the strong uptrend in the days before triple witching dates by e.g. increasing their exposure to equities. By contrast, the expiration day itself – which many investors are focused on - was typically characterized by a remarkable lack of volatility.

Take advantage of your information edge

Many investors are mesmerized by the approach of triple witching days. This leads to an increase in tension in the days preceding the expiration date – and to rising stock prices. Alas, very few people are aware of this. Most are fixated on the triple witching day itself and some even try to trade amid the hectic activity.

Things everybody knows about rarely lead to investment success in the stock market. It is therefore important to have precise information at one's disposal.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.